There is no bubble: says JPM

The Market Ear writes:

The dream team of thought-leaders at JPM had a conference call arguing that there is no bubble in the equity markets or credit markets: “We do not see a broad equity market bubble but rather certain pockets of the market that are experiencing hyper growth such as electric vehicles and renewables. While there is a lot of talk about bubbles, it is hard to see one in the broad equity market, where a dominant group (FANGs) practically hasn’t moved for 6 months despite massive amount of stimulus and an expected economic recovery, Financials that have barely recovered 2020 losses, and Energy that is still down 25% from last year despite a commodity bull market”

So, this is totally ordinary behaviour for a broad stock index?

x

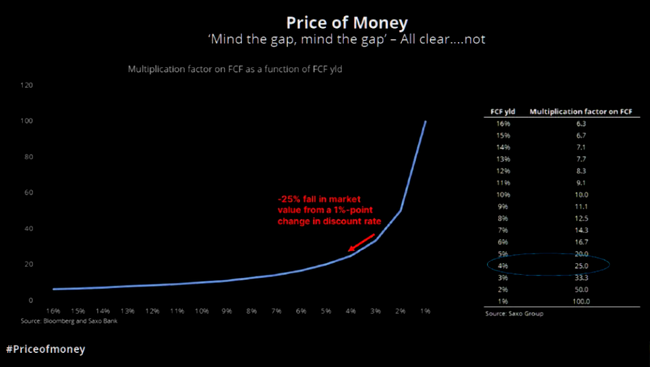

I don’t know how Saxo Bank have arrived at this. I am frankly sceptical that anyone actually can predict, with any meaningful accuracy, the free cash flow of Facebook in 20 years time: the assumptions needed to arrive at any hard numbers would have to be so heroic as to make Superman seem like Clark Kent.

However, the fact remains that if one holds onto the idea that a share price today is equal to the present value of cashflow returns to the holder in the future (an assumption that more or less underpins all corporate finance theory), you have to assume some insanely low discount rates going out a very long time indeed.

The world has experienced four decades of declining nominal rates. Maybe this trend will continue for another twenty years. Maybe, even, it will continue for another thirty. But surely the probability of Japanification of the West coming to an end must be significantly more than zero, which would be a big problem for the FAANG.

x

I don’t know how Saxo Bank have arrived at this. I am frankly sceptical that anyone actually can predict, with any meaningful accuracy, the free cash flow of Facebook in 20 years time: the assumptions needed to arrive at any hard numbers would have to be so heroic as to make Superman seem like Clark Kent.

However, the fact remains that if one holds onto the idea that a share price today is equal to the present value of cashflow returns to the holder in the future (an assumption that more or less underpins all corporate finance theory), you have to assume some insanely low discount rates going out a very long time indeed.

The world has experienced four decades of declining nominal rates. Maybe this trend will continue for another twenty years. Maybe, even, it will continue for another thirty. But surely the probability of Japanification of the West coming to an end must be significantly more than zero, which would be a big problem for the FAANG.

Alex Manzara captures the mood of yesterday neatly:

Hipgnosis

He sells Sanctuary? The music business/press love-in with Hipgnosis reached new heights this week, with a Billboard cover lauding founder Merck Mercuriadis as “the man who bought the world”.

You’ll maybe know Hipgnosis as the fund that makes headlines every couple of weeks whenever it buys up some massive share of a famous music artist’s back catalogue. So far it’s raised around $1bn and bought the rights to thousands of songs, under the theory that these are all assets that will appreciate in value.

One thing largely overlooked in all the self-publicity though is how similar the early trajectory of Hipgnosis is to Merck’s previous employers, Sanctuary Records. Sanctuary was huge for a while. The business model was to buy loads of management companies in eyebrow-raising, publicity-generating megabucks deals. This increased their valuation and share price, making big bucks for the bosses. Or at least it did until it became obvious that the deals actually created little in the way of value. Then the share price tanked, regulators found a load of accounting irregularities and it was left to be rescued by Universal.Hipgnosis is currently paying huge money for a load of songs. The share price is going up and Merck makes his advisory fees based on the valuation of the company. So let’s hope the business model is a bit more robust this time around.

# Wrap

Fairly risk-off/deflationary:

- NDX +1%, DJI -1%, SPX 0% – deflationary,

- US 10Y yield down to 1.44%, but nearly all other markets, yields up,

- Most global equities markets down, especially FE & EM,

- All commodities down: gold by 2.3%. Oil & copper down by ~3%.

Personal Consumption Expenditure in the US jumped 2.4% month-on-month, which you’d expect to be inflationary, but it’s increasingly looking as though Biden will continue a lot of Trump policies:

- bombing the Middle East,

- cancelling the Federal minimum wage,

- cancelling the stimulus cheques (at least the $1.4K),

- ? cancelling infrastructure spending.

It looks as though the conclusion is that real interest rates are increasing, which is boosting bonds and crushing gold. Janet: we need you!

Comments !