19 May 2021

Markets

The Fed finally moved. Some committee members whispered the possibility of reducing QE, or “tapering” in the jargon. This knocked 3.2% off the price of oil (but see the item about the China credit impulse below). The markets are fixated by the Fed, because it’s all the is backstopping the market. If the Fed blinks, the market will implode is the consensus.

Personally, I can’t see this happening. The asymmetry of risks and rewards for the Fed committee is too great. Easing for too long will create some inflation, which will:

- give workers more money in their pay packets,

- put a floor under the price of real assets like houses and 401Ks,

- make mortgages more affordable, especially long-dated fixed rate ones which are unique to the USA,

- make it easier for the Treasury to service govt. borrowing,

- push down the dollar, thereby boosting the competitiveness of US industry and making domestic producers of all products more able to defend their home markets.

It will of cause, in the long run create all the miseries that we associate with the seventies. But it could take a decade before these become serious, by which time J Powell will have had time to retire to his island in the Caribbean, and Biden will not care one way or another.

Details for today:

- all commodities down,

- dollar up 0.5% to 90.16,

- US stock markets down, except NDX which is flat,

- US 10Y practically flat,

- Credit (e.g. Iboxx high yield corp. bond index) down 0.25%,

- crypto currencies weaker, with linked stocks down (e.g. $RIOT down 4.7%); bitcoin touched $30K, down from $59K a few weeks ago.

I expect the market to bounce tomorrow. More and more big groups are defunding fossil fuel producers, so $XOM might struggle, as oil prices rise.

Crescat Inflation Bulletin

Crescat’s letter makes a strong case that this time it’s not transitory. I know you’ve read a lot of similar arguments, but Crescat have assembled a very solid case.

Austerity is inevitable

Yanis Varoufakis explains that avoiding austerity is politically impossible.

Like all good Marxists, Varoufakis would be aware that “inevitable” is word beloved of Marx and his followers. The article explains that the powerful actors in society cannot tolerate any increase in interest rates (because capital is so highly geared), so more government spending, to fix inequality (or “level up” as the UK catch phrase has it) will provoke too much of a backlash before it can work.

I don’t know whether this is an accurate account, but it’s a persuasive one.

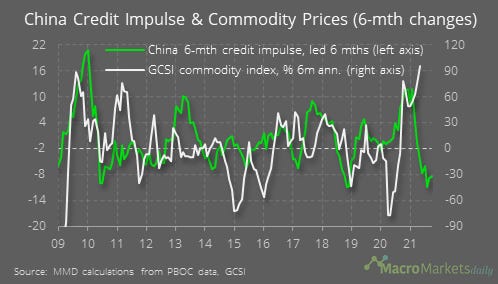

Commodities under pressure

China is the world’s dominant consumer of most commodities. The authorities seem to be getting worried about overheating. They are trying to make rating agencies get real about ratings for company debt in China. This is all going to push down the demand for commodities.

Obviously, we’re in an odd time, and some commodities, such as energy, have a global demand. And probably battery factories will not shut down, which is good for lithium, cobalt and a host of rare earths. However, maybe copper and wood have peaked.

Forecasting inflation is difficult

I post some variant on this chart from time to time. Central banks have always underestimated the size of the output gap, which is why they keep overestimating inflation. I think their measure of labour market supply is off. People live healthy lives well into their eighties now. The pool of workers in their 60s and 70s means that whenever the labour market gets a bit tight, this extra supply puts a lid on wages.

The labour market is an incredibly complicated thing, I realize. But we simply have a lot of idle hands these days, probably an order of magnitude more than the unemployment statistics indicate.

A similar point is made in this tweet, which I noticed after having written the above.

For 2021, the biggest inflows have been into financials and TIPS. This indicates that people are investing as though they believed that inflation is coming. There are a few clever products that will allow cheap exposure to rapidly rising inflation (which will trigger a selloff in long-dated bonds). The one I am interested in is PFIX. Note that I do not know exactly how this works, and it might be an expensive way of getting an equivalent exposure. In particular, I don’t know how it compares to buying puts on 30-year TBond futures.

On the other hand …

Comments !