Energy

I’m quite bullish on energy. Commodities have been weak for a long time, and the biggest (‘consumable’) commodity of oil is oil. The relatively strong dollar has held down commodity prices, and it has weakened, but now it’s going back up again. Short dollar is supposedly the most crowded trade in the universe, so it’s easy to imagine all those dollar shorts covering as the USD rises again, spiking the oil rally, and with it prices of downstream oil producers.

Added to all this is the massive capital injection into ‘green’ energy. Even if wind power ends up costing ten times the price of energy from oil, this is not necessarily a reason that we don’t end up using it, because all governments agree that free markets are fine, as long as they are not used for important goods and services.

I remain convinced that $XOM is a better bet than $TSLA, but I am not sure that I’d want to go out very far on that particular limb, given the huge political and geopolitical risks which may affect both stocks.

Bonds

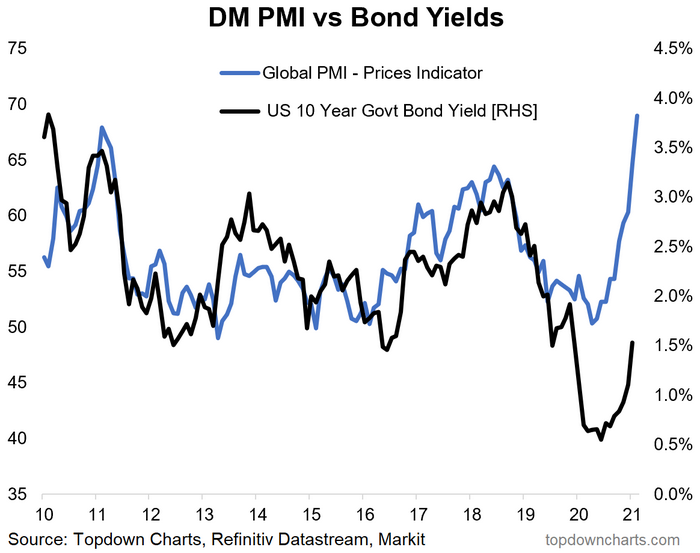

Ten year yields are lagging developed markets PMI surveys. Both should be strongly correlated with future inflation.

Grant is gloomy about bonds

The problem is that the US Treasury has to raise a lot of money, but without spooking bond markets. Things could get interesting, but for sure the primary dealers are going to try to shake out the bond shorts before the auctions!!

From Grant’s Almost Daily Commentary.

Buckle up: A potentially pivotal week is in store for fixed-income investors, as the Treasury department is set to auction a total of $120 billion across 3-, 10- and 30-year matures between Tuesday and Thursday. Recall that the disastrous Feb. 25 auction of $62 billion worth of seven-year notes, featuring a yield well above the when issued price along with the weakest bid-to-cover ratio on record, helped catalyze a sharp selloff in Treasurys. Currently the 10- and 30-year yields remain at their highest since the pandemic got underway.

Of course, signs of stirring inflation (including a 25% year-over-year bulge in M2 money supply), in tandem with a Federal Reserve actively striving for higher consumer prices, present a daunting backdrop for would-be Treasury holders in the context of a near 40-year bull market. “Until investors are comfortable knowing the Fed’s tolerance for higher rates, it is unlikely that most buyers will want to ‘catch a falling knife’ for higher yields,” Meghan Swiber, U.S. rates strategist at Bank of America, tells the Financial Times.

One fundamental gauge suggests Uncle Sam’s creditors may have reason for worry. Bloomberg notes this afternoon that, with economist consensus calling for a 7.6% advance in nominal output this year, the 600 basis point gap between GDP expectations and the 10-year Treasury yield is at its widest since 1966.

Grubhub is not nourishing for your business

Short thesis on delivery companies pic.twitter.com/GOfBWwLODN

— Bread Crumbs Research (@breadcrumbsre) March 3, 2021

Wrap

Deflationary day:

- Massive jump in new economy stocks ($TSLA up 20%!),

- NDX up nearly 4%; nearly all equity markets up, but not by so much, (Alex Manzara’s take),

- Banks, industrials and big oil down,

- Oil, most commods down (Crude down 1.9%),

- Bonds actually fairly muted: UST 10Y at 1.54%, down 5bp.

From Trading Economics:

Wall Street rallied on Tuesday, with the Dow Jones up more than 200 points after hitting another intraday record and the S&P 500 rising 2% as investors focus on prospects of a strong economic recovery and further stimulus. The House is expected to pass the $1.9 trillion aid bill tomorrow. Meanwhile, the Nasdaq added more than 4% after sinking into correction territory the day before, as Treasury yields retreated ahead of sales in the coming days and tech shares recovered some ground. Tesla stocks outperformed and surged almost 20%, rebounding from a 5.8% drop on Monday as upbeat China car sales data offered some support. Since hitting an all-time high on January 26th, the firm has shed a third of its value.

How it started How it's going pic.twitter.com/NL9YiBrGZa

— Masa Capital (@MasaSonCap) March 9, 2021

I own the unsigned version of this, and it's just as useless. https://t.co/lanvJWjYhF

— John P. Hussman, Ph.D. (@hussmanjp) March 9, 2021

Biden doesn’t seem to remember the name of his defense secretary Lloyd Austin here. Really not great, this, and it shouldn’t just be the right-wing press pointing it out pic.twitter.com/XJE4MHZ1D0

— Jemima Kelly (@jemimajoanna) March 9, 2021

— Marx 🟡⚫️ مارك (@MarkBFadel) March 9, 2021

Comments !