Are we really in a reflationary environment?

It’s hard to say. The government is injecting money ‘into the economy.’ But, someone is buying those bonds, and those people have spent their money, on bonds, and aren’t going to spend it on new cars or homes. Keynes talked about fiscal multipliers, but they are impossible to measure accurately, and some people think that they are actually divisors: when the government spends money, it shrinks the size of the economy.

- A careful study of BOGOFs for chipwiches suggests that inflation is in the air.

- McKinsey are a malign force in the world. They seriously are a danger to democracy. We’ve seen an explosion in costs for consultants in the UK, and it’s getting worse.

- A lot of the stimulus money is going to end up being wasted. Well, you knew this already, but when a former central banker says it, maybe people will pay attention. As usual, the snouts at the trough will not be the genuinely needy, they will be the 0.1%. Read on and weep.

Wrap

Today was basically a continuation of last week. The Biden Go Big and Build Back Bigger plan is pouring petrol onto the flames of the flickering embers of the pandemic and the stock market is burning brightly. SPACs like $BOWK (the carcass of We Work) are shooting into SPACe, like the Chamath crap.

In other news,

- Project Zimbabwe is starting to weigh on the dollar: DXY down 0.47%, although still 92.6,

- Bonds pretty flat: 10Y up 0.12%, 30Y down 0.08% (actual futures prices: too lazy to check yields),

- precious metals basically flat,

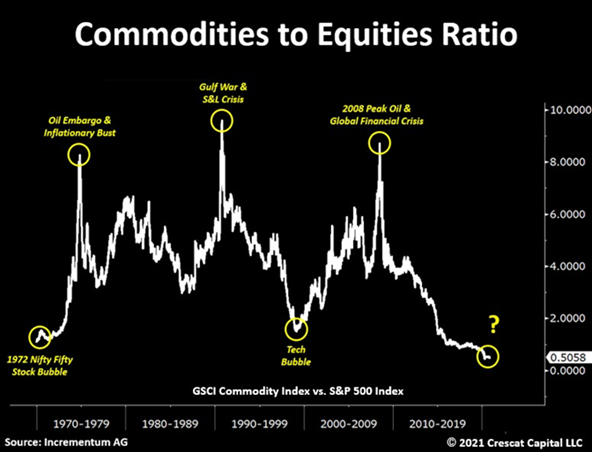

- GSCI commodities index down 0.56%,

- $CL1 (front month WTI crude futures) down 4.4%!,

- Oil production and exploration predictably heavily down.

The Goldman Sachs Trolley Problem pic.twitter.com/limLgLYa58

— Kenneth Dredd (@KennethDredd) April 3, 2021

(1/11) There seem to be a ton of tweets going around regarding total return swaps (many good; some not so much). Here's my perspective from someone who has used TRS countless times over the years with several counterparties globally.

— Saang Lee (@saanglee) March 29, 2021

A TRS is quite simple: An institution…

The backstage of the Federal Reserve pic.twitter.com/ocK2tzm7dN

— Alessio (@AlessioUrban) April 4, 2021

Official US inflation rate: +1.5%

— Dan Held (@danheld) April 3, 2021

Oil +80%

Corn +69%

Steel +145%

Wheat +25%

Coffee +34%

Cotton +35%

Copper +50%

Lumber +126%

Soybeans +71%

Home Values +8%

Stock Market +23%

Money Supply +24%

h/t @redditinvestors

Comments !