15 Sept 2021

Substack update

I decided to bite the bullet and parlay my blog, generated by Pelican into an actual newsletter.

I had a try using Convert Kit, but I got bored with cutting and pasting.

It wasn’t too bad for the actual post, but I have a habit of noticing typos after I’ve uploaded to the server, so fixing these things when I was using ConvertKit meant a double edit.

The same problem will exist unless I can find a way of auto-posting to substack from Pelican (without learning the Pelican API and grovelling around in Python).

I imported the archive into Substack, via an RSS feed, but I seem to have lost all but the summary parts of the post.

Childcare costs

This chart from the OECD shows that the UK has fairly high childcare costs. I know these things are hard to compare across countries, even if they are scaled off average wages, because an average loses so much information about the distribution of costs. The vast bulk of childcare is ‘free’ in the sense that it the reward for doing it is not monetary. Still, it is depressing, especially for parents of small children who live in the UK.

Brave choice

I have been using Firefox as a browser for a long time now, but somehow the latest update is incompatible with a favourite extension: the KeepassXC browser extension. I had noticed that Firefox can be very heavy on CPU usage in the past. To be fair, this is more a fault of the site owners larding their pages with Javascript, but I can’t do anything about that, whereas a browser potentially can (even at the cost of some functionality). I am agnostic in my preferences of browsers, so I decided to give Brave another go. One the whole, it seems to run well.

It’s in the price!

I first came across technical analysis in the 1980s. Yep, that long ago. The introduction was along the lines of “Chartists, who are to finance what astrologers are to economics, stare at price histories, transformed in various ways, possibly, to come up with implausible predictions about the future.” Reading books like “A Random Walk Down Wall Street” convinced me that there was no auto-correlation in prices, that all securities executed a random walk (or, as I later came to understand it, a series of values drawn from a martingale). This essentially rules out technical analysis as having any predictive value and so renders null any value in studying price histories.

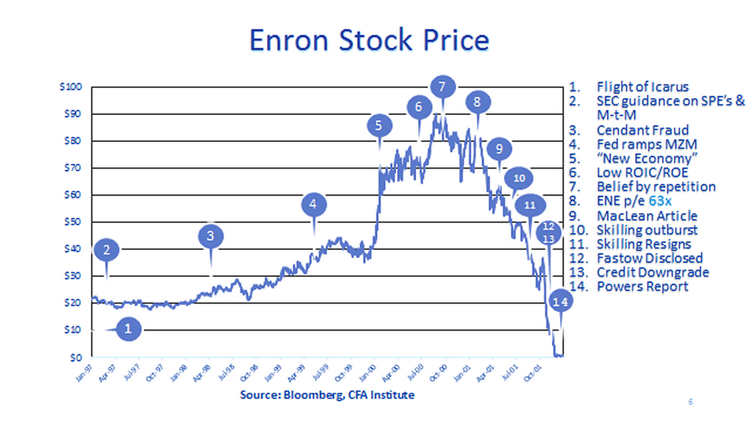

In my old age, I have revised my view somewhat. I have done so on a number of matters in which I had a high level of conviction in the past. I am still not convinced about the Voodoo, but I do acknowledge that a convincing thesis has to be backed up by some indication that “the market” has at least started to be aware of it. Consider the price chart below. At point 6, on a fundamentals basis, Enron should have been a sell. But the stock didn’t really start to sink convincingly for another year, and actually went up for half of that year. Looking at a price history can warn you that the time is not yet ripe to transact. As they say, to be early is just another way of being wrong. And I acknowledge that it’s very unlikely that prices are actually random walks.

The economist in me wants to say that even if prices don’t have any autocorrelation, it’s still impossible to reason from them because a clearing price is determined by the intersection of two schedules, supply and demand, both of which might be moving around to cause the price change. In a secondary market, every buyer has a seller. In the secondary market in equities, very often the marginal buyer, and seller, is the company itself, with at the money offers and buybacks becoming increasingly important.

Continuing anger about Kaplan and Rosengren

I simply don’t understand why this story is not bigger news. There is a minor meme on Twitter where people joke that the market is now starting to sag, because Kaplan is in liquidation mode, following his being outed. For example, this tweet from Sven.

Tesla and @Jack

TC, aka Tesla Charts has discovered that Twitter is blocking visibility of his tweets. I don’t understand the details of this, but it appears to be fairly convincing evidence that Twitter is colluding with Elon Musk to suppress negative, but legitimate, commentary on Tesla Inc. Elon is by far the best stock price manipulator on the planet right now, and having some sort of ability to suppress negative comment on social media would surely be part of this guy’s toolkit. Although I’d like to think this will all come out in the court case after the truth comes out, I think there is a better than even chance that it never comes out.

Wrap

Uranium, natty gas, oil, all rising strongly. Monetary metals are still weak. Most equity markets fairly subdued, except for China (and HK, which is of course still China), which is being dragged down by Evergrande, which is widely expected to default on its debt any day now. Will this be the catalyst? China is looking increasingly unattractive, with all but one of the major indices (Shanghai, CSI 300, Shanghai 50 and CH50) down in 2021. The one is the Shanghai index, which is (presumably) the wider market.

Bonds are flattish, presumably balanced between strong opposing forces in the form of weak equity markets and roaring inflation, which may or may not be transitory.

Some micro-cap exploration companies, such as $SD (Sandridge) and $BTE (Baytex Energy) are catching a strong bid, no doubt driven by the spike in natural gas prices. It may be too early to call this a turnaround, but energy is almost the last sector to not benefit from QE∞. The danger is that a weakness in the broader market will derail the rally before it gets going.

Russian equities, particularly energy-linked like $GAZP, $ROSN, $LKOH (all traded on the Moscow exchange) benefited too. Rusal ($RUAL) is not an energy company but sells a product that embeds a lot of energy in its production and, and presumably can get energy at cheap prices, compared to smelters in the west, also went up.

This market feels as though it might be about to start moving. In which direction is anyone’s guess.

Comments !