Friday 15, July 2022

Tacit reasoning

When I was at school, polytechnics were increasing their intake. Our headmaster, who had been an undergraduate at Oxford, encouraged us to think about applying to polytechnics. When a friend of mine, who was on track for getting a good set of results at A level, said he was thinking of doing so, he was immediately told that he should not do this under any circumstances.

I’ve probably come across many other examples of double standards in my time, but this was an early one in which I realized that I had been told stuff that was at best only partially true.

China

I continue to believe that if China can pull off enough stimulus to keep growing, the rest of the world will avoid a severe recession, and commodity prices will not collapse further. SEB explains the dilemma: if China can get out of the cycle of opening up and then locking down, rapid growth could take off. However, Xi looks increasingly authoritarian and out of touch with the concerns of ordinary citizens, and in China this will matter a lot. The longer-term outlook for China must be fairly poor, but that has been true since 2001, when it joined the WTO. Ultimately, GDP growth cannot overcome the deadweight of nepotism and corruption that invariably accompanies authoritarianism.

China’s GDP growth. Statistics today show that China’s economy shrank by 2.6% in the second quarter. Annual GDP growth landed at a low 0.4%. Comments: China’s zero tolerance strategy against the spread of infection has a high economic price when shutdowns hit industry and private consumption hard. Today’s retail data for June, however, confirms that growth can return quickly when restrictions are removed. The full-year outcome for 2022 now looks to be well below 4%, more than 1%-point below trend growth and annoyingly low in relation to the target level that Beijing has for 2022: “around 5.5%”. Economic policy has taken a step in a more expansionary direction; more is to be expected.

Expensive stocks

Vince Martin identifies a few possibly overvalued stocks. Namely:

- CVNA,

- COIN,

- TSLA,

- UPST,

- BYND,

- SHOP.

These are the usual suspects, which are capable of insanely high valuations, so shorting is dangerous. TSLA is the prime example here: although the company has never really made a profit from selling cars, its share price has soared into the stratosphere. It has come down a lot, and Elon probably has bitten off more than he can chew in his Twitter takeover offer, but he might still wriggle out of it. It’s clear that if you behave consistently as if normal rules do not apply to you, after a while you are given a pass for not obeying normal rules.

My understanding of the following tweet is that Elon will not do what the DE chancery court tells him to, according to a former judge of this court.

With @Twitter taking @elonmusk to Delaware court, former vice chancellor Carolyn Berger gives her judgment on the complaint submitted to @davidfaber: Twitter has a chance of winning if the facts prevail, but not necessarily under terms of “specific performance.” $TWTR@CNBC pic.twitter.com/BC4dQIgBDN

— Squawk on the Street (@SquawkStreet) July 13, 2022

Wrap

Oil:

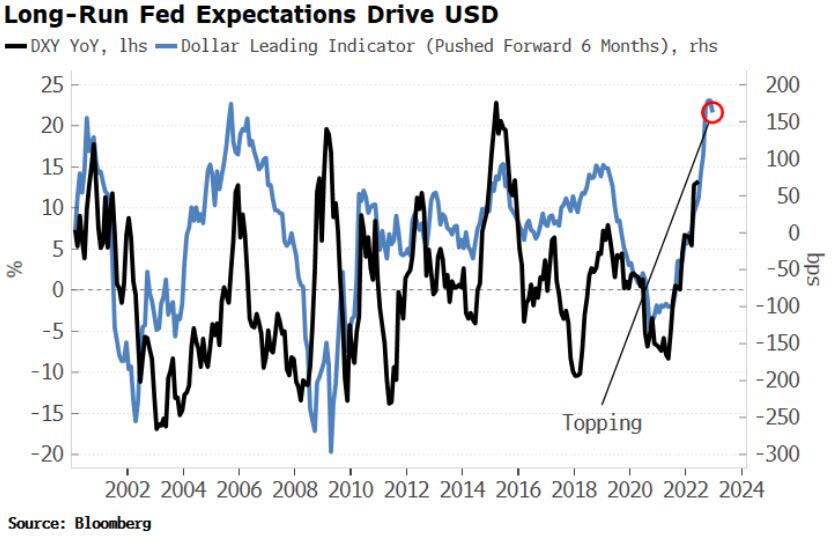

The dollar:

Zerohedge says the dollar rally may be nearing its end.

Generally, today was recklessly risk-on.

Biden is in Saudi Arabia palling up to MBS, something that the Washington Post considers shameful. I think they are onto something; I am fairly fed up with the obeisance shown by and endless series of UK ministers of the crown, and members of the royal family themselves, to the corrupt and murderous leaders of Saudi Arabia (and other similar dictatorships in the region), just because we want their oil.

Comments !