Some people when confronted with a problem think “I know, I’ll use options.” Now they have two problems.

(The above title is adapted from the Regular Expressions sub on reddit.)

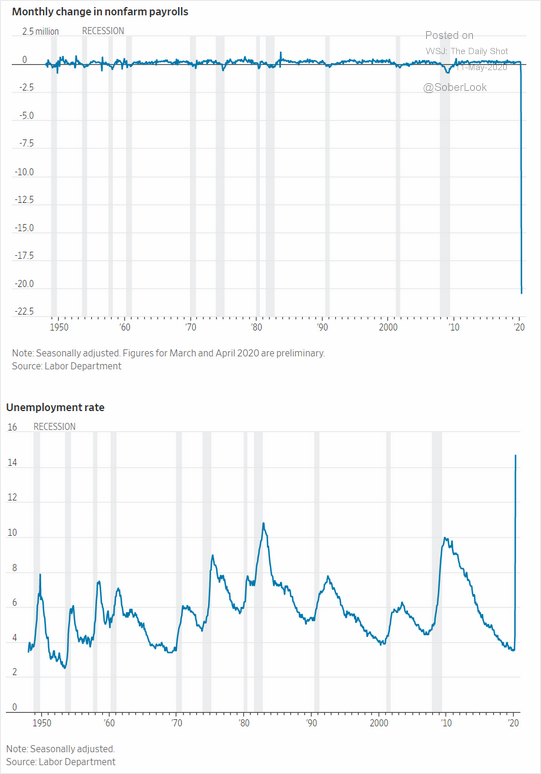

Well, we have some incredible numbers for unemployment. Any regression model trying to fit this charg is going to explode. We have to fall back on our intuition. I can’t see this is going to fully reverse for a long time. Larry Summers said as much in today’s FT. But the CBs are doing their bit, and the “don’t fight the Fed” trade is in the ascendant.

.

.

From today’s Daily Shot.

There is a sense we’re moving out of lockdown. I am getting a few enquiries for properties.

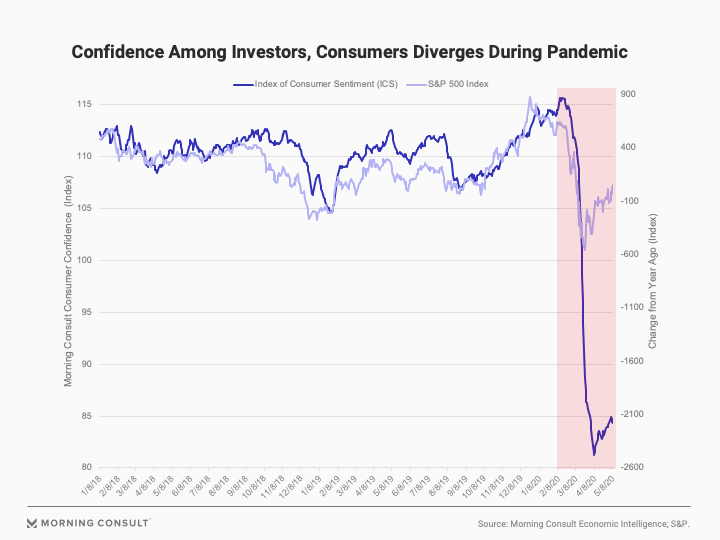

But still, the disconnect between the stockmarket and the consumer is incredible (Morning Consult)[https://morningconsult.com/2020/05/12/analysis-consumer-confidence-wall-street-main-street-fall/].

.

.

We must not forget the human cost of all this. The jobs picture, coronavirus response protocols and mental health.

From Bill Fleckenstein:

“Anyone Who Isn’t Confused Really Doesn’t Understand the Situation” So for those itching to buy puts or short stocks, you really have to wait until there is some sign of a rollover in the market and some weakness that allows you to convince yourself that the rally has ended and that, in hindsight, it will be seen as a failing rally. (As a practical matter, someone — in this case, me — making the case that today’s action was the end of the rally could short a few targets with nearby stops to see if the idea wants to work.)

That may be restating the obvious, given all that I have said about this in the past, but I can tell in discussions with people that there are many who just can’t fathom how we could be seeing what we’re seeing, but that is the power of the printing press, as nebulous a concept as that may seem to some.

Comments !