Wrap

Jay Powell started some Congressional testimony. It seems that he wasn’t asked any difficult questions, and didn’t say anything too new, so the market rallied hard. Powell is due to go in Feb., and the last thing he wants to do is start a stockmarket crash before he has made his exit. The market is betting that $120B of QE will continue unchanged until the heat death of the universe, and who can blame it?

Basically, all global equities were up. Nothing really matters any longer apart from the Fed.

In other markets, the dollar is heading back down again, DXY is at 91.74. I would guess this will continue, i.e. down 0.17%. BTC bounced to $32K. Most other currencies moved in line with DXY.

Commodities were mixed, with oil down 0.8% with most food. Lumber continues to crash.

Bonds were flat: 10Y at 1.465%.

With risk assets so strongly correlated because of the dominant role of the Fed, it’s hard to hedge specific risk, or succeed in a classical hedging strategy. The Fed is having a strongly negative impact on what repressing the normal processes of creative destruction in the economy. It makes everyone (Dave Portnoy) look like a stockmarket genius.

International Economics and Policy

I’m reading Krugman and Obsfeld’s book on International Economics and Policy. It’s actually extremely readable, and could easily be absorbed by a non-specialist. It goes through the theory of how tariffs and quotas and policies which add friction to international trade generally make the world, and the countries imposing these policies, poorer places. However, it points out that some trade barriers do make citizens better off. One example is Saudi Arabia. If KSA sold oil at the cost of production, it would certainly be worse off today, in terms of the welfare of its citizens. This is an anomalous case. Krugman shows how these situations can arise, while pointing out that for most “small” countries (which cannot affect world prices by imposing barriers) are not in this category.

He has a great description of the various GATT trade rounds, and the process of negotiating a trade deal. I read the financial press fairly religiously (the FT), but I felt that I understood these things much better. For example, I now know the difference between a free trade area (like NAFTA) and a customs union (like the EU). There is a lot to be said for the latter, as the UK govt. is discovering now in relation to Northern Ireland.

Oil price thesis

This is worth reading. The thesis is that supply is constrained, because nobody will fund upstream and exploration, demand is picking up, because of the end of the pandemic, and the dollar is going down.

Any one of the premises could be challenged, but it’s hard to argue that Romil Patel is 100% wrong.

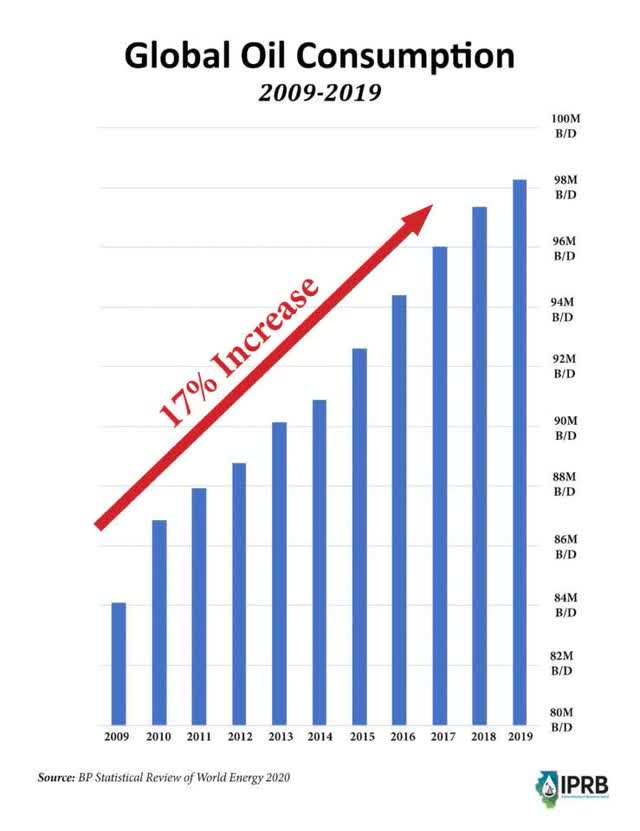

This is a great chart.

Net Zero is anything but a free lunch

Politicians dissemble about the real cost of Net Zero. Well, they would, wouldn’t they? If stopping using natural gas, oil and coal was such a no-brainer economically, there would not be any need for vast amounts of government regulation and subsidy. If these things are necessary, there will be a heavy economic price to pay. It will be paid by poor people in the rich world, but it will not work because rich people in the poor world will not risk riots caused by imposing impossible costs on their populations.

$RIG looking strong

It’s $RIG (Transocean). Someone thinks that we’re gonna get some drilling going.

DLNG

Dynagas, LNG carriers. This makes the bull case.

Essentially, this is a play on six LNG carriers. It is losing money,

It is highly geared, and has preferreds, but its cashflow is strong, and has solid operational profits. Whether or not you think it’s a good investment really depends on your view on LNG. Personally, I think it has a future as a clean alternative to coal which is not prohibitively expensive to produce or to transport.

Twitter Treats

https://twitter.com/kenklippenstein/status/1407402033896902661?s=20

New US military training document calls socialists a “terrorist” ideology and lists them alongside “neo-nazis” amid Pentagon crackdown on domestic extremism, per counterterrorism training material leaked to me: https://theintercept.com/2021/06/22/soc

https://twitter.com/isabellarileyus/status/1407409949114875904?s=20

Powell: “we actually use PCE not CPI” Why? because the weights of both used cars and shelter are much bigger in the core CPI than in the core PCE, and because health insurance prices are not included in the PCE. https://twitter.com/zerohedge/status/1407410055314554883?s=20

Comments !