Friday 4, March 2022

Moving money internationally

This is an insanely good essay on what it means to move money internationally, by someone who really understands what money is. You need to read it (H/T to Matt Levine who mentioned it in today’s column). What Patrick McKenzie points out is that your money is just a record of what someone (your debtor) owes you: an asset on your balance sheet, a credit on the balance sheet of your debtor. That someone has to be pretty credit-worthy, which is why it’s a bank. Or maybe the central bank (in effect, when you have a ten pound note). It doesn’t work as money unless more or less anyone is willing to accept the credit. So, most Brits trust UK banks, and so a current account works great as money, for a transferee who is in the UK. But to pay someone overseas, somehow, that debt has to be safely converted to an obligation that your payee trusts.

Currencies are just obligations of central banks. There are as many currencies as there are central banks. Peripheral banks bank with the central bank, just like you bank with the peripheral bank. But, they also bank with overseas banks “correspondent banks,” to allow international funds transfer.

Anyway, McKenzie’s essay is wonderful, because it explains how SWIFT’s role is nothing to do with its technology, and all to do with established custom, “consensual fictions” as he calls it. He points out that political policy ends up being implemented, rigorously but arbitrarily, in an environment where nobody actually is accountable. In Russia, and in China, people are denied access to services that would normally taken for granted, without any recourse or protection. The consensual fiction that SWIFT is a Belgian co-operative allows the targetting of bad people. The problem is that it can end up targetting good people, without those people having any redress.

In society, we know that there are some bad actors who we just can’t prosecute because we don’t have the evidence. If we just say “Oh, everyone knows that guy is a bad actor, let’s put him in prison where he can’t do any more harm,” we could well end up like Russia. In places like Singapore, one can be bankrupted by the state using libel laws, if you speak out against the People’s Action Party. The population mainly don’t protest. But a lot of them want to move to a democratic country. People value freedom.

BTW, Matt Levine is an amazing writer. It’s insane that his newsletter is free. I guess his cost is written down as a marketing cost for Bloomberg; his value to Bloomberg must be many times his cost. If only the FT could have such great content!

Moscow-on-Thames

Russian emigrés are a feature of London life, and have been for over a century. Many, I am sure, are utterly honest and law-abiding people. But a certain percentage are mafia bosses. One can know this from various sources, and certainly the odd op-ed in the FT discusses the implications of this situation. Magazines like The Economist acknowledge the problem too, as in this article. My suspicion, though, is that the proletariat is blissfully unaware of what’s going on in Belgravia, and that the political class would prefer to keep it that way. Clearly, the Conservative Party receives quite a bit of its funding from these people, but I would not be surprised if this applied to the other parties too, and that Russia (and China) couldn’t care less about the ideology of the party they are funneling funds to, as long as that party (i) wields political influence and (ii) understands that if policies are enacted to harm the interest of the donors that the consequence will be diversion of this support to the opposition party.

One thing that oligarchs care deeply about is cloaking of ultimate beneficial ownership. As Private Eye regularly reports, the various UK Companies Houses makes it very easy to conceal this, as do the various crown dominions, such as the Channel Islands and the Caymann Islands. Every so often, one glimpses the scale of this sort of activity. One recent example is the Suisse Secrets, where CHF 100bn of funds were identified as belonging to kleptocrats and similar compromised individuals. Somehow, governments never seem very motivated to act to return this money to those whose money this rightfully is. I wonder if it has anything to do with the sorts of people who make use of these facilities, such as Tony Blair who was revealed to have bought a London property from a UAE sheik in the Pandora Papers. To be fair, the BBC did report this one.

Banks

Banks are a mystery to most people. They read a lot about them, and about central banks, they are told they are very important, and they know that they are subject to a lot of regulation, but they are hazy on the hows and whys of the institution.

Part of the problem is that the jargon used to describe the components of a bank’s balance sheet is almost intentionally confusing. What is referred to as equity for any other type of company is referred to as “capital.” Banks have to be very creditworthy, so they are subject to numerous regulations about how much capital they most hold.

Russian equities

At some point, Russian equities are going to become tradeable again, and those who hold them are going to make a lot of money. When you buy a stock, you go short cash (rouble) and long the stock (a real asset, maybe oil or similar here). This seems a very good idea in Russia now. On a mark-to-market basis, these things may appear to be worthless, but that’s only because people are locked out of buying. At some point, people will want oil, and will pay a lot for it (especially in terms of roubles). This is not advice, but even if it was, you wouldn’t be able to follow it because no broker can sell you Russian equities anyway.

Reflexivity

People seem to be addicted to

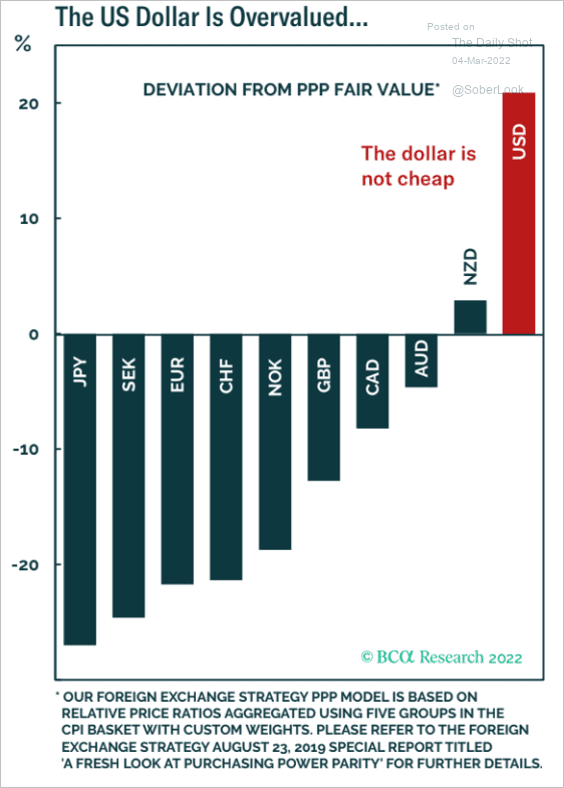

Currencies

USD.JPY looks a sell here:

Comments !