Note for 5 July

I was away over the weekend and didn’t look at a screen. Well, maybe my phone a bit, and I read some stuff on my Kindle, but that doesn’t count. Does it?

Wrap

US markets were closed today. Other equity markets were generally flat: MXEA nearby future was up 3bp. In currencies, DX continued its slow decline, to 92.2, but this is still a long way above its low point in May, which was approx. 89.6. Commodities were generally up, consistent with dollar weakening, including gold ($GC), but still below $1800/oz, so well behind its highs in May. Bonds were pretty flat outside of the US. Everything seems to have changed direction on or around 10 June, when J Powell gave his “We’re Not Even Thinking About Thinking About Raising Rates” speech. This will probably seen as a “We will do whatever it takes” moment. I assume the market thinks that the USA is really going full Japanese, and that the rest of the world will have no option but to follow. But to be fully Japanese is to run a deficit of under 3% of GDP, rather than the nearly 5% in the US. Having said that, it’s remarkable how the public sector deficits of the two countries track each other.

Tesla

I’ve stopped following the $TSLA share price. No matter how shamelessly Mr Musk manipulates the stock price, and the price of various crypto currencies, it is clear that the SEC and the automobile safety agency are simply not going to take any action against him. The latest fiasco is that a new engine configuration in the Model S causes almost new cars to burst into flames. Until someone really famous dies in a Tesla the stock price will not be harmed. This fact says volumes about the transparency and regulation of securities markets in the US. I have no doubt that markets elsewhere are usually worse. The same unwillingness to prosecute securities manipulation has characterized the treatment of the bulge bracket banks.

Nat Gas

I am long-term bullish about nat gas. I believe that the world simply cannot keep running without a base level of fossil fuels, for electricity generation, plastic feedstock, fertilizer energy and possibly hydrogen production. This article makes the case. The economics of this have not changed for a decade. Even if we do manage to make carbon capture and storage economic (a big “if”), we will probably use it in conjunction with nat gas because that produces the least CO~2~ per Joule.

IPOs

Everyone is fixated on SPACs, but firms to come to market in the old fashioned way, via IPOs. The following were picked out by Grit Capital as having done spactacularly well:

- Esports Technologies (EBET) | Market cap: $290M | YTD: 251%

- UTime Limited (UTME) | Market cap: $98M | YTD: 207%

- ZIM Integrated Shipping Services (ZIM) | Market cap: $5B | YTD: 199%

- Global E-Online (GLBE) | Market cap: $8B | YTD: 128%

- FIGS, Inc (FIGS) | Market cap: $7.4B | YTD: 127%

Edward Snowden on conspiracy theories

Edward Snowden writes that it’s not the wild conspiracy theories that we should be worried about, but the open manipulation of our behaviour by mainstream institutions. Persuading everyone to install an app like the NHS Covid 19 app on his or her phone is an example of a conspiracy in plain sight. The idea that we’d all walk around with an app designed by the government to monitor with whom we come into contact is … Orwellian, but somehow because the app is branded with “NHS” we all install it. It is actually nothing to do with the NHS, because ministers knew that a lumbering dinosaur of an organization like the NHS would never be able to develop such a thing in a sub-decade timescale.

Trump

Everyone, I suspect, knew that Trump cheated on paying taxes. Only now he’s disappeared from the scene are the authorities willing to risk taking action against him. Well, not really against him yet, but they’re warming up for it. Maybe people were more persuaded of Trump’s virtue than cynical me, and this is why so many Americans voted for him. Or maybe they voted for him while holding their nose. Or maybe they voted for him because he was smart enough to not pay taxes, and they wanted to stick it to the boring establishment that notionally play by the rules.

Or maybe this is just a witch hunt, and his accountant will be full exonerated, and Trump will ride the wave of sympathy to become the 47th president. I simply have no idea what might happen, which is what makes US politics such a great spectator sport.

The indictment took square aim at Mr. Weisselberg after months of increasing pressure on him to offer information that could help that broader inquiry. Prosecutors had subpoenaed Mr. Weisselberg’s personal tax returns and bank records, reviewed a raft of his financial dealings and questioned his ex-daughter-in-law — all part of an effort to gain his cooperation. That effort is expected to continue, and now Mr. Weisselberg is under even greater pressure: He could face more than a decade in prison if he is convicted.

Mr. Trump was not charged, and no other executives were accused by name of wrongdoing.

Just to remind you, Trump has form for associating with tax evaders.

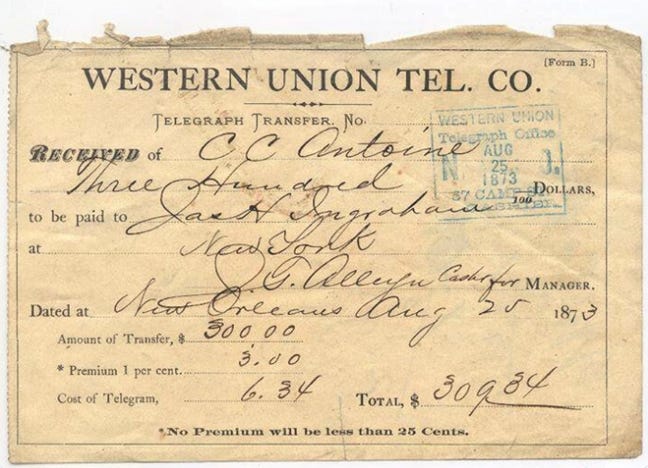

Telegraphic Transfers

This amazingly interesting read explains why it is so hard to make money by shorting a stock based on understanding how disruptive technologies are going to play out. The first example is horses. Although Ford was churning out Model T’s in 1905, it wasn’t until 1920 that the number of horses in use was clearly declining. Fifteen years is a long time to wait for an investment idea to bear fruit.

The other example, which is fascinating, is Western Union. This is a company that has been in decline since 1856. But it’s still profitable! It took thirty years for the number of “telegraphic transfers” to halve. Even now, many decades since telegrams simply ceased to exist, people will still refer to an electronic transfer as a “TT” (i.e. “telegraphic transfer”). This is insane, given that the telephone was patented in 1876.

It’s not just that the force of habit is very strong, it’s that competitors all exit a market, leaving the residual player able to extract rich economic rents. Who else offers a cash transfer from Patagonia to Timbuctoo? If you need to get that money between those places, you have nowhere else to go. Especially for the great unbanked, who make up the vast bulk of the human population.

Inflation transitioning from economic statistic to political football

Ben Hunt argues that nowadays your view about the future path of inflation is likely to get you shot down as being a partisan. It hasn’t happened yet in the UK, but we nearly always seem to follow the US in these matters. Once we get a CPI print of 5% per annum or above, we’ll get the finger pointing and CB spokesmen talking about how this is all transitory. The voice in the wilderness now is Andy Haldane. I don’t expect him to remain alone for long.

Covid is transmitted long distances via aerosols

Read this great article from Wired. It’s rather long and detailed, but the TL;DR seems to be that medicine is very siloed and doesn’t welcome input from physicists who really know about how suspended particles move in the air.

Sampling Bias

Reverse Repos

Zoltan Sees Reverse Repo Hitting $2 Trillion In Weeks: What Happens Then?

Zoltan Sees Reverse Repo Hitting $2 Trillion In Weeks: What Happens Then?

Comments !