Mortgage REITs

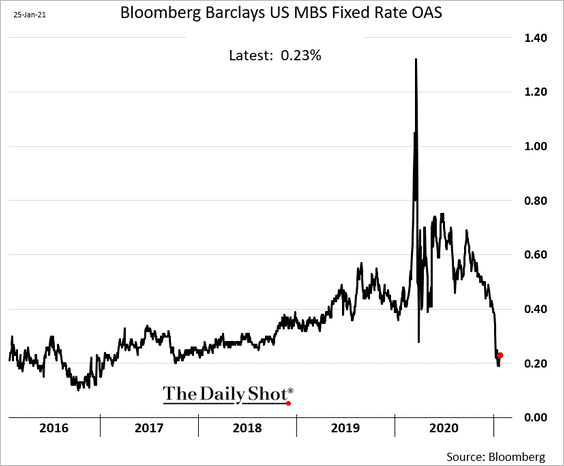

MBS spreads are as low as they have ever been. Assuming that rates generally are pegged lower, this is bullish for mortgage REIT ETFs such as $REM or $MORT.

Retail Army: some astonishing observations

Households own 36% of the $57 Trillion US equity market. ~$21 Trillion. If you add in households, active mutual funds, and passive mutual funds and ETFs this is 63% of the market. ~$36 Trillion. Hedge Funds own 3% of the $57 Trillion US equity market - so “Retail” is 12x more important than hedge funds. And in 2020 “retail” started trading. Prior to 2020, retail activity (single stocks and options) stayed flat for 20 years. 5 out of the top 10 largest call option volume days in history (data goes back to 1992), happened in 2021. To be continued, in a big way, and it will end like a Greek tragedy.

Going short low vol

Quant/Strat star Inigo at Sanford Bernstein: “In anticipation of further reflation and rising nominal yields in the coming quarters, we decide to go tactically short low vol, which is now in-line with our recent tactical upgrade of value. Not only has low vol had a negative relationship with inflation/bond yields for the past 20 years, but valuations are also at historical extremes. While valuation alone isn’t catalyst for reversal, falling yields have has supported its re-rating – with inflation inflecting upward, low vol stocks become vulnerable to underperformance”

This seems so like 2000.

Tweet of the Week

Will the SEC step in to protect Wall Street from aggressive Mom & Pop traders?

— Joe Weisenthal (@TheStalwart) January 25, 2021

Crumbs

- everyone is fretting about the supply of semiconductors. And yet Intel ($INTC) is in the doldrums. Taiwan Semi (TMS) is a big player. $6723 (Renesas) and NXP ($NXPI) maybe caught up in the tailwind. Maybe even AMD ($AMD), which has been doing much better than Intel lately.

- SPACs are going to the moon (uh, Space). There is a discussion on a recent Market Huddle.

A deal derby in corporate debt. S&P Global reports this morning that domestic pro forma high-yield bond issuance reached $40.3 billion so far this month, surpassing the $38.3 billion last year to set a new high water mark for the opening month of the year. Last week alone saw 20 deals worth $16.4 billion according to Bank of America, making it the sixth-busiest week on record. Likewise, a slew of activity in the leveraged loan market yesterday featured some 17 deals coming to market according to Bloomberg, the busiest day since November 30.

More broadly, global corporate fundraising exceeded $400 billion through the first three weeks of the year according to data from Refinitiv, nearly double the 20-year average. Of that sum, equity offerings accounted for $64 billion, blowing past the 2014 high-water mark near $40 billion, while blank-check companies (a.k.a. SPACs) raised $21 billion through today, already one quarter of the 2020 fundraising total, which itself exceeded all SPAC fundraising from prior years combined.

- Silicon Valley is not a place, it’s an attitude.

- Eventually, in some circumstances, the money supply does matter for inflation.

- $FIZZ stands out as vulnerable.. It has a high short interest, a low float (as a proportion of the outstanding shares) and a sector (fizzy drinks, non-alcoholic) which has some pretty fierce competition.

Comments !