Wrap

Generally, this was another reflation trade day. Bonds drifted down a bit, DXY held steady, the equity markets were up a bit and commodities overall (GSCI) were flat. Oil managed to eke out a 1% rise.

ACWI was up 40bp.

Core PCE was up 3.4% YoY. This is pretty steep, given that all the expensive stuff is kept out of the index. I guess everyone was expecting this, otherwise the bond market and dollar would not have been so sanguine. I would not be surprised to see some soft of reaction in the FX market, except that the EU and Japan are probably going to show some similar figures. The stimulus spending, another $1.3T agreed today, in the US is much heavier in the US though.

The PCE deflator (the Fed’s preferred measure) was up 3.9% YoY. This is sanitized relative to CPI, and must be a big worry for the Fed. Of course they are maintaining their “transitory” narrative, because they are desperate to avoid tapering (i.e. buying Treasuries at a slightly slower rate than $120B per month).

My view is that five year Treasuries are going to take a hit, fairly soon. Not advice!

BoA sees up to four years of hyperinflation

Here is the link (ZeroHedge: you have been warned).

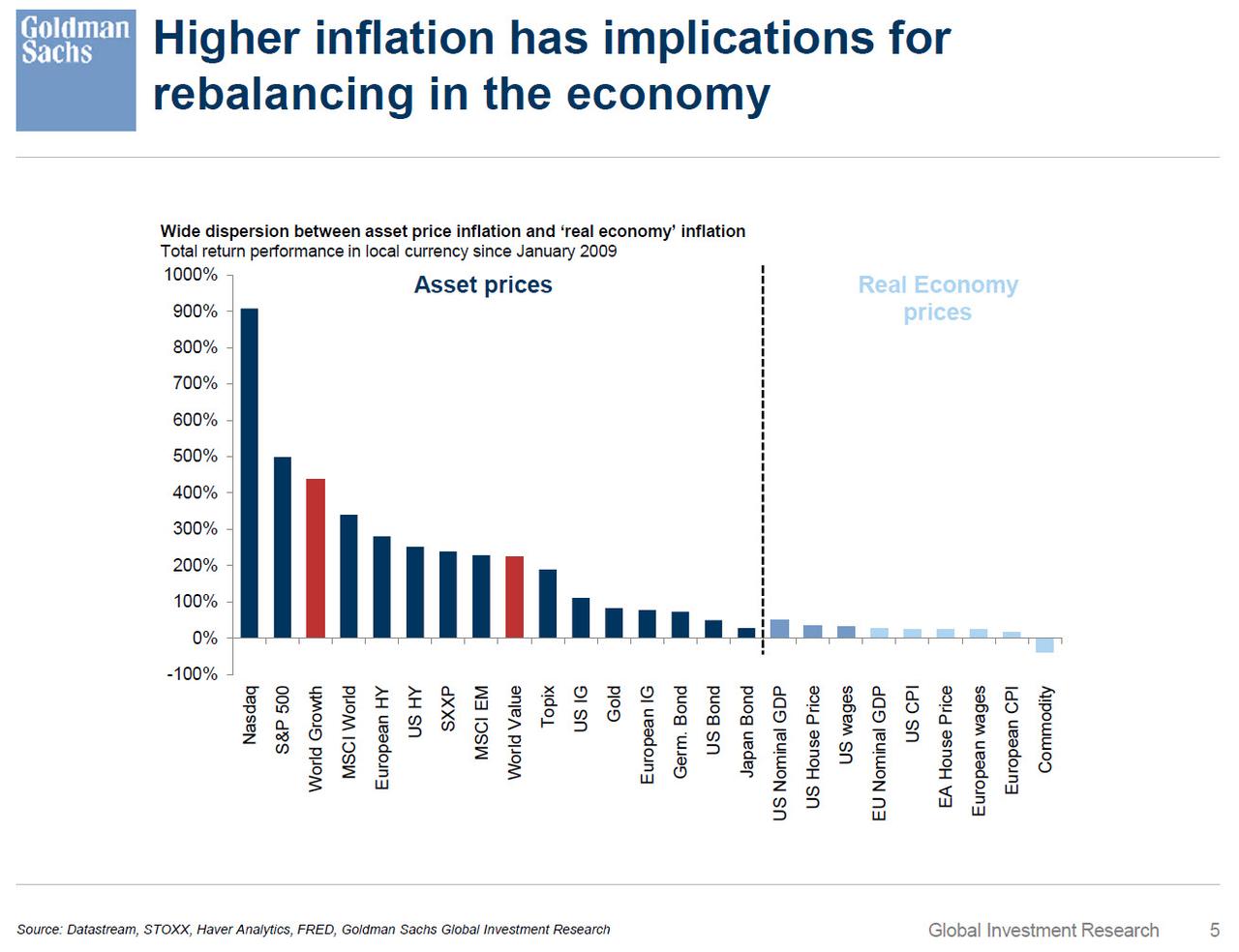

As the head BofA strategist concludes, it is “tough to solve inequality with QE.” If only anyone at the Fed had this degree of clarity.

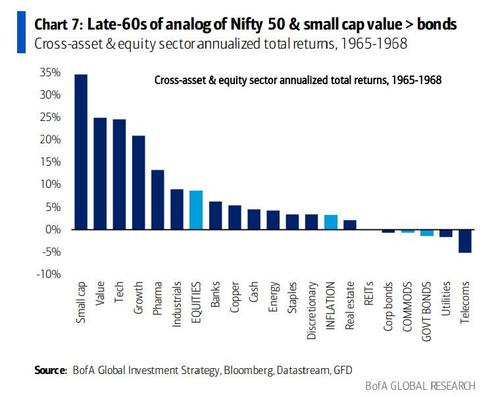

The nearest equivalent, it is asserted was ‘65 to ‘68. I was around, but I was not following equity markets at the time.

Back in the 60’s it was small caps that were the winners and real estate that barely moved. I doubt if they will repeat the trick, but really it doesn’t matter much. Equities as a class did pretty well. I think the only lesson to be drawn is that in this sort of environment it’s dangerous to be short of any real or financial asset. Even bonds!

El Salvador and BTC

The government of El Salvador is planning to airdrop ~3,000 BTC into the hands of its citizens.

And they can’t even print money to buy the Bitcoin.

This will be really crazy to think about 10 years from now.

https://twitter.com/gladstein/status/1408272559192252423?s=20

I don’t know enough about this experiment to have a handle on the consequences. I don’t know anything about El Salvador. I do know that Maduro of Venezuela was promising an oil-backed cryptocurrency for Venezuela, to replace the worthless predecessor, but as far as I know it never happened and, presumably, the economy became dollarized.

Ray Dalio and Denis Gartman are saying this is a good time to buy stocks

The cynic in me tells me that these guys don’t come on CNBC to tip their hand. They tell people to buy when they want to sell. I might be totally wrong, and these guys might like to share the profits around to the little guy, and pay their taxes. But every time I err on the side of giving these guys the benefit of the doubt, I err.

EXX

Net profit margin: 32% Return on investment: 16% Revenue has grown monotonically over last 5 years. Price/cashflow per share: 5.2 Tot. debt/Tot. capital: 23%

Looks too good to be true, eh? The problem is that this is a coal miner with most of its operations in an increasingly unstable African country, South Africa. Maybe Ramaphosa will grip the politics and put SA back on the economic growth track, but the obstacles against this are huge. I have never believed that a company with bad economics can be “turned around” but a celebrity manager, and I believe the equivalent thing about a country.

I think Exxaro might be worth further investigation. Buying on the local exchange (JSE) means that you are long coal and short ZAR, so even if the SA economy ends up as a basket case, the stock price will look good.

Comments !