Crumbs

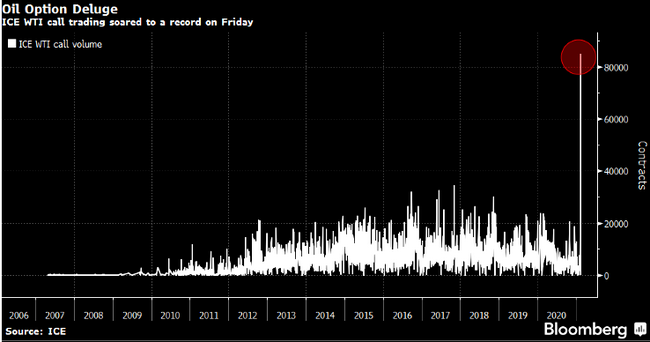

It looks to me as though oil is going to strengthen in the near future. An alternative to actually buying the commodity or the upstream oil companies I may be wrong, of course!

Inflation

The world has experienced low or negative inflation. This is a great worry to central bankers, and the pandemic, which has shut down large parts of economies has created huge output gaps. Given the unwillingness (so far) of most governments to enact fiscal stimulus on the scale required to offset the drop in demand (GDP down 10% in the UK last year), the bankers have decided that their only option is to “go big.”

Generals always fight yesterday’s battles. Central bankers may just have reached the age when the rapid inflations of the 1980’s are no longer a searing memory. Certainly, thirty years of deflation in Japan has convinced a lot of us that loose monetary policy does not inevitably lead to inflation, in an economy with a strong currency and current account surplus.

Nordea has contempt for the ECB. But also has a lot of interesting analysis on FI and FX. The theme of this week’s missive is mis-measurement of official inflation statistics. The US is criticized for not estimating the “rent of shelter” component (which has a massive 40% weighting in core CPI) plausibly, and the Statistics Sweden for fudging the notorious ‘hedonic adjustments’ to CPI: Statistics Sweden is close to world-leading in quality-adjusting CPI numbers so as to remove inflation. You even get black Scandinavian humour in this newsletter! Actionable trades are always thin here, but the summary is that even in Europe there is likely to be record-breaking growth, and a pickup in yield and inflation.

Taps Coogan says that gold bugs are wrong to argue that gold will go up because inflation is about to take off. He suggest that what happens to gold will depend on exactly how willing the Fed is willing to tolerate inflation, and with it ever-increasing negative real rates.

Recycling, Chinese style

This post from Money: Inside and Out gives some analysis of the capital account for China, which is in deficit to exactly the same amount as the current account is in surplus. The year of 2020 has been particularly tough: China has continued running its factories at near capacity, but the rest of the world has produced virtually nothing. Even President Xi’s promise to buy more US soybeans didn’t get delivered. Maybe he took a gamble on how the election would turn out.

The post is highly technical, but my take is that this will put further downward pressure on the dollar (DX). Currency movements are hard to forecast, and will go against fundamentals for career lifetimes, but the weight on the dollar is getting heavier.

Revolut

I read a long article int the FT over the weekend, about Revolut. The article pointed out that this ‘fintech’ company had a market cap larger than Ireland’s largest bank. I have a Revolut card. It’s good, but it’s just a credit card. OK, they don’t try to gouge you with crap FX rates like the banks do, but most people who need FX know that the banks will always try to rip them off, and that there are lots of much cheaper alternatives. How being one in a million cheap FX offers help (I also use TransferWise, which seems better for larger transactions). Revolut offer gambling on Bitcoins. Is this a sensible thing to combine with a credit card? OK (I’m a) Boomer. Maybe I just don’t get it. [I actually wrote this nearly a year ago, but in a post where it didn’t fit.]

Wrap

Fairly inflationary day:

- steepening,

- energy complex up,

- value stocks up,

- many commods up, ex gold & silver & some refined oil products.

Comments !