Crumbs

Quantumscape: fraud or no fraud?

The WSJ says that Quantumscape, which is developing solid state batteries that are superior to the liquid electrolyte ones already in use will disadvantage $TSLA because it uses rolled cylinder batteries, whereas its competitors all use prismatic ones. Solid state batteries cannot be rolled, so they stack better. I’m not completely convinced, but $QS should not be shorted (in spite of just having dropped by ~15%!).

Banx nails it: (from the FT)

Central Bank Digital Currency

I have a google alert for the title of this section. I get half a dozen hits ever day. This is a representative recent one but there are literally hundreds. Central banks are simply banks which account holders restricted to commercial banks and governments. Once they get a digital currency, there will be nothing preventing large corps having accounts, and in due course individuals. This will really tighten the link between money supply and inflation.

Most amazing frauds of 2020

These are the ones that came to light. I am confident that some more will emerge in 2021.

Wirecard

Wirecard ($WDI.DE), for so long a rising, high-tech star of the German stock market was shown to be a fraud. Not only was it amazing to see a top member of the DAX exposed as a huge fraud (and see its stock price crash from €145 to €0.31 in a matter of days) but to see the FT, which had basically been saying that it was a fraud for years, proved right. The story is fascinating, but the thing that particularly sticks in my mind are the attempts by the German equivalent of the SEC try to arrest the journalists trying to expose the fraud, rather than the crooks perpetrating it.

Ant Group

Jack Ma flew close to the sun (king), Xi, and fell to earth. This one will run and run.

XRP investigated by SEC

I think the real whale is Tether, a supposed stable coin, but not really backed by anything. I have followed XRP for many, many years (even mined a bit). It seems very clever: maybe too good to be true. The artfully contrived distinction betwee XRP and Ripple always confused me.

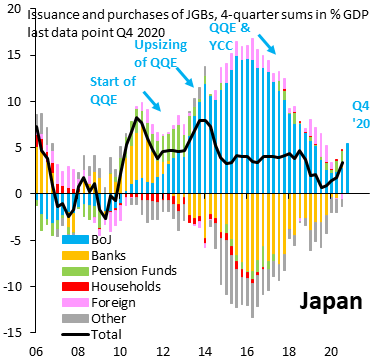

MMT is already here, it’s just not evenly distributed

From Robin Brooks.

It’s always too early to buy gold

This article says it, but in more words.

The long and the short of it

@LSValue put his top picks on Twitter. They are:

- Long: $SEAC (SeaChange), $IAC (Interactive Corp), $ANGI (Angies List), $WIX (Wix), $IDN (Intellicheck),

- Short: $QS (QuantumScape), $PEN (Penumbra), $BLNK (Blink Charging), $BYND (Beyond Meat), $NKLA (Nikola).

I have never heard of most of any of the longs. $QS is mentioned above, $PEN is surely heading to zero, $BLNK and $BYND don’t have any material competitive advantage that I am aware of, and $NKLA has been exposed as a fraud.

Once the market turns, the shorts might be worth checking out more carefully. The longs: not so sure. Intellicheck does instant verification of photo ID. Sounds great, but I am not sure they are the only ones doing it.

Why we need more young people in charge

Humans (and other species) evolved memory as a strategy for avoiding danger. Our ancestors who remembered nearly being eaten by a saber toothed tiger when going down to the water hole in the evening were the ones who survived long enough to reproduce. That’s why our memory of negative emotions (shame, humiliation, danger) is so much stronger than that of positive ones. The net result is that our aged leaders become afraid of their own shadown, and refuse to try anything new or remotely risky. It’s illogical, because as we age we have less life left to lose. But it’s how we’re programmed. Younger leaders would also put more resources into childcare, education and sports, and less into the health service and other services for the aged and sick. (My favourite statistic: we spend 80% of the whole NHS budget on patients who will be dead within 24 months.)

Comments !