Crumbs

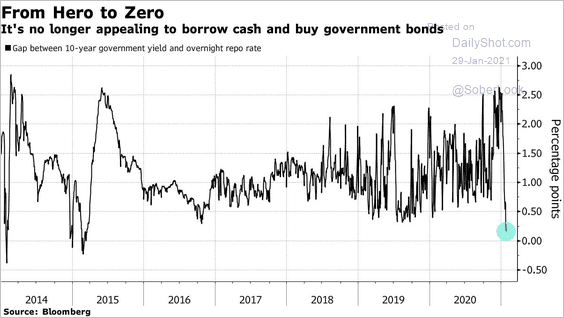

This chart shows that banks will be even keener to dump their Treasuries on the Fed. I guess that’s what Yellen wants.

It seems incredible that a few punks on Reddit can spook the whole of the hedge fund short selling crowd.

TBF, after Tesla, there can’t be many of them left.

What is interesting, now, is who will buy when prices fade: there are no shorts left to cover.

It seems incredible that a few punks on Reddit can spook the whole of the hedge fund short selling crowd.

TBF, after Tesla, there can’t be many of them left.

What is interesting, now, is who will buy when prices fade: there are no shorts left to cover.

The guys at The Market Ear are worried:

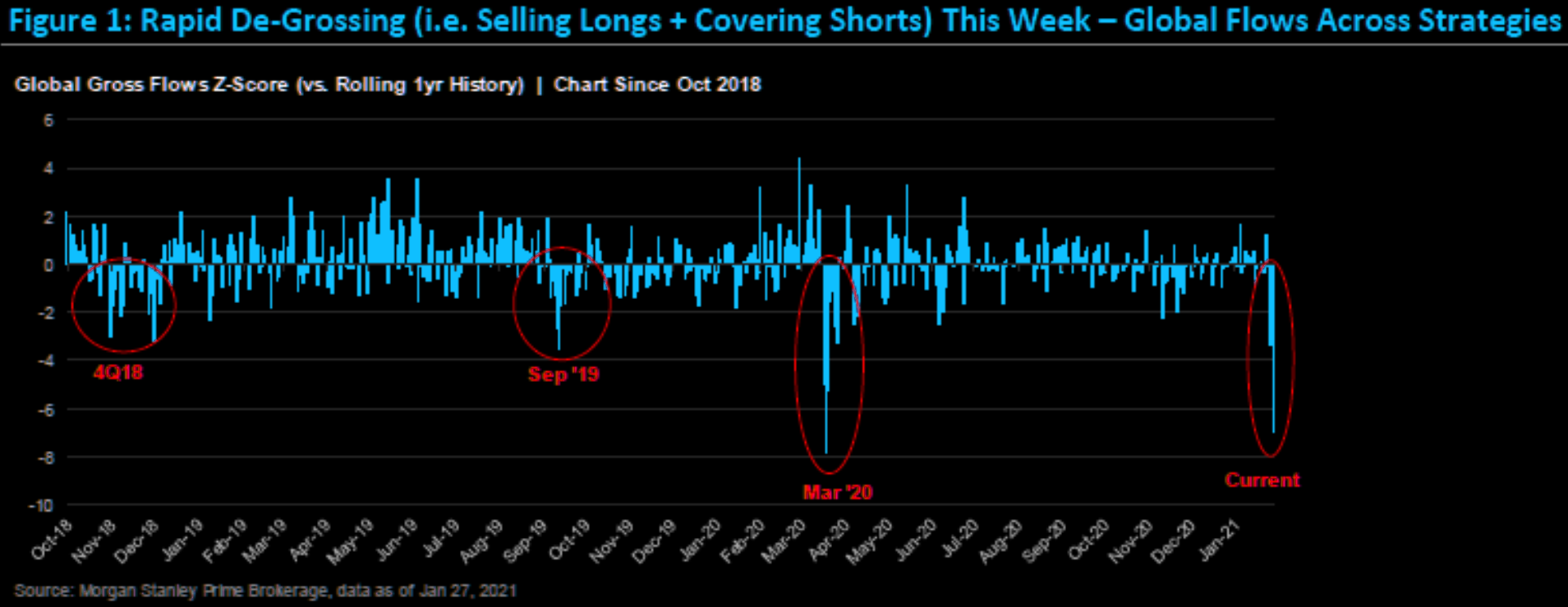

It’s been an interesting period since Biden entered the house. Latest developments in equity markets have been extreme. There are many views on what is going on, who did what, who is to blame etc, but we leave this to you to decide.

The run up to this latest mini correction has seen “impressive” price action in many assets and forcing most to join the momentum trades, from chasing bitcoin, Tesla, small caps and now lately the Reddit shorts.

This has created an interesting aggregate psychology of the crowd, all based on the same principles of greed and fear. Lot of newbies have joined the trading space. As GS pointed out earlier this week there are more than 50 million “traders” across the various trading Apps these days, and that figure has probably spiked after this week.

The FOMO aspects of trading has never been stronger. The new normal is having 40%,50%,60%, +100% returns. Risk is something people have not even spoken about, until this week. Frequent readers of TME know our strong focus on managing your p/l via a rigorous risk management methodology.

Most people lack these skills, and at best follow some VaR model they hardly understand (at the institutional level). Rest of the crowd, majority of the new trading retail elite, at best have a stop loss strategy, but that’s it.

Anyway, the first chart is showing the imploded shorts in SPX. Thinking about the downside has been out of fashion. Long in pretty much anything has been well rewarded. This has led to people abandoning index shorts as hedging has lately been seen as “only costing money”. Bottom line is shorts are at extremely low levels.

What about fear (VIX)?

While people have puked shorts, the “structural bid in volatility” has continued to trade with a strong bid during the entire autumn. Recall our various posts regarding the strong bid in VVIX. VIX of VIX has traded extremely strong for months and has been indicating VIX at low 20’s (despite low realized vols back then) was simply too low given the trajectory of VVIX. Things obviously changed this week.

The problem for most “pundits” is they saw VIX as too high in the low 20’s and investment banks have all been in “sell VIX and vol” mode. After the Georgia run off, all we have seen is sell volatility notes from banks.

So this time around people dismissed hedging for several reasons.

People are long, have poured record amount of money into equity longs recently, puked shorts, dismissed having vol hedges/downside protection and then “suddenly” the most ironic catalyst, a giant short squeeze in “hot” names, creates a massive de-leveraging and hits VaR hard.

Second chart shows the huge move in VIX and VVIX. VIX is trying to catch up to the VVIX gap we have been pointing out for weeks, but VVIX remains well bid.

Third chart shows SPX and the 2/8 month VIX futs spread. The recent panic bid in short term maturities has seen the spread explode to the upside. The crowd has gone from hating protection, to “must buy” it at any price. The most “bang for the buck” in term of gamma risk is in the short term maturities, so despite these costing less in terms of premium, people bid up the short end of the curve just to get as much protection as they can for the “sudden” moves (this is (still) not a vega squeeze).

The stress this time is huge. All things equal the 2/8 VIX spread should be less sensitive as the corona stress should have been ebbing out by now, but note that the move in the spread now is similar to the first part of the sell off during the corona crisis. Back then SPX was down approx 12% when the VIX 2/8 months spread reached similar levels to where we are trading now. So far SPX is down some 3.5% from all time highs. No, it does not mean we must crash another 9% from here just because the VIX 2/8 spread is trading the way it is, but it shows the extreme stress this market is pricing, despite the moves actually rather small so far.

The weekend has provided some extra time for risk managers and head traders/CIOs to stress test books and scenarios. Expect next week to be as “dynamic” as this week turned out to be.

Best quote relating to the Reddit Rampage

Alex Manzara is wonderful. He quoted this:

Fear? That’s the other guy’s problem. Nothing you have ever experienced will prepare you for the absolute carnage you ae about to witness. Super Bowl, World Series – they don’t know what pressure is. In this building, it’s either kill or be killed. You make no friends in the pits and you take no prisoners. One minute you’re up half a million in soybeans and next, boom, your kids don’t go to college and they’ve repossessed your Bentley. Are you with me?

For the context, click here. The Tuesday post, which is referenced in this post, is here. When insiders like Alex are disgusted by what is going on in the Fed, the whole system has got to be rotten. This is not one of the Redditors sounding off.

Wrap

Today was definitely risk on/deflationary:

- ES futures up 1.75%,

- nearly all commodities up: uranium >10%, $PAAS UP 12% (the WSB crowd talking about ramping silver),

- $GLD up 1% (probably dragged up by silver),

- TIP down 0.2%,

- $TLT up 4bp,

- Nat Gas. up 10%,

but

- bitcoin down 2.4%,

- DX down 0.5%.

Thought for tonight

When governments throw a lot of money at a project, it’s easy to get carried away by technological success, without examining the economics.

When Apollo 11 reached the moon, all the pundits confidently stated that this would be the beginning of a new age: the Space Age. The reality is that we’ve never really made any use of the exploration of space, and it has brought mankind no tangible benefit. At its peak, the US Space program was burning through 5% of its GDP. This represented a huge loss of welfare for its citizens. Until recently, this sort of spending could have paid for free healthcare for all (until the 90’s the UK was spending of this order of GDP on its single-payer health service, the NHS).

We had similar promises about the Atomic Age in the fifties.

I would not want to downplay the success of the pharma companies in producing a vaccine against SARS-Cov2, but this was not the result of a lot of committees in Whitehall deciding what the country needed to spend resources on.

Sometimes, being reactive is a good thing.

Tweet of the day

the meme has become reality pic.twitter.com/2IgwSzMMPZ

— ☀️👀 (@zei_squirrel) January 31, 2021

Must follow

Horizon Kinetics. Very interesting quarterly letters.

Comments !