Crumbs

- Nordea put out a first class macro note as usual. The takeaways are: buy USD, sell SEK, EUR. Suggests going long AUD/NZD based on ZN central bank policy divergence. It’s always a good read, and it’s free!

- Negative note on $BYND. I’ve never been convinced about this company. Here.

- The Market Eye makes a good point about a distressing lack of liquidity in large-cap US equities. We know that this has been a problem for a while, as demonstrated by various ramp operations, not least by Elon Musk with $TSLA. The suspicion is that reported volume is partially or largely wash sales between related parties. It’ll be interesting to see what happens to the market when a player bigger than Bill Hwang gets into trouble.

Both CBS ($30bn market cap) and Discovery ($20bn market cap) were down a neat 27% Friday, on what appears to be (allegedly) forced selling from Tiger Cub Archegos Capital. If this is the truth and there is nothing else going on here - this is a horrendous data-point on the true liquidity in the markets. The rumored “block offerings” from MS and GS were not multiple days of average volume. These are not some Mickey Mouse companies with shaky fundamentals. The only thing that is shaky is the “true” liquidity in the equity markets. Because it is non-existent. In a “normal” world this would have been done at maximum 5-10% down.

- TME points out that ARK has no clue about how to manage risk. I copied the text here since it’s paywalled.

- Find out more about Matt Stoller. He’s a commentator who has written extensively about the threat posed by the accumulation of power by the corporate sector in the USA. As you are probably aware, I think this is a huge problem both in the USA and Europe, certainly compared to the attention it receives. I am not sure I dare say it, but to me it looks like a much bigger problem than anthropogenic global warming. The interesting problem is how the end game plays out. It could be very destructive.

- Kuppy twists the knife in the Ponzi sector once again. Entertaining, and informative. He explains a bit more about how the shell game is set up, how the 2000 crash mirrors the current one and why “Project Zimbabwe” will not save SPACs. Kuppy is always worth reading.

- We Work (and aliases) has an insane story. It’s one of the “rolling series of bubbles” that Kevin Muir has identified. It’s crazy, but I think we’ll find that the Chamath and Musk things are crazier. #Theranosonwheels

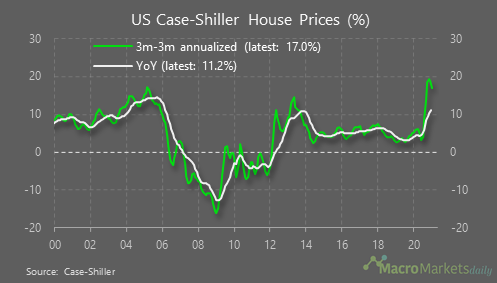

extraordinary jump in US house prices.

extraordinary jump in US house prices.- lockdowns are not just for Covid, they are for life.

- Summers blocked the sort of stimulus spending that would have allowed a much more rapid recovery from the 2008 GFC. Follow the links in this post from The Ink to see more. Summers is a menace.

- Marine Le Pen may yet become the next president of France. It’s going to be a tough fight, but she understands that if she can keep moving her party towards the centre ground the prize is hers. Read about the latest polls here.

- Housing in the UK has been badly constructed for a long time. Various planning changes in the late 90’s and early 2000’s gave rise to a rapid increase in building of apartment blocks. They have a lot of problems. This is not a small problem: it affects maybe 5% of the UK housing stock.

- Biden goes Big

- Chart: Real vs Financial Asset Ratio the Lowest Since at Least 1925

- BTC correlations with other assets. Great chart.

Unemployment

Unemployment is a terrible number to base a central bank policy on. It is the difference between two numbers: the number of people who they should be employable and the number of people who are actually employed.

Wrap

The markets are still buying the Fed line that inflation is not happening. Gold has had a terrible quarter, although it is up 1.32% today. In detail:

- $QQQ is up well over 1%,

- other US indices flat or slightly up,

- very odd mix of sectors up: tech & utilties, with consumer discretionary (motors),

- value down (staples, industrials, real estate, and of course the hated energy sector plus banks): reflation trade dead (or dormant?),

- global equity mixed,

- bonds pretty flat: 10Y @ 1.73%,

This was the end of the quarter. 28% corp. tax with measures to prevent offshoring of profits might dent the stockmarket, but it may never happen.

Soapbox

Economies benefit from rapid population growth. The Industrial Revolution, which delivered huge material gains to the mass of the population at the time, and even more to their descendants, was accompanied by a rising birthrate (and a declining infant mortality). Australia has enjoyed growth through immigration. Similarly HK, Singapore, UK (compared to neighbours). A young country is a productive country; short of forcing citizens to reproduce the only way to achieve this is to welcome immigrants.

There are many mechanisms for sharing the benefits of immigration with those who lose economically: older native workers, and the taxpayers of country of origin (who have paid for the training of all the Indian GPs who come to work in the UK). The ideal would be a market based one (e.g. a bidding system for visas, the proceeds of which would be paid to the originating country authorities) but the details are left to clever minds than mine. We could restrict immigration to economically disadvantaged areas, which typically have plenty of schools and houses. There are lots of schemes.

Obviously, there are political problems, but if we do not embrace immigration we will be poorer. If we choose to be poorer, well that’s democracy, but politicians should not be allowed to pretend things will be different.

Comments !