Thursday 7, July 2022

Not such rare earths!

I don’t know how reliable this is, but if it is true, it sounds kinda important. I haven’t seen this anywhere other than as a random tweet on Twitter.

Nadhim al Zahawi

This guy has some risk-taking abilities. Within hours of being appointed to the second most important post in government by Boris Johnson, he tells him (Johnson) that he must go. I don’t know what the odds are, but if you get to the top by being ruthless, this guy has what it takes.

Neocons and US Hegemony

Jeffrey Sachs has written this piece that has been picked up in many publications. It’s a rather personal attack on a number of individual (and now mainly very old) US neocons. It argues that the US is warlike and constantly strives to expand its global influence by getting involved in ‘wars of choice, such as Serbia (1999), Afghanistan (2001), Iraq (2003), Syria (2011) and Libya (2011).

I don’t really agree with this, but I’d like to see some sort of official denial of this as US policy. Sachs argues that many of Biden’s key advisors are linked to a key group of 70’s neocons.

The main message of the neocons is that the US must militarily dominate every region of the world, and must confront rising regional powers that could someday challenge US global or regional dominance, most importantly Russia and China. For this purpose, US military force should be pre-positioned in hundreds of military bases around the world and the US should be prepared to lead wars of choice as necessary.

Market Report

From SEB. First rate, and free.

Stock markets in the US rose moderately yesterday and are followed today by markets in Asia except for Hong Kong’s Hang Seng index. The rise is driven by technology stocks, led by Samsung, following a report of stronger-than-expected revenue. US and European stock futures point to a stable opening with small movements later today. The US Fed published the minutes of the June meeting yesterday, which showed concern among members about rising inflation (more below). This led to a selloff in the bond market, albeit a limited one. At the time of writing, the US 10-year interest rate is 2.92% compared to 2.80% yesterday. The dollar strengthened and is approaching parity with the euro, although it has fallen back a bit today with EUR/USD at 1.02. Oil prices fell on concerns of declining demand in case of recession but are back over $ 100/barrel today. Rising covid cases in Shanghai also caused a drop in oil demand expectations, as well as signs that Russia has managed to redirect oil supplies to Asia. Discussions on how to limit Russia’s oil revenues continue without signs of a clear solution or concrete proposal on how to proceed. Despite the Norwegian government stopping the strike in the oil and gas sector, the price of natural gas continued to increase, driven by concerns about continued disruptions in supplies to the EU from Russia.

Hawkish Fed not entirely credible according to investors who see economic slowdown. The minutes from the Fed’s meeting on 14–15 June, which were released yesterday, showed that the members agreed that they must continue to raise the policy rate to prevent inflation from taking hold, even if it would mean that the economy slows down. Several members also said that they must act decisively so that the public does not doubt their intention to bring down inflation. The protocol indicates that more increases in the magnitude of 75 points are to be expected (more from Jussi Hiljanen here). However, the rise in the US stock markets yesterday was a sign that many investors believe that the protocol has already been overplayed as statistics since the June meeting pointed to a slowdown in demand that would help lower inflation even with a slight monetary tightening. The undersigned is sceptical. Given that the energy war between Russia and the EU is not over and given China’s continued zero tolerance for covid, inflation looks set to continue to rise for a while longer and who does not want to be compensated for that when wages come?

Boris

I saw on Twitter a comment along the lines of “Don’t think of it as the country losing a Prime Minister. Think about it as the country gaining a game show host.”

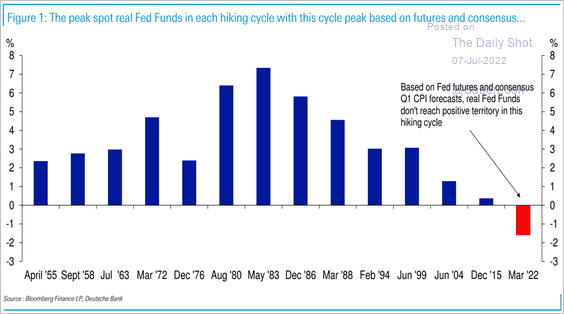

Real rates still expected to be negative

Modern economies cannot tolerate savers receiving any real return.

Modern economies cannot tolerate savers receiving any real return.

The yen

JP Morgan (writing in the FT) considers the yen to be still overvalued. The arguments are:

- the carry trade is dead now,

- Japan now barely has a current account surplus, since it offshored all its manufacturing,

- the BoJ is hell-bent on yield curve control, which will prevent them tightening in the way that other central banks are doing.

The counter argument is that most Jap debt is owned by Japs, so the currency is a safe haven, and that asset prices in Japan are cheap, so re-pricing should increase demand for yen.

Exchange rates. Anyone’s guess. Who would have guessed that total chaos in the UK government, the vastly increased chance of an early election and a socialist party victory would have been positive for sterling!

Wrap

Today was a boring, textbook risk on day. All real assets up, silver being an exception, just. Oil bouncing back 4.3%. All indexes up, Nasdaq by 2.13%. VIX down. Bonds all down.

I don’t know about the gold market, but gold bugs have been convinced that the market has been manipulated for years.

Comments !