Stocks and Bonds

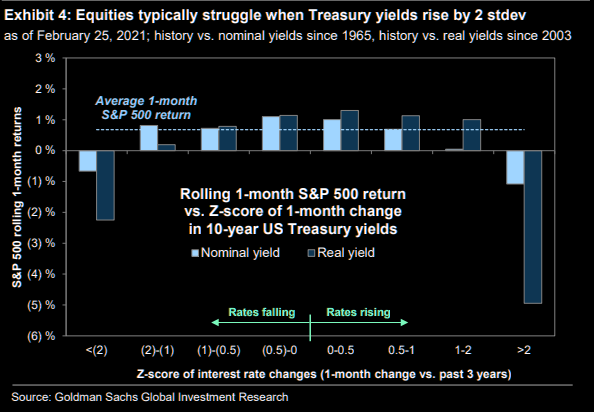

The so-called ‘Fed Model’ of the stock market says that you can just compare the dividend yield (or free cashflow yield, EBITDA yield etc.) with bond yields, to get a handle on what the stock market is doing. So, if yields fall, the stockmarket goes up (because net incomes of companies are relatively stable). As this chart, from the Market Ear, makes it clear, extreme moves in yields in either direction provoke large negative returns for equities.

Obviously, the Fed model sort of works most of the time. Equities and bonds have gone up in tandem, with the 60:40 portfolio blunting the edge of risk off events in the equity markets with spikes of divergence between the asset classes. But this works while we do not have big moves, and yet Janet Yellen has already promised that this is the time for government to “go big.” Going big means spiking inflation expectations, which spikes yield moves.

Taps Coogan has written another excellent piece about the Fed, balance sheet expansion and inflation. In this he points out that increasing Fed assets cannot simultaneously be the cure and the cause of the disease of rising inflation. Although J Powell has denied it, everyone seems to expect the Fed to start yield curve control to offset the rise of yields on long-dated Treasurys. They have followed the Japanese playbook slavishly so far: why would the diverge now? Well, it has been tried before, with mixed results.

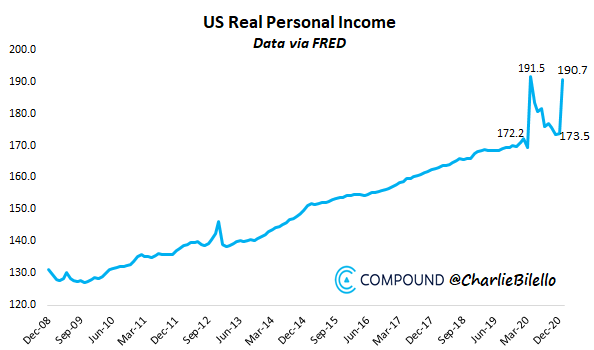

A lot of people say that deflation will still happen because the Fed can’t affect wages. A supplementary reason is that many states are deeply insolvent and simply don’t have nearly enough money to pay their pensioners and employees. Somehow, I think that some way will be found to inject dollars into the accounts of these people. Real resources … that may be more tricky.

David Rosenberg thinks that after an initial surge the need to reduce deficits will kill any economic recovery. He’s bullish on long-dated Treasuries, and on Chinese equities (and related Far East assets). He also prefers banks to bitcoin (me too!) and reckons that yield curve flattening will not flatten their appeal. I’m not convinced, but he’s a very smart fellow, and has been right in the past.

Realpolitik

Richard Haas, previously director of Policy Planning at the US State Dept. explains that signalling to MBS that you are an ally of his by dropping some bombs on people in Syria who might be linked to Iran is a perfectly understandable and normal diplomatic move, and that the only difference between MBS and Putin is that the former is rather more effective at killing his political enemies than the latter. Oh, and of course noboby would criticize the USA for not criticizing Putin. Well, it’s depressing, but it’s probably accurate.

Truth in Tweets

rich yuppies will never hire a maid bc its déclassé but will gladly hire a serf to go fetch their groceries so long as it's hidden under at least one layer of digital indirection

— roon (@tszzl) March 1, 2021

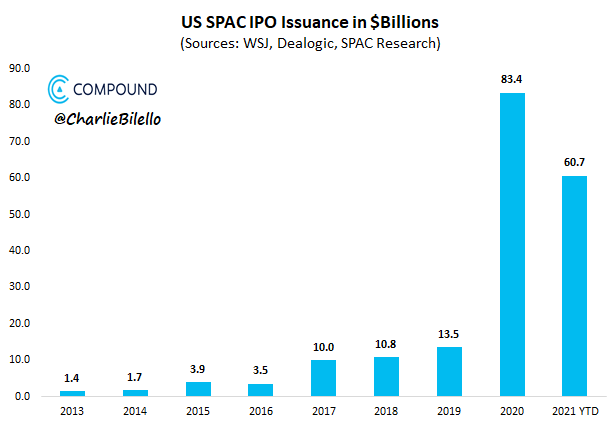

SPACmania

If this isn’t a bubble, I’ll eat my shorts.

Manzara blasts Brad Sherman

Alex Mazara is a technical specialist. His blog is about changes in a few basis points of yield levels between adjacent maturities in the T Bill futures curve. It’s all the more astonishing that he does such an excellent demolition job on politicians, here. The point is that the politicians have no understanding of markets or economics, and will be clueless when the wheels come off the economy. Just read the blog. It’s excellent (as the weekend ones always are).

Inflation, since 1913

Inflation was pretty wild in the first few decades of the last century, and spiked up regularly after wars subsequently. We haven’t had a war in a long time, but we’ve (globally) spent a lot of resources on paying people to sit at home watching Netflix. This may just tilt the balance.

Wrap

Hard to classify. The $1.9B stimulus bill galvanized nearly all assets:

- bonds up,

- equities up (virtually globally, US by ~3%),

- NDX up 2.9%, Russell 2000 3.6%. Best day for ages,

- All sectors up, max tech, least real estate. Energy did quite well, but oil was down 1.7%. No, I have no idea why either.

- DX up 0.2%.

Given the virtual certainty of this bill being passed, one has to wonder what on earth was the real driver of this rally. The fact remains, though that over 5 days, the market hasn’t really moved much either.

Strength in the US Dollar is going to be a big headwind for commodities. They’ve had a great time (except gold, of course), and everyone is bullish on them. But that’s not the time to be getting into a long position.

Tweet of the day

Newton WatchPad. pic.twitter.com/c25N8bUdqE

— Dana Sibera (@NanoRaptor) February 27, 2021

I have no idea if this is real.

Comments !