Monday 14, February 2022

Junk is trash

There are lots of charts showing that inflation is not tamed yet. There are lots of charts which show that sentiment is weak as rising prices of all sorts of goods is draining the spending power of ordinary workers. The Fed is almost certain to raise by at least 100bp this year. The construction sector is likely to roll over, as it is the most interest-rate sensitive of them all, but there is a big risk that the wider equities market is crashed, because there are so many zero yield stocks now.

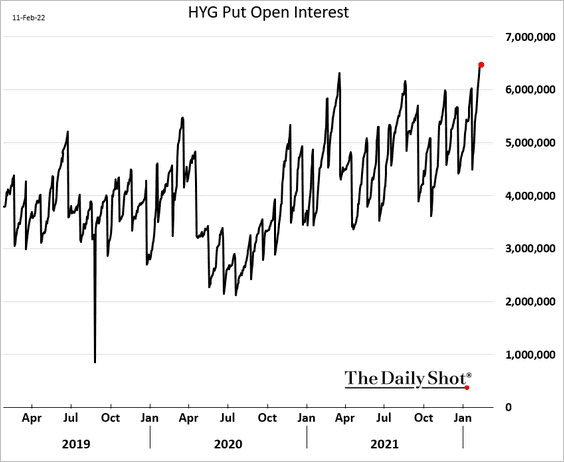

Treasury bonds hold up with the economy is stalled, but anything with credit risk tends to go down. The $HYG ETF is a basket of weak credit bonds. It has not been doing well, and investors are beginning to protect themselves against further losses by buying puts.

The problem with buying puts is that the market makers will hedge their delta risk by selling the underlying. This can create the opposite of the (call) gamma squeeze that Elon Musk has deployed to such deadly effect to keep the price of $TSLA way above what would be justified by fundamentals.

This is not investment advice, but I think it’d be foolish to take the other side of these put purchases.

Comments !