The day in retrospect

Reflexivity

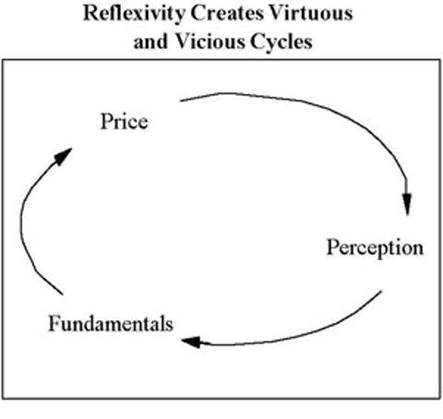

I saw this great thread on reflexivity, George Soros’s contribution to investing lore. I have read his book on it a couple of times, and at the end of it I’ve always thought:

- wow, is that all there is to it?

- so, demand for a security might even go up as the price increases. I can get that, but it won’t go on forever, right, because otherwise the stock market would just be all $AAPL,

- OK, so regular demand supply curves aren’t exactly quantitative, but the only thing that matters for trading is when a trend reverses, and Soros doesn’t really say anything about how to stop this,

- umm, technical analysts, chartists and astrologers have chanted mystical incantations over lines on price history plots, and asserted that certain trends would continue/reverse/other for a long time, and yet there are no billionaire chartists that I am aware of,

- there is probably something in this, but it’s not clear how to profit from it other than to be aware of the possibility that trends can continue for a long time.

One example of the operation of reflexivity is as follows:

Well, I’m still not totally won over, but I sort of see the point better now than after reading a whole book, so I thought I’d share this.

I must confess, my understanding after reading the book was that this was purely a “technical” effect: that the rising price trend dragged more buyers into the market as they became more convinced that the security had been previously mispriced.

The administrative state

I really don’t know much about the SEC, but I assume if what the Martens write was factually wrong, they’d be sued to Kingdom Come, given that they regularly attack lawyers and very well connected individuals. I never see this stuff in the mainstream media. Either they think it’s not worth reporting, or that it’s better than ordinary people do not learn about these goings on.

Bill Gates defends IPR

This is a sort of “dog bites man” story. As Mandy Rice-Davies would say “He would say that, wouldn’t he?” The brilliant newsletter The Ink has a good take on this, here.

Pyrogenesis will ignite your returns if you buy puts!

Basically, a wildly optimistic company in the crowded space of 3-D printing, which may be booking sales to a related entity.

Wrap

US yields grind higher as evidence of a rapid bounce piles up.

- US 10Y at 1.638%,

- WTI crude at ~$65, up 1.7%,

- GSCI basket down 0.75%, by poor performance of metals, including precious metals,

- equities grind higher in the US: SPX up 0.67% to 4211; in Europe drifting lower,

- DXY down to 90.56 on a steep downtrend.

Overall, fairly reflationary and slightly risk on. No strong trends.

The end of neo-liberalism?

It seems that with the election of Biden the small government ideas of Hayek, Friedman, Reagan and Thatcher might be falling out of favour, after four decades in the ascendant. The religion of neoliberalism is more worshiped in the breach than the observance, but it had set the tone of governments promising fiscal continence even if they failed to deliver it in practice. With the huge stimulus spending to combat Covid-19, the idea that government spending was a terrible thing has quietly faded away, just as it did in the years after WWII. Unfortunately, when the pendulum swings, it usually goes too far, and we are likely to see the return of wage inflation and price inflation and, maybe even, at some point, defaults on government debt either explicit or via financial repression.

In 1981, this was done by ideologues. In 2021 this will be done by pragmatists who realize that returns to capital have got out of line with returns to other factors of production. I am not sure whether this means that the right wing parties will lose out, or they will just steal the clothing of the left wing. I think it’s more likely to be the latter, since the Right would rather lose their principles than their elections. This is idle speculation on my part, and is not in any respect a comment on UK politics.

Comments !