28 July ‘21

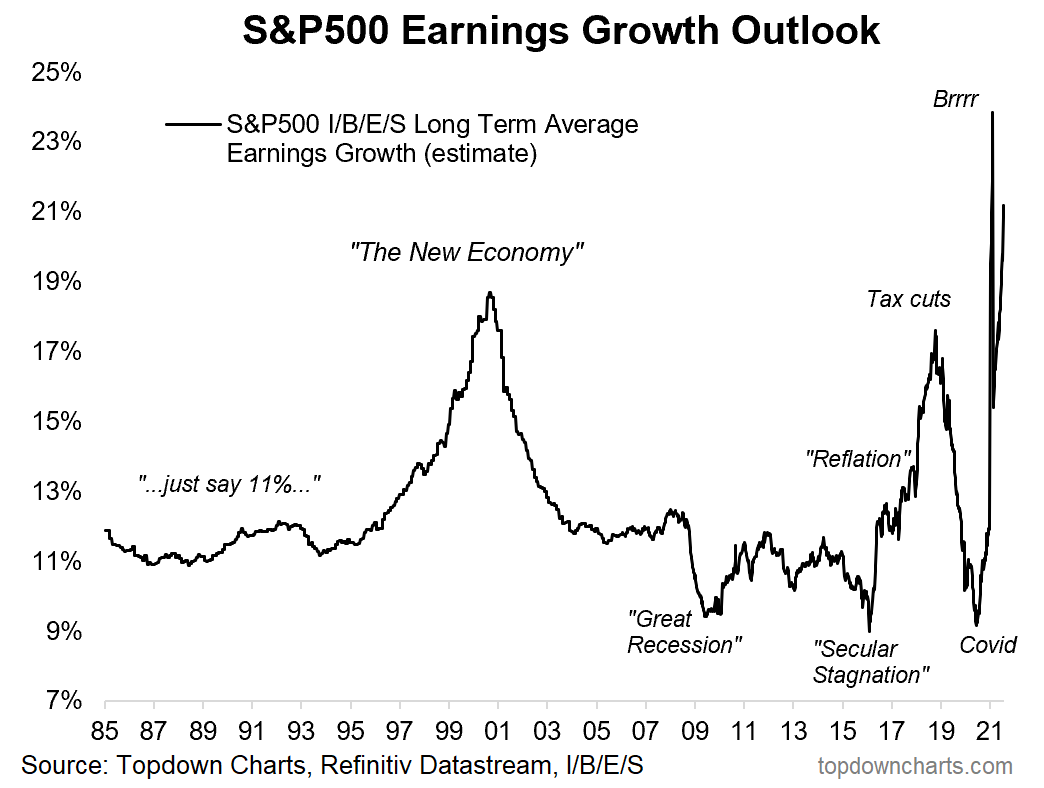

Earnings set to rocket

Analysts’ forecasts for earnings, which are typically for 3-5 years, are more backward looking than forward looking. What goes up like a rocket tends to return to earth quite smartly.

Inflation expectations

Like a lot of people, I tend to think of the bond guys as the ones who understand what is going on in the economy. Bond yields are being crushed, which implies that the bond buys think that the central banks are correct in asserting that inflation is merely transitory. But this makes no sense. The marginal buyer of govt. bonds (off whose yields the rest of the bond market trades) is those very central banks. It’s almost like Elon Musk predicting that Tesla’s deliveries will break records this quarter and then going out an buying a ton of calls.

Money supply (M3) growth in the EU is running at 8.2% annually. The US is higher (13%?). If this doesn’t lead to inflation, monetarism is dead. The bulk of the contribution to the increase is loans to governments. It is just about possible they will spend this on capital projects, but it’s much more likely they will use it for transfer payments, I feel.

VIX and SPX diverge

Wrap for 27 July

Stocks took a dip ahead of tomorrow’s FOMC rate decision, as the S&P 500 and Nasdaq 100 pulled back by 50 and 110 basis points, respectively, though each finished well off their worst levels of the day following an overnight liquidation in Chinese equities. Treasurys caught a bid with the long bond yield sinking to just 1.89%, while WTI crude remained near $72 a barrel and gold finished near $1,800 for a fifth straight session. The VIX advanced to 19.4, up 10% on the day. |

The general tenor of the market seems to be risk on, except for Chinese internet stocks ($KWEB) which has infected various Far East markets. There is an FOMC announcement tomorrow, which will undoubtedly be dovish to some extent, but if it is less than extremely dovish this time it could well spook equities.

The 10Y is now down to 1.23%.

Amplats

American Platinum has had a good quarter and is confident enough to have a strong payout. American Platinum

Stan the Man

Summer serenity

The markets seem eerily calm at the moment. No new themes seem to have emerged for ages. To me, we seem to be living on borrowed time. We’re either getting inflation, or a crash. Nobody seems to like what the Fed is doing (maybe Larry Fink or Ken Griffin are an exceptions). One good example of this is this op-ed by Brendan Greeley.

[The Fed] takes some of the $5.2tn in Treasuries it holds on its balance sheet, transfers ownership of some of them to money market funds and commercial banks, then credits itself with cash, in the same amount. The next day, the Fed reverses the transaction: it buys the Treasuries back. But this time the Fed loses a little money. It buys high, then sells low. On purpose.

Comments !