Inflation about to be crushed!

Eric Basmajian thinks so. The argument is that consumption (and hence demand) is being crushed by demographics (and the need to pay down debt) so that the world we end up awash with an excess of physical capital and goods and services that nobody wants to buy. Eric does a good job of channelling Lacey Hunt, but even Lacey admits that if the Fed printing seeps out into the pockets of real consumers all bets are off.

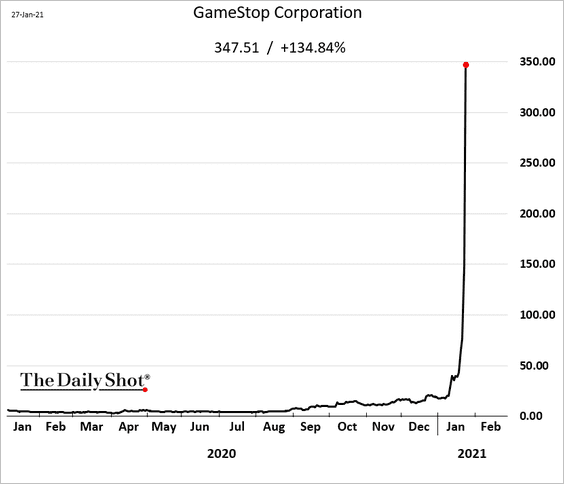

Chart of the day

Well, it had to be:

Everyone and his dog is searching for the next short squeeze

It may be $CXW or $CBLAQ, OR $PEI, or $WPG, or $SKT, or $MAC, or $SRG. (Yes, $CBLAQ is is bankrupt.) At some price, even the most egregious rubbish is worth buying. Be careful, though: $SRG dropped 12% today.

Data Privacy Day

Yesterday was Data Privacy Day. It’s not as widely celebrated as Christmas Day, but may be more important. Privacy, including data privacy, is important for us as individuals, if we are to enjoy freedom. The lack of it is important to governments, if they are to exercise control over their subjects, and is important to advertisers, if they are to maximize the effectiveness of their advertising. In turn, it’s important to big business, as they have no means of understanding their customers except by monitoring their behaviour. The business model of a lot of very profitable firms, such as Facebook and Google (Alphabet), is predicated on us willingly gifting a huge amount of our online (and offline) behaviour to them in exchange for a free email address or a photo sharing platform. The EU has, to its credit, tried to limit the uses of private data (or data that should be private), but it’s very hard to enforce or police a law where the victims are unaware of how much has been taken away from them.

No real human has the resources needed to read the terms and conditions of the various web services and apps we use, but at least think before signing up to any “free” service, and also think about alternatives to the obvious. Facebook is not the only place you can keep in touch with friends. Think about the fact that Apple is paid billions of dollars by Google to make it the default search app. Think about using Thunderbird, and think about whether you really want Google to be the default search engine of your browser. For that matter, think about using Firefox as a browser, rather than Chrome or Edge. These are not difficult things to do. Your data is valuable. Think before sharing it.

Wrap

Fairly heavily risk off/deflationary day.

- major indexes down by ~2%,

- food and gold up, copper and energy down,

- currencies fairly flat,

but

- govt. bond yields slightly up.

No obvious driver (to me, anyway), but markets have had a good run, and maybe hedge funds are liquidating their shorts, and also liquidating their longs that hedged them.

To me, it’s clear that $GME is going to crash to earth and make a big splash, which will discourage the RH crowd (who probably already think the game is rigged against them anyway).

Charts

This already looks like the GFC.

I don’t put much politics here, but this hits the mark:

This is why we preferred Bernie over Warren. Plain and simple. pic.twitter.com/Uej9R4Nui7

— Raadiant™ (@raadiating) January 29, 2021

This is why we preferred Bernie over Warren. Plain and simple. pic.twitter.com/Uej9R4Nui7

— Raadiant™ (@raadiating) January 29, 2021

<blockquote class="twitter-tweet"><p lang="en" dir="ltr">Interesting perspective on <a href="https://twitter.com/hashtag/StonkGate?src=hash&ref_src=twsrc%5Etfw">#StonkGate</a> from an Ask Reddit thread. This has a bunch of financial professionals who are on Reddit, but not active on /wsb, weighing in.<a href="https://t.co/467lBEBz3F">https://t.co/467lBEBz3F</a> <a href="https://t.co/n6d7yst4bt">pic.twitter.com/n6d7yst4bt</a></p>— Aaron Huertas (@aaronhuertas) <a href="https://twitter.com/aaronhuertas/status/1355153781063905281?ref_src=twsrc%5Etfw">January 29, 2021</a></blockquote> <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>

Interesting perspective on #StonkGate from an Ask Reddit thread. This has a bunch of financial professionals who are on Reddit, but not active on /wsb, weighing in.https://t.co/467lBEBz3F pic.twitter.com/n6d7yst4bt

— Aaron Huertas (@aaronhuertas) January 29, 2021

Comments !