Monday 23, May 2022

Chart of doom

For some reason, the cult of equities is still alive, even though it should long ago have departed the scene.

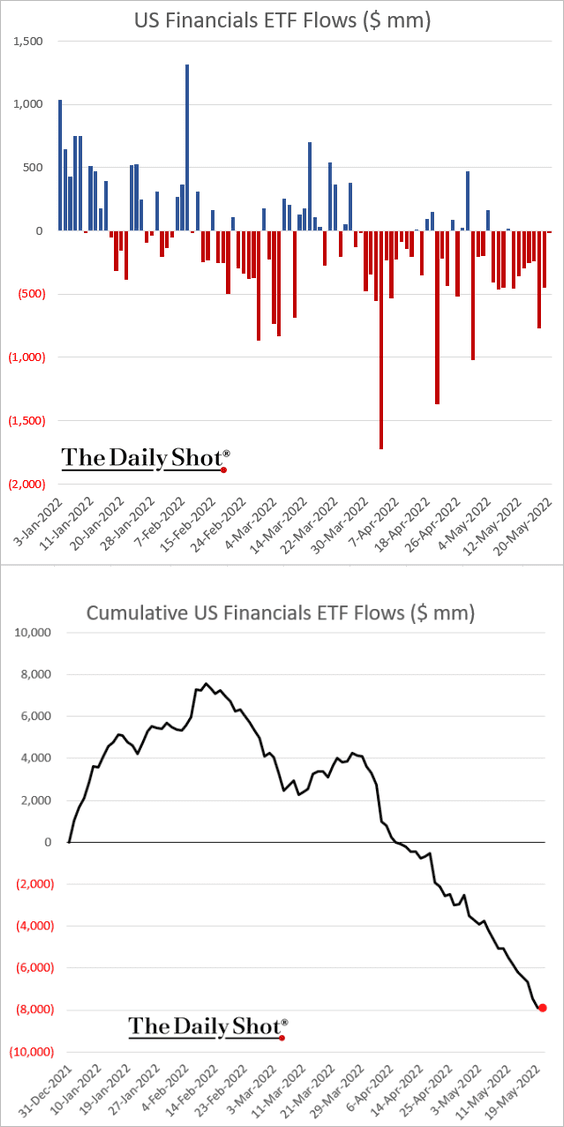

Anyway, we are finally seeing some flows out of equity passive funds. I am not quite sure what a “Financials ETF Flow” is, but I assume it is a close proxy for ordinary punters putting money into the stock market.

Positive flows into ETF have been a feature of markets for a couple of decades. Eventually, there are no more actively managed funds to close, or people notice that the ones that survive are outperforming the index, and decide to keep their money in them

Equities are correlated with a lot of other assets. Risk-on currencies, like AUD, and most crypto. Of late, investing is a zero sum game. The stock promoters who received dollars for these richly priced IPOs and ATM capital raisings will put the money somewhere. Maybe it’s oil, maybe its real estate, maybe it’s carbon credits, maybe it’s short-dated T Bills. Some assets are going to get a rocket boost, the $64e6 question is: which? My best bet is oil, or refiners, but not with great conviction.

Breadth of market decline

Almost everything Tiger Global Management touches turns to dust. Its recent (this year) performance has been beyond dire. The FT wrote about it.

Trans woman selectively disclaims sex she identifies as in order to inherit peerage

Gender may be something you’re born with, or something you choose later in life. Different individuals can legitimately have a difference of view about which of these things is ‘true’. But it’s very hard to comprehend an attitude that the same individual can be a man for some purposes and a woman for others. However, it seems that the law of the land in the UK explictly allows for such a dual gender status. Who would have guessed? Read all about it here.

Wrap

Generally, today was risk-on: high-yield debt ($HYG) was up, NDX100 vol ($VNQ) was down (but still elevated at 33), EUR.USD was up, SPX futures ($ES) were up (quite a bit: 2%), commodities generally up, but not by a lot (nearby WTI crude futures, $CL1!, was up 0.2%). The 10Y yield was pretty flat at 2.8%.

My instinct is that this is a bear market rally. SPX is still 800 points off its high of 4800. There doesn’t seem much in the way of news to justify a bounce, but maybe the markets had got out over their skis last week in reaction to the crypto apocalypse.

What a great summary… as a friend @agnostoxxx just said. So sad it’s almost funny: Just cause these knuckleheads inflated asset prices we were all somehow lulled into believing they are omnipotent seers, instead of ordinary pols looking to hang on to their seat of power pic.twitter.com/aQgdOMt7xS

— Minnow (@KoniKltd) May 22, 2022

Image

📷 Fikri Amanda Abubakar pic.twitter.com/cfJbeqh9de

— Lisandru (@Alex00762690) May 23, 2022

- HYG (high yield)

Comments !