Calum Thomas’ Thesis

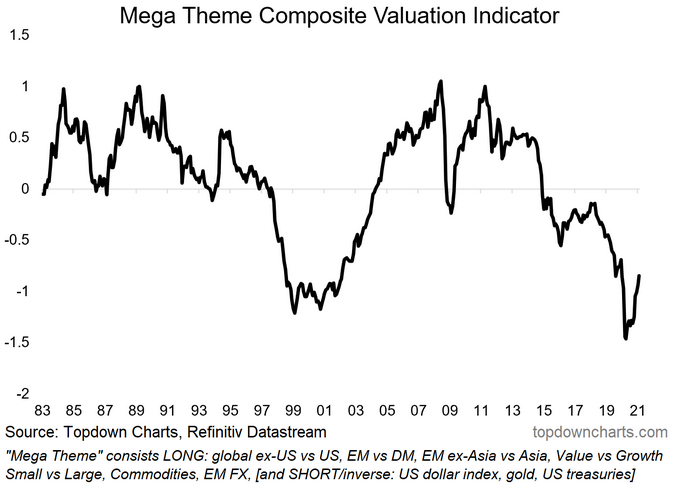

Calum Thomas combines his top charts ideas into one. His ideas are: 1. global equities should outperform US ones, 2. emerging markets (EM) should outperform developed ones (demographics, deficits, trade), 3. EM ex-Asia should outperform EM within Asia: rotation play, 4. Value will outperform growth (it’s gotta happen, eventually!), 5. small cap will outperform mega cap, 6. commodities will come back, 7. EM FX should outperform. Deficits again, twins in most cases, 8. DX should sag (the world consensus, except Brent Johnson), 9. gold will trend down as real yields go up (production function, deflation, deficits), 10. Treasuries will wilt under the weight of the deficits they have to fund.

I’m on board with all this, except perhaps gold. If real yields go up, so will the real cost of govt. debt financing, which will mean politically difficult tax rises. My money is probably on CB’s finally igniting inflation, but they’ve been spectacularly bad at doing this in the recent past. Govt.s could do it, but the short term spike in nominal rates might kill them.

The correctness of this view has been combined into a composite chart. You’ll have to read Thomas’ post for details. The thesis is that this view came right in about April 2020.

Bitcoin Satoshi Vision

I dabble in a tiny, tiny way in cryptocurrencies. I like the idea of a distributed ledger with a democratic process for agreeing and confirming transactions. I also like the fact that it relies on public key encryption. I also like the idea that it was invented by a guy, who remains anonymous but is now semi-trillionaire, who made up an obviously fake name from bits of well known Japanese appliance manufacturers.

But it’s clear that in their current form, the vast bulk of blockchain-based cryptocurrencies are unusably slow. The cause of this is small blocks, and one currency, BSV, tries to fix that with … big blocks! The result will be a less distributed ledger, but much quicker confirmation times, and throughput of transactions. The currency that delivers this is BSV. It’s hard to have a huge (and endlessly growing) blocksize and at the same time let everyone run a full node on his PC. The BSV tradeoff is to have fewer and more centralized servers, which means that BSV is not so good for money laundering or buying drugs, but if it is ever going to be usable in the way that was originally envisaged, I can’t see any alternative. Buying BSV seems tricky: Coinbase doesn’t seem to support it. I have done the most cursory of checks.

To find out more about BSV checkout Unbounded Capital. I should warn that BSV is very, very controversial. Many bitcoiners despise the BSV crowd as heretics and want them burned at the stake. BSV certainly has low volume, and it’s capability of processing many transactions clearly makes it more vulnerable to attack by the NSA and/or the Kremlin.

Unionization

Paul Krugman wrote a newsletter commenting on how Joe Biden had implicitly encouraged workers at Amazon to unionize. He reviewed why it was that union membership in the US private had cratered, in a way that was not replicated in Denmark (or Canada). He concluded that it was because union-hostile Republican administrations had been in power for too long. It seems a bit simplistic, but he has a point. In the UK, we’ve had a mix of Labour and Conservative, but the Blairism was as hostile to unions as Thatcherism. It’s hard to see the pendulum swinging back here, even if we get a Starmer govt., but it might just happen under Johnson, as he cares more about winning elections than being ideologically pure.

Wrap (~20:30 gmt)

Another inflationary day:

- All major indexes down, although some rallying towards the close,

- FAANG stocks hammered, except $FB, $TSLA too,

- DXY up, to 91.6: on increased yields. The FX market is ignoring inflation. BTC down 4.9%, in spite of the fact that everyone sees it as an inflation hedge (“digital gold”),

- bonds yields up, 10Y by 7bp, to 1.54,

- hydrocarbons all up (crude by 4.57%, to 64.1, except gas (down 2.5%),

- most ag. commods down, except soybeans,

- gold & copper both down heavily (copper by 4.7%).

Main news today was:

- OPEC which seems to have agreed to keep production unchanged in April,

- Powell giving some testimony, saying that he’ll let inflation rip (well, I don’t think he actually said that, but that’s how the market reacted).

ARKK, the Ark ETF, which is down 5.7%, and was down further. It’s an active portfolio, but the ETF sponsor agrees to replicate the portfolio as held by Crazy Cathie. Everyone expects her to reduce the more liquid stocks first, which will simply add volatility and illiquidity to the remaining portfolio, making it more and more vulnerable to a selling attack. With bitcoin down quite a bit, the crypto equities were hit. $MSTR is down nearly 13%. The market will probably recover, but today will have shaken out some of the RobinHooders.

Comments !