Crumbs

Oil forecast

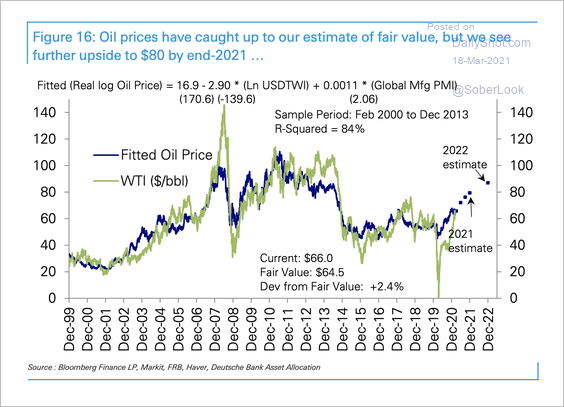

Currently, oil is trending down.

Commodities fading

Strong move down in commodities. Is this the consensus trade fading?

Crazy Cathie lives up to her name

Just listen to her, if you can bear to. Pick up the remarks at around 11m30s. Insane: she breezily dismisses the risk that having a load of highly illiquid issues in her portfolio by explaining that she can meet redemptions by liquidating the more liquid names (like, presumably, $TSLA), that will be relatively unscathed by a market selloff. Well, we may find out how this pans out.

UK version of Sarbanes Oxley likely to be as rubbish as the original

That’s the verdict of Francine McKenna, who knows about these things, and knowing the how recondite this topic is, and to what extent this is a wedge issue between the 1% and the rest, I think she’ll be right.

Cameron, an “advisor” to Greensill, lobbied for the govt. to guarantee their loans

Well, he would, wouldn’t he?. In the comments in the FT online version, someone made the comment that it’s just as well he’s as hopeless as a lobbyist as he was as prime minister (he failed to deliver the support he lobbied for).

Quad witching

Expiry of futures, options, all sorts happening today. Also, the SLR is due to expire at the end of the month, and the dovish blandishments of Tuesday have already been forgotten, judging by equity markets.

China and USA not so friendly any longer

Senior diplomats from America and China held their first meeting since Joe Biden’s election to the White House. The talks, in Alaska, opened icily—served with lashings of fire. Anthony Blinken, America’s secretary of state, accused China of threatening “the rules-based order” and thus “global stability”. His counterpart, Wang Yi, called America a “struggling democracy” that “suppresses other countries”.

from The Economist.

Elites baffled by popular distrust of experts, who are closely linked to those same elites

Yep, from the WEF, i.e. Davos Man

The current US Monetary system is due to be ‘reset’

Longview Economics expresses the view that the current system run by the Fed is existing on borrowed time. I think Chris Watling is onto something, but I think that the Fed is good for another few years, or even chairmen. The current system, and the bias towards debt deflation, suits the 1% very nicely, and they’ll do whatever it takes to keep the system functioning.

UK Government clueless about improving energy performance of UK homes

Chris Giles nails it. The article is behind a paywall, so I’ve extracted the text and shared it here. The copy will disappear in a few weeks, so if it’s gone, you’ll have to pay to get into the FT website. Basically, Giles points out that heating houses generates as much carbon as surface transport, but the government is doing essentially nothing to reduce these emissions. The reasons are many, but largely to do with the incentives facing ministers.

Wrap

Pretty dull day, in the end. Quad witching didn’t make a difference. Generally slightly inflationary/risk on:

- US equity indexes mixed, NDX up 0.4%,

- Commodities recovering, after a rough day yesterday,

- most govt. yields up,

- best performing equity sector comms, worst real estate,

- small cap growth did best (+1.4%), large cap value worst (-0.5%),

- BTC up 1.2%, EUR.USD practically flat.

Main news was the Fed announcing it will the SLR (special liquidity ratio) that allows banks to count treasury bill holdings as cash. The market seems to take a day or so to digest Fed announcements, so I am not sure that the relatively muted response to this is the last word from the market.

Chart of the day

The Philadelphia Fed General Diffusion Index is at practically an all-time high. The US is on the cusp of finally running its economy hot.

The market is beginning to expect inflation.

Comments !