Crumbs

Investors are behaving as though they expect the govt. yield curve to steepen. The suggestion is that the BoJ will move away from yield curve control of the long end. It’s hard to imagine there are any JGB traders still working, it’s been so long since trading the things was remotely profitable. We know that Japan lead the rest of the world into Financial Repression. Maybe it will lead it out of it, which would be music to the ears of bond bears (except they are extinct).

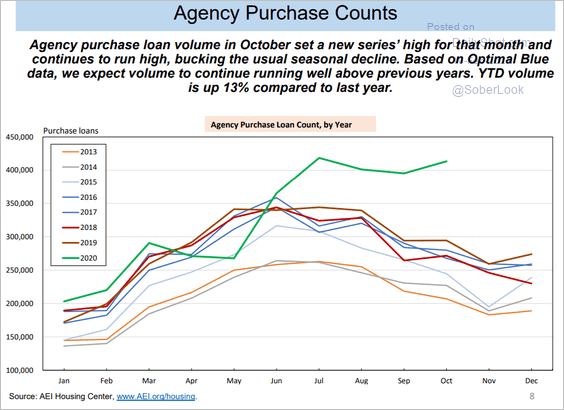

Fannie Mae et al. are doing more business. We know how this ended last time. But surely, this time it is different? S

Fannie Mae et al. are doing more business. We know how this ended last time. But surely, this time it is different? S

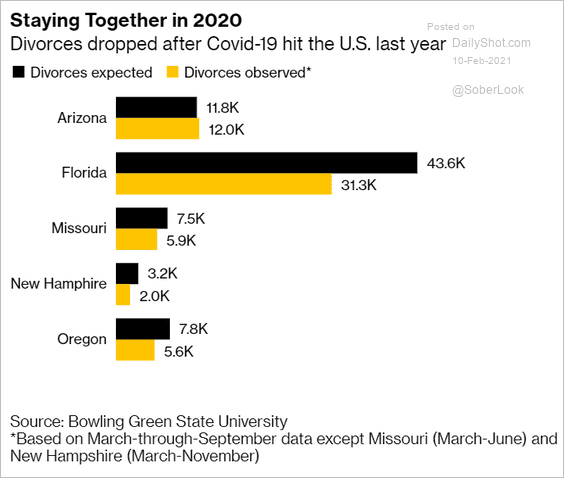

Absence may makes the heart grow fonder, but not necessarily for the original object of affection.

Absence may makes the heart grow fonder, but not necessarily for the original object of affection.

My summary of The Market Ear for yesterday (sorry, it’s now paywalled):

- the market has recovered strongly since the $GME fiasco, with a lot of short positions closed. There are almost no shorts left, everyone is long; put/call ratios are at record low, the VIX is (relatively) crushed. [My take: there are no more good news stories to be released]. The only way the market can go from here is down. This sounds plausible, but we’ve been here a thousand times before.

- CDX IG: investment grade credit default swaps index (I think) has not moved since last Sept. It’s hard to square this against the behaviour of the equities market, which has been stellar. Once of these groups of investors is wrong.

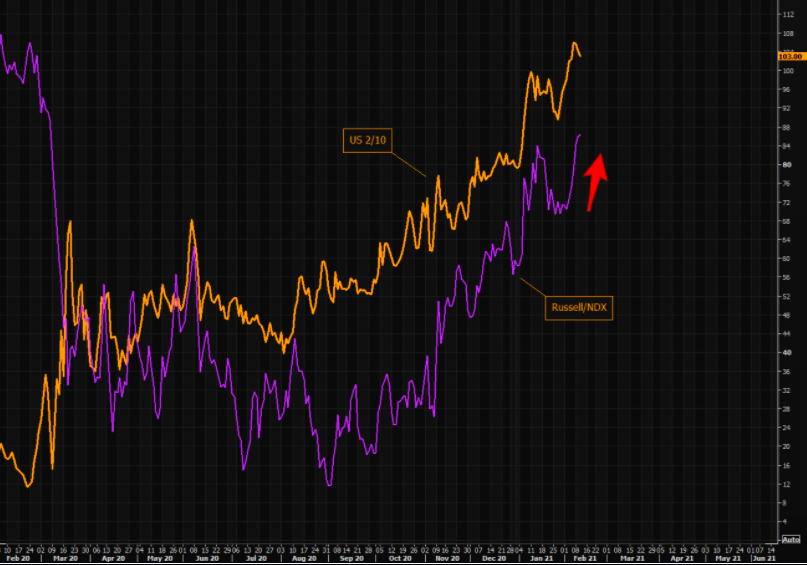

- Russell 2000/Nasdaq ratio is a measure of duration exposure, as is the 2 year 10 year spread. These have moved closely together, as the chart shows but maybe we are due for a retrace.

- $TSLA chart showing exhaustion, (don’t do it!),

- oil getting ahead of itself.

- Maybe we should aim for a single vaccine which works against all corona viruses. A number of groups have worked on a variety of different coronaviruses, including the original variants that caused SARS (and MERS) and (of potentially great utility) the Common Cold.

Wrap

- $UBER is down a lot in ride sharing (27% Q4, but most of the hit taken by the drivers, which doesn’t impact the P&L, presumably) but up a lot in food delivery. It lost $68B on a revenue of $11.1B. It’s trading at 7.4 times consensus revenue, with 34 analysts rating it a “buy” (with one “sell”). Read more here (you may have to register and log in but it is not paywalled).

- Reuter’s headline is “Global stocks nudge higher, sustained by bottomless stimulus.” This more or less sums up the last 20 years.

- Oil weakened, for no clear reason except maybe exhaustion,

- UK economy to shrink by 10% (spot on forecast): the biggest drop ever. Markets slept.

- the Dutch index, AEX reached a 20 year high, of 667.96 in Amsterdam,

- this was generally a risk off day, but also deflationary day, with long-duration stocks (NDX) benefiting at the expense of short duration (‘value’) stocks.

Worth reading

This NY Times Editorial explains why California is such a disaster for poor people, in spite of being by far the most progressive state in the union. Reasons include:

- non-selective, non-rigorous state (‘public’) schools which are so bad most better off CA residents have no option but to pay for private schooling,

- very onerous building codes that make new builds very expensive, with a result in very low rate of housebuilding,

- lots of consultations and regulations to protect existing residents against adverse nearby developments, with the result that it’s almost impossible to build a homeless hostel anywhere,

- lots of green virtue signalling that has resulted in expensive and impractical projects like high speed rail,

There is an old finding in political science that Americans are “symbolically conservative” but “operationally liberal.” Americans talk like conservatives but want to be governed like liberals. In California, the same split political personality exists, but in reverse: We’re often symbolically liberal, but operationally conservative. Renaming closed schools is an almost novelistically on-point example, but it is not the most consequential.

Comments !