Notes for 30 June

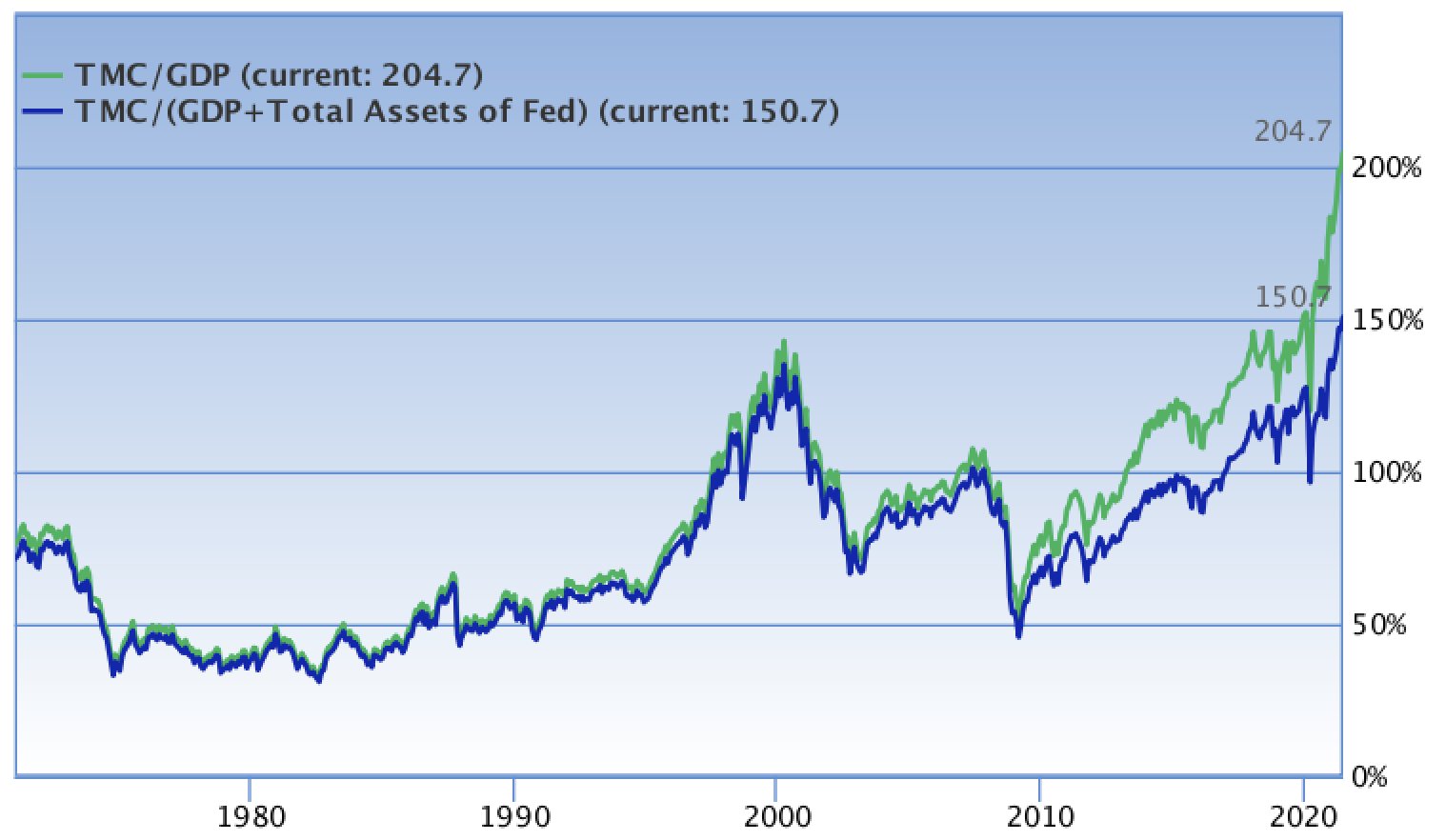

This market really is crazy

Google has become bureaucratic and slow moving

The NY Times has a story which says that Google’s CEO is risk averse. Every other disruptive company has opted to defend its existing markets rather than keep challenging incumbents. That’s what monopolists do. I am sure that the shareholders are delighted.

Macro matters

China has huge demographic headwinds. It’s like Japan, but worse. Nobody is going to migrate to China. Anyone sensible with funds will GTFO, especially when growth runs out because the labour supply has dried up.

The argument made by Vincent Deluard is that China needs the RMB to become a reserve currency, and that the only way this can happen is if RMB collateral is valuable and stable. This is very bullish for PRC bonds. Individual companies may be taxed out of existence, but sovereign bonds will be solid. I’ve heard the argument that countries which need to be aligned with China because they are so tightly coupled with it for trade reasons (Vietnam, Korea) might be a better play, at least in currency terms. But Deluard argues that RMB bonds are the way to go. To be fair, this is what Gavekal has been saying for ages.

StoneX goes on to say that the factors that make China want to preserve the value of its currency and bond market at all costs simply do not obtain in the USA. From an electoral point of view, allowing the stock market to crash would be a disaster for both the Democrats and the Republicans. If the price of this is allowing a purging dose of inflation, the collapse of the dollar and double digit inflation, well, this is a price worth paying.

As Deluard points out, with N. Pelosi having a $120M stock portfolio, which she actively trades, the establishment of the ‘Left Wing’ party in the US maybe about to “euthanize the rentier class,” but only those who have invested in Treasuries, and they are certainly not going to upset the 0.1%.

There is something in the FT about China’s demographic timebomb. Certainly, it seems likely that China will follow the route that Japan has been taking for a long while.

This story has been touted for a long time. I think that it will come to pass, but there needs to be a catalyst for the trend to change. Emerging market fixed income has been negative to flat for a long time. Ultimately, this is because investors have more attractive assets to

Wages of sin

Yemen bombing map. This is deeply depressing. It shows the companies which made these arms, and the countries they are based in. All bought by Iran and Saudi, whose proxy war has killed about a quarter of a million people out of a population of 28 million.

The case for a bull market in fossil fuels

This article by Lyn Alden makes a detailed case for fossil fuels having a golden twilight. The argument is that as the world gets richer, energy use per capita goes up rapidly, too rapidly for decarbonization can keep up. Meanwhile, capex is falling. Mix in the fact that most of the growth in population and wealth will be in emerging markets which don’t have the political need to appear green and you get a strong bull case.

Stock picks (hers, not mine):

For simplicity, investors can consider an oil and gas ETF like the iShares Global Energy ETF (IXC) along with a uranium producer ETF like the Global X Uranium ETF (URA) or the North Shore Global Uranium Mining ETF (URNM).

In terms of individual energy producers or transporters, I like names such as Canadian Natural Resources (CNQ), Lukoil (OTCPK:LUKOY), Enterprise Products Partners (EPD), and Kazatomprom as buy-and-hold positions.

Wrap

- Equity markets grind higher: $SPY hits another ATH, but generally markets lack direction,

- yields down a few bp (10Y now 1.44%),

- energy commodities continue to be strong, especially natural gas, dragging

- slight recovery of prices for precious metals, from a low base,

- USD gaining, against EUR, 10bp, tracking DXY,

- LB (lumber futures) continue to be crushed, but $WOOD, the forestry ETF has turned around.

- credit (e.g. $IBXXIBHY) continues to be strong. I think that when this edifice starts to totter, high yield credit will be where the cracks appear first,

- continued anger over the collapse of the Florida apartment block,

- 7.5% pop for EV maker Xpeng ($XPEV),

- Didi, Chinese version of Uber sagged after IPO.

- RobinHood fined for abusing its customers. $70MM. About one quarter’s revenue.

Comments !