Wrap for 29 June 2021

Oh what a dull day. No particular news. Probably biggest move was DX up 20bp. No big deal, but it seems to have dragged energy commodities down. NZD was down 0.7%, so quite a big move, but it’s not a deep market. Equities and bonds both desperately flat. BTC up 5.6%, so practically flat.

Crumbs from the interweb

Steel is the new lumber

Hot rolled coils futures off the chart.

Lots of chatter about $100 oil.

EV stocks are very strong, still. Tesla, Nio, Nikola, Workhorse.

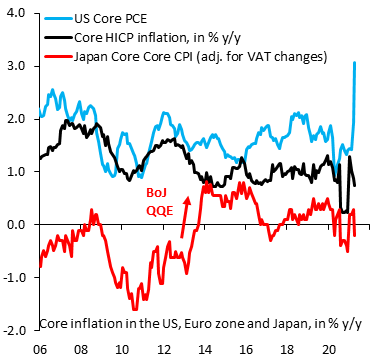

Fed needs to do more tapering than the ECB, so this is bullish for the USD.

Miners may be able to exercise more restraint in cranking up capital expenditure this commodity cycle. The combination of this and the defunding of energy exploration companies might actually be very good for investors in miners.

Florida building collapse linked to corruption. As usual, building standards do not make a difference without a transparent process of bidding and incorruptible inspectors.

Day-One Advice for New Hedge Fund Portfolio Managers. This is from Brent Donnelly, author of Alpha Trader. My takeaways from the summary are:

- your real stop loss is less than your notional one. Understand what you really stand to lose.

- trade cautiously, especially at first.

- understand that being up by 1% followed by being down by 1% will, cumulatively, wipe you out,

- don’t be too proud to do a stupid trade. As long as it makes money, it doesn’t matter if its stupid.

- don’t decide that the markets where you have an edge are too dull and that you’ll start punting in markets you’ve never traded before,

- keep your powder dry. If you get allocated more capital, don’t just use it up on day one.

- always remember that the global macro cycle is the most important driver in nearly all markets,

- don’t be afraid to run against the crowd (especially when you’re a PM in a shop where everyone is on the other side of the trade).

Comments !