Nine meals from anarchy

I heard the phrase ‘nine meals from anarchy’ mentioned without any context. It appears that it comes from the title of a talk given in Leeds in 2008 about the vulnerability of our oil-based agriculture. I had assumed it was some pithy summary of the fact that if you push people hard enough, you will eventually trigger a revolution. It is sometimes observed that food riots have always presaged a change in dynasty in China, which is why the politburo there is always so focussed on ensuring that the masses have enough to eat.

Anyway, in the US, and in Western Europe, governments fall when the economy fails. “It’s the economy, Stupid!” was Clinton’s battle-cry. Fuel prices are a great source of political friction. They move together, and a large part of the population experiences a sudden loss of purchasing power simultaneously. The UK fuel protests in 2000, the Gilet Jaunes protest in France are modern-day examples of how quickly things can get out of hand. The annual ritual of delaying the imposition of the Fuel Price Escalator (twelve years and counting, I believe) shows how sensitive governments are to the importance of keeping fuel prices from rising. People are impoverished more by runaway house price inflation, but that bites very unevenly, and is a benefit to a large slug of the population. Not many voters have oil wells in their back yards.

There is a lot more personal debt around nowadays than there was in the 70’s and early 80’s. A serious jump in interest rates is going to wreak havoc with a lot of people, who will suddenly find they cannot afford the lease deal on their car, or their mortgage payments, or their store cards. Whether or not central banks are really independent, they will not cause this sort of pain, and will prefer to let inflation rip, or maybe just explain that fiscal policy is the only effective way to tackle inflation after all.

Anyway, my view is that politicians will blink, and we’ll get inflation, and with it more energy price increases.

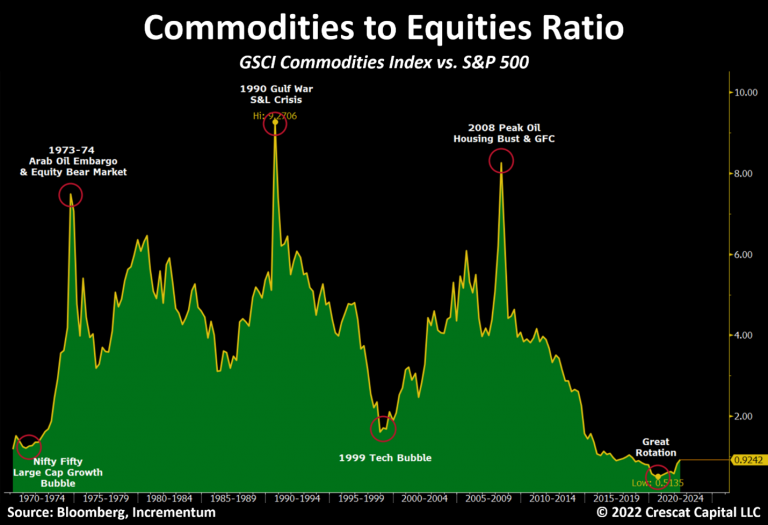

Commodities are still cheap relative to equities

Lyn Alden speaks

She only writes a bulletin once a month, but it’s always worth reading. It’s free too! You can read it here. She has a fairly mainstream take on economics, but has lots of data and good historical perspective.

Overall, my base case is that the Fed will tighten monetary policy until something breaks, which will force them to reverse course. It might be a recession, or it might be a near-recession slowdown.

Wrap

All real assets were down today. The dollar edged a tiny bit higher to 103.7 (DXY). Equities were hard hit again: NDX down 3.7%. Oil was hit hard, not sure why, but the fact that Europe could not agree a ban on Russian oil, and that KSA dropped the price of Arab Light crude grade by $5. The China lockdowns cannot have helped … but surely they are near the end? (I don’t really know how KSA prices its output, but it seems to be relative to a benchmark: Brent?)

So Maersk says 2022 container demand growth will be negative, and the Freight Rail CEO recently said “we have no issue finding and booking space from Asia to the US”

— Calvin (@calvinfroedge) May 8, 2022

But you go on and keep chasing container shipping stocks higher…

Image

Léon Gimpel, autochrome, France, early 20th century pic.twitter.com/0J2RDWxAsi

— Daniel Brami (@Daniel_Red_Eire) May 9, 2022

721e3055e885161987639dcbc3427d967d145432

Comments !