Crumbs

REITs

We all need somewhere to live. Homes are both a necessity, and a luxury good. A house is like a loaf of bread, we must have somewhere to rest our weary head, even if it’s a tent under a flyover. Like art or opera tickets, a house is something we spend more of our income on (in percentage terms) as our income goes up. This makes residential real estate both a defensive and a growth asset. It is also very interest rate sensitive. It is very sensitive to the the overall state of the economy. Finally, it is a value sector, and therefore has underperformed the rest of the market over the last ten years.

As this article from Seeking Alpha points out, Wall Street analysts change their price forecasts when the market has shown them why their previous forecasts were wrong.

This chart from the same article shows a few REITs which are traded in the US. The time may still not be ripe to investigate this sector, but it’s worth reading up on it. As the article points out, just buying or selling on naive metrics like price/book or dividend yield is probably going to be a bad choice. As in all cases, a deeper dive is needed.

| —- | —- | | Ticker | Name | | CLPR | Clipper Realty | | APTS | Preferred Apartment Communities Inc. | | NXRT | NexPoint Residential Trust Inc | | BRG | Bluerock Residential Growth REIT | | IRT | Independence Realty Trust Inc | | UMH | UMH Properties | | ESS | Essex Property Trust Inc | | UDR | UDR, Inc. | | MAA | Mid-America Apartment Communities Inc | | AVB | AvalonBay Communities Inc | | ACC | American Campus Communities, Inc. | | CPT | Camden Property Trust | | EQR | Equity Residential | | INVH | Invitation Homes Inc | | AMH | American Homes 4 Rent | | SUI | Sun Communities Inc | | ELS | Equity LifeStyle Properties, Inc. | | —- | —- |

Junk is now Shabby Chic

Talk about getting in on the ground floor. The recent upward jolt in interest rates has had little ill effect on the booming high-yield market, as the average yield on double-B-rated companies reached a record low 2.98% earlier this week, dropping below the dividend yield on the S&P Utilities Index for the first time. On the other end of the credit spectrum, yields on the triple-C-rated component of the Bloomberg Barclays Index also reached a record low 6.1% earlier this week.

Evaporating yields have flipped traditional dynamics upside down. Bloomberg reported on Feb. 5 that income-hungry investors have resorted to “calling up companies and pressing them to borrow, instead of waiting for bankers to bring new deals to them.”

Grant’s is pointing out that we are still in the Euphoria stage of a bubble, according to Minsky’s taxonomy (we’ve been through Displacement and Boom, we still have Profit Taking and Panic to look forward to). It’s still too dangerous to call this market: this music is still playing, we’ve got to get up and dance, but ideally not too far from the emergency exit door.

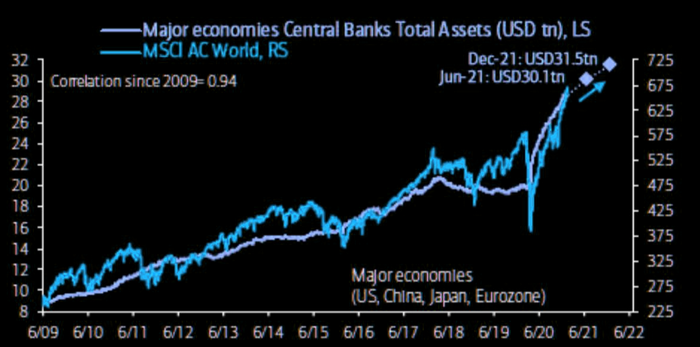

Equities need more QE

New Commodities Supercycle?

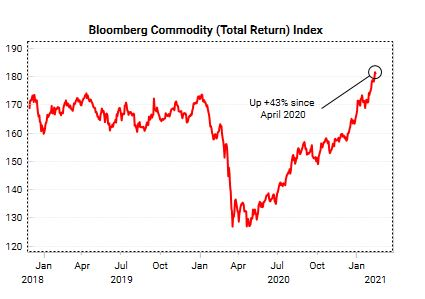

Variant Perception has written a report on the idea that commodities are due for a bull run.

I don’t need convincing, but this might persuade you.

The thesis is that energy and copper are poised to rip, and precious metals too.

Anyone who is watching gold will know that it has simply not gone anywhere lately, so the thesis is damaged.

A basket of commodities, though, has done well (especially oil) since last April. It is quite plausible that it has further to go.

NOT INVESTMENT ADVICE!

I don’t want to worry you … but

There’s a lot of talk right now about how equity valuations aren’t helpful in forecasting returns.

— Julien Bittel, CFA (@BittelJulien) February 19, 2021

As with anything, that’s a question of measurement.

Here is my composite US equity valuation model vs. S&P 500 YoY.

Current valuation extremes are consistent w/ -29% YoY 12M fwd. pic.twitter.com/NuhFAhdjCB

Comments !