Wednesday 1, June 2022

Levine again on how money works

Money is an entry in a bank ledger somewhere. A US dollar account at your UK bank is a liability of the bank’s, which is exactly matched by an asset which is that bank’s account with a US bank. Matt Levine writes about this in relation to payment of interest by Russian issuers of USD bonds. He explains it very clearly. It’s really quite easy, but most people have a very hazy idea about what money is, how it is created, and how the supply of it affects the real economy. Levine’s piece is Russia Has Some Dollars Somewhere.

The bank that your bank keeps its dollars in is called its “correspondent bank”. The account with the US bank is called (by your bank) it’s ‘vostro’ account. This stuff goes back centuries.

Levine makes this peerless observation about what will happen in the next episode of the Musk SEC soap opera:

Musk’s response is not yet public, but there’s not much he can really say. I guess this is the first salvo in a very annoying war in which the SEC tentatively seeks mild penalties from Musk and Musk responds intemperately about how the SEC is evil and trying to oppress him.

I think it’s safe to say that Musk is continuing to drop in Levine’s estimation, although not yet as far as I believe he should.

Oil Price Dynamics

The NY Fed produces a nice analysis of oil price dynamics. It’s understated but looks at demand and supply as a driver of price. You can read the latest bulletin here. You can sign up for free email updates here.

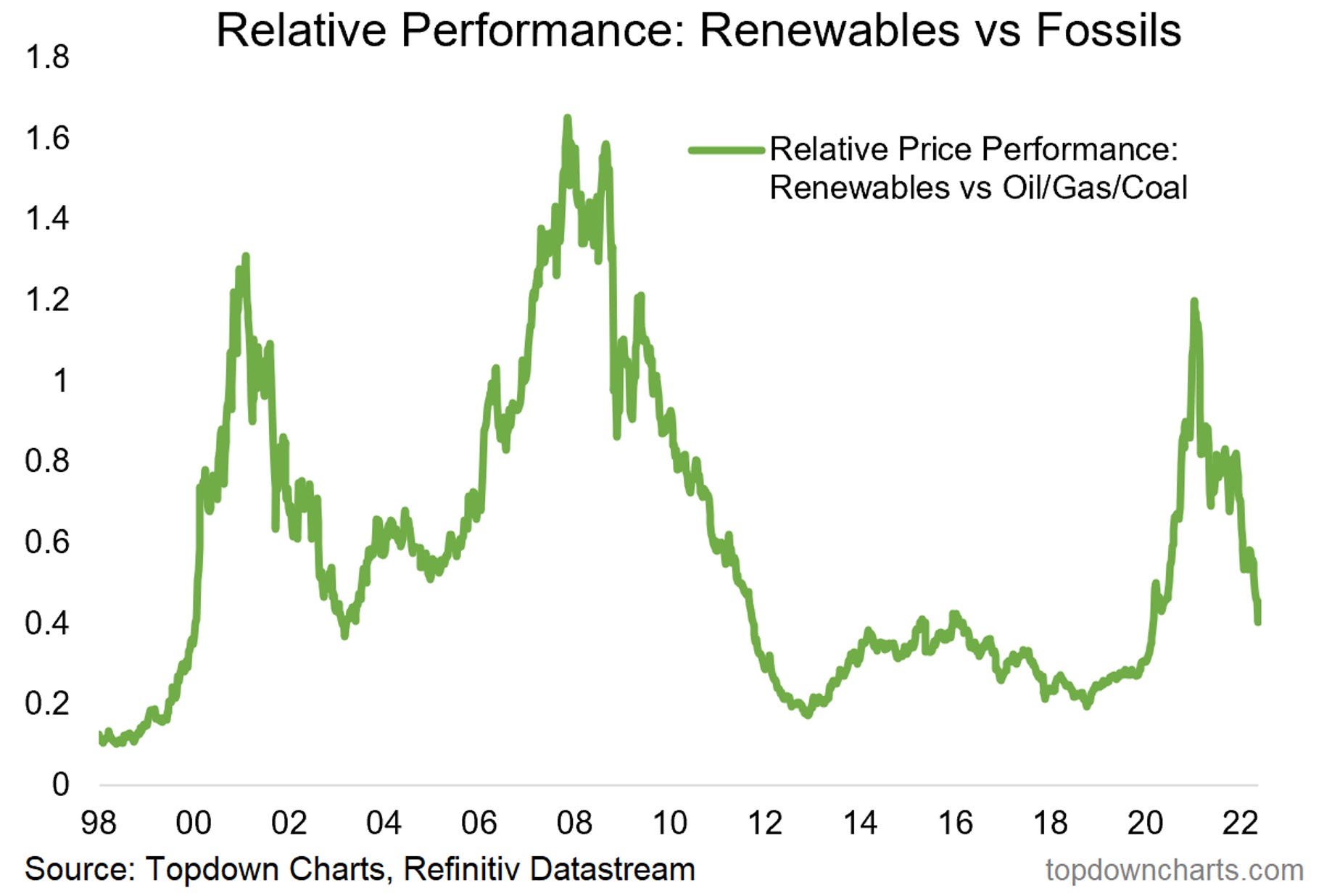

Renewables

As Callum Thomas points out clean energy as an investment have seriously trailed the dirty sort lately.

looks like she’s leaning out https://t.co/08Tvw8zmfO

— Edward Ongweso Jr (@bigblackjacobin) June 1, 2022

I don’t know why everyone I follow on Twitter absolutely loathes Sheryl Sandberg. I suspect it’s the connection to Larry Summers, Bill Gates, Jeff Epstein et al. Nobody likes Zuck either, but it seems more visceral with Sandberg. One suspects she’ll go into politics, but somehow women struggle to make this transition. Most men too, to be fair.

Image

Dorothy Janis, 1920s pic.twitter.com/OPNYDa91xI

— Daniel Brami (@Daniel_Red_Eire) June 1, 2022

Wrap

Bonds generally down (yields up), but not much. Dollar up, 0.8%. Oil and most commodities up, even in the face of a headwind from the dollar. The VIX was down a bit, at 25.7, which is about in the middle of its range over the last month or so. Most equity markets down on the day, after bouncing around a lot. Probably on balance risk-off, but not by much, and not with great conviction. A lot of crypto currencies off by 10% on the day. I cannot imagine what it’s like to trade this stuff. Surely, most of the retail tourists have thrown in the towel by now.

Comments !