Crumbs

- Howard Marks has written another of his annual memos. I haven’t read to the end, but it seems to be about defining better what ‘value’ and ‘growth’ really mean. He points out that a company that is not capable of growth should not be considered to have ‘value.’ He spends a lot of time talking about Buffett and Munger, and points out that it was really Munger who understood that a company could be expensive by Graham and Dodd metrics but could still represent great value. I think this point has been flogged to death by Terry Smith. Of course, if the straightforward accounting ratios fail, then the task of identifying value becomes a whole lot harder, and implies that value style ETFs are going to miss the point. Marks is a thoughtful writer. Marks also points out that credit investing and equity investing require very different mindsets. Investing in corporate debt forces the portfolio manager to think exclusively about what can go wrong, since if everything goes right the valuation is trivial.

- Indians are not very bullish about their local stockmarket. Emerging markets are always full of problems, but they are also full of opportunity. It’s interesting that the weakness of the dollar will become a problem for India, according to this article. [Assuming that the dollar will continue to weaken, which may be a consensus view but is far from certain.]

- Walmart doesn’t want to be yesterday’s story.

Wrap

Risk on stuff:

- most equity markets up,

- yields rising across currencies and maturities, with the exception of the core EU countries, for nearly all tenors now,

- bitcoin stabilized,

- $TSLA up,

- Energy up, food up, metals up, both industrial and precious.

Risk off stuff:

- JPY up,

- US equity markets down (or flat, for the meaningless Dow).

News: new job openings in US not going up as much as hoped. Data from Nov., so maybe already long discounted.

Angela Merkel criticized Twitter (and, implicitly the gang of five) for silencing Trump.

Trump remains in danger of being impeached, although the odds of this happening are fading.

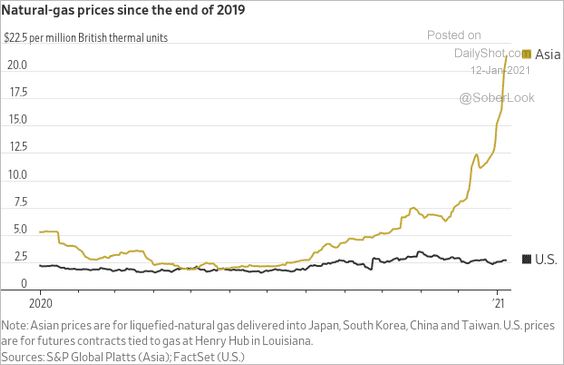

Natural Gas looks expensive in Asia:

Chart of the day

5-Year, 5-Year Forward Inflation Expectation Rate (T5YIFR) is continuing to tick up.

Comments !