What a crazy year!

January

- $TSLA gained 55%,

February

- $SPCE opened the month at $17.15 and finished it at 42.49. The first of the exploding SPAC attacks,

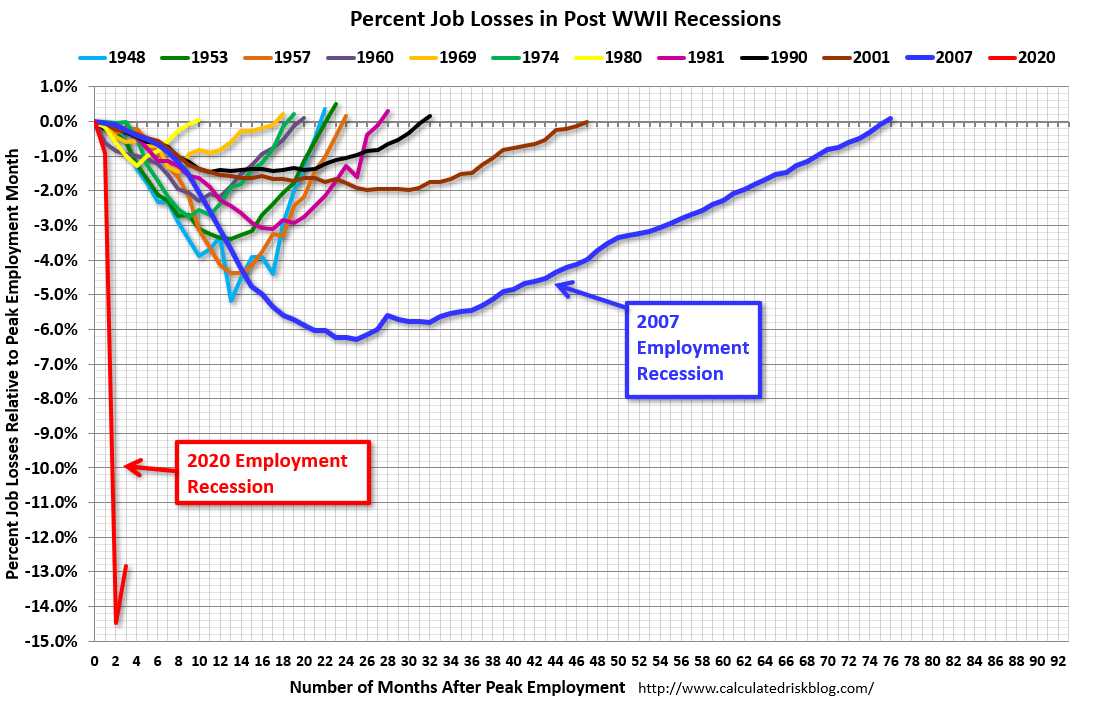

March

- All markets crashed, stock markets closed, puts were no offer, the end of the world was nigh,

April

WTI futures went to $-40. You literally had to pay anyone to take oil off your hands,

May

The NDX (well, $QQQ) hit a monthly all time high. The markets were roaring back.

June

$NKLA shot up 135% before falling back to earth.

July

August

$AAPL and $TSLA did stock splits. The shares immediately started levitating upwards. People wondered about whether RobinHooders fully grasped the concept of share dilution.

September

Tiktok exploded.

October

$SNAP and Pinterest jumped higher during this month.

November

Markets toyed with all time highs (in the case of the $DJIA it made it).

December

- $BABA was destroyed because Jack Ma complained about how Chinese banks allocate credit,

- AirBnB and DoorDash had big pops at their IPOs,

- Bitcoin continued to rocket higher.

Overall

Commodities did better, but still did not shine as much as they might have.

Equity markets are more overbought than they have ever been.  There is more margin debt than there has ever been

There is more margin debt than there has ever been  .

.

And the stockmarket is at its all-time high as a percentage of GDP

(and yes, I know that the stockmarket is very unrepresentative of the economy, but that’s a whole different issue).

All these charts shamefully stolen from The Felder Report.

Comments !