4 Sept 2021

The week

The resignation of Suga, the Japanese PM, seems to have had a galvanizing effect on the Japanese stock market. I don’t know anything about the politics over there. My understanding was that he was just a caretaker PM, brought in because Abe became too ill to carry on. I assume that there will be no change in ruling party, which presumably means more of the same stagnation. Anyway, the TOPIX was up.

US equity markets ground higher. US stocks (Russell 3000) are up 18% YTD. It’s amazing what the Fed can achieve. Further gains this week were presumably a reaction to the payrolls print. Weak employment growth would imply delayed tapering, and so the band plays on.

The big beneficiary of this monetary policy is real assets, specifically real estate. REITs are up 40% YoY. This is great news for Blackrock, not so great for ordinary voters who see a house as a place to live, not a financial investment. The UK has had a similar boost in house prices, with the result that a number of institutions (most visibly, Lloyds Bank) have decided to invest. Nothing goes on forever, but even if nominal rates go up, it seems likely that real estate will keep going. Supply of real estate responds very slowly to demand, in the UK hardly at all because of the centrally planned economy in land development rights. I think a basket of UK REITs would be worth looking at closely.

As real assets go up, nominal ones tend to lose momentum. US bonds ($IEF and $LQD) were down. I think credit instruments are the canary in the coal mine, but it’s too early to call an end to the bull run.

Eat my shorts (© Bart Simpson)

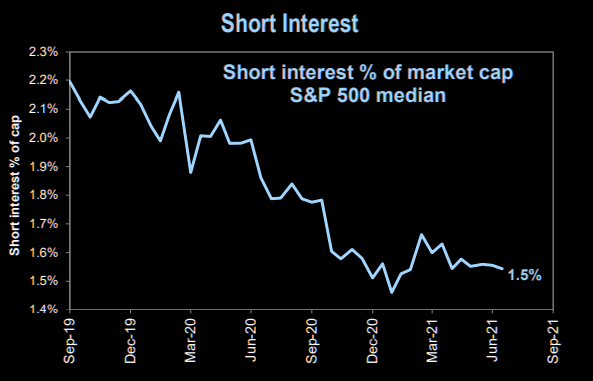

H/T The Market Ear Short interest has never been lower. But just as a short squeeze can result in a rapid rise in the market, when all the shorts have capitulated, there is nobody left to sell but the passive funds.

This may be nothing, but unlike interest rates, short interest cannot fall below zero.

The age of oligopoly

The 19th Century was the age of steam power, the 20th Century was the age of the automobile, the 21st Century could well be shaping up as the age of oligopoly.

It doesn’t have quite the same ring, and of course everyone thinks that we are living in the Internet Age.

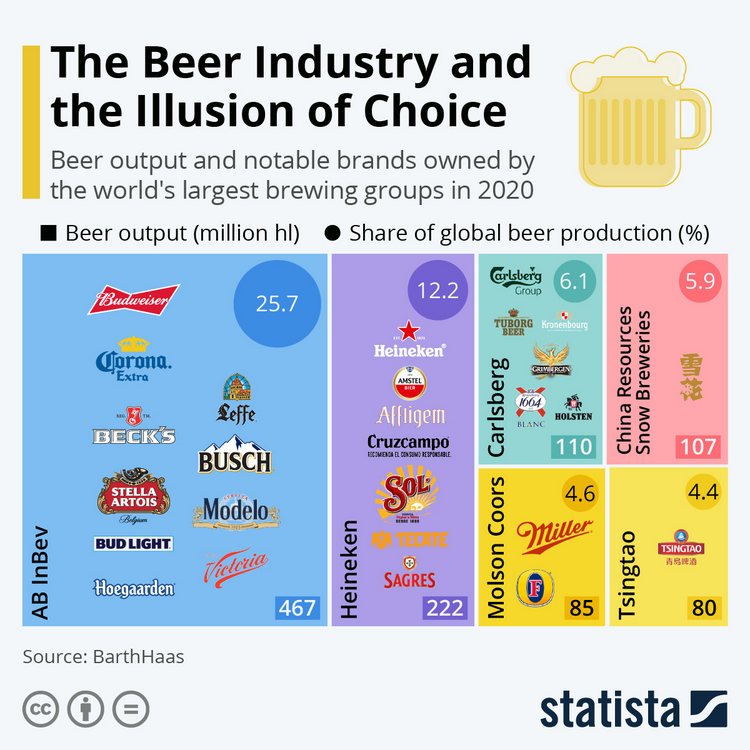

But the real power of the internet is to allow industries like brewing beer to organize on a global scale.

The way forward was shown by Coca Cola, which expanded globally on the back of the US Army’s global deployment in WWII.

Technologies like the humble container, fax, the telex, etc. all supported this global expansion.

The advertising industry, which includes companies like Google and Facebook, is suddenly global,

although many advertising agencies had led the way in an earlier generation.

It doesn’t have quite the same ring, and of course everyone thinks that we are living in the Internet Age.

But the real power of the internet is to allow industries like brewing beer to organize on a global scale.

The way forward was shown by Coca Cola, which expanded globally on the back of the US Army’s global deployment in WWII.

Technologies like the humble container, fax, the telex, etc. all supported this global expansion.

The advertising industry, which includes companies like Google and Facebook, is suddenly global,

although many advertising agencies had led the way in an earlier generation.

As industries became more concentrated, their lobbying power increased, and they were able to de-fang anti-trust legislation that would otherwise have impeded their progress. Maybe the EU will prove resistant to this sort of corporatism, but I wouldn’t hold my breath. One suspects that the reason the EU has opposed the expansion of some global industries is that there are no national champions in these sectors based in the EU. Once there are, world markets will continue to be carved up into a small number of pieces, I predict.

Image of the day

Léo Caillard, Miami Beach.

Conspiracy theory of the day

Here it is. This is mad, but suppressing it will just recruit believers.

Comments !