9 July

Market review

I haven’t had time to write daily ‘wraps’ recently. The opening up of the UK economy has had a personal impact on me. I have needed to spend my time working on other things. I will therefore try to make sense of market behaviour over a slightly longer period than one day.

The current driver seems to be the resurgence of Covid, particularly the ‘delta’ variant. It was always likely that Covid would evolve to form a more transmissible strain. This was always the worry with HIV which, if it were as contagious as Covid would have practically wiped out the planet by now.

Commodities

The only asset which has not seen strong price action since 2008 is commodities. I don’t know whether this means that they are cheap, and even if I did know that they are cheap there is no reason why they should not become even cheaper.

This week, the oil price has recovered from its swoon on Tuesday. Most commodities have benefited, but particularly hydrocarbons. There seems to be an expectation that the supply of oil will ease, as OPEC+ struggles to impose strict quotas on producers. Demand will undoubtedly rise, so if it is not met by an increasing supply will drive prices up.

UAE and Saudi Arabia were reported to have failed to agree and this failure was deemed to have led to the cancellation of the OPEC meeting. This should result in more production and falling prices, but this sort of reasoning is usually wrong.

Bonds & Credit

Bonds have been very strong since about 20 June. In fact, bond prices have been rising (yields dropping) since about July 2020. This is presumably because of some slowing narrative. Certainly, the global economy hasn’t exactly felt strong during the pandemic. This has now turned around, with the surprising result that $WFC has strongly tightened personal credit availability. Credit card borrowing has shot up recently, presumably as shoppers and diners use their cards in shops and restaurants.

Crypto and currency

Friday was a risk-on day, so of course BTC rallied. It seems to be stalled in a range between $36K and $30K. I guess this means that sentiment is fairly stable, although I suspect that there is a lot of transfer of assets to bagholders. Time will tell.

Most currencies seem to have lacked direction. With all governments trying to pull their economies out of a pandemic-induced recession using very loose monetary policy, maybe that’s to be expected.

Equities & Vol

The VIX really hasn’t managed to get off the mat for the last three months. After a spike earlier in the week, it has crashed back down to 16.3.

This is all consistent with punters “buying the dip.” I think that we’re stuck in this territory until we get inflation persistently exceeding targets for an extended period. The ECB have started targetting 2%, and dropped the “or below” language. I have a horrible feeling that they will get what they wish for and will regret it.

Private Equity

Private Equity is having a banner year. With real interest rates held down at deeply negative rates, it’s not surprising that old, boring cash-generative businesses like supermarkets are being snapped up, to be replaced by SPACs which will buy unicorns with free cash flow negative for the next few decades. Some people will become very rich from these SPACs. Principally, the sponsors, but probably some of the early investors with good timing.

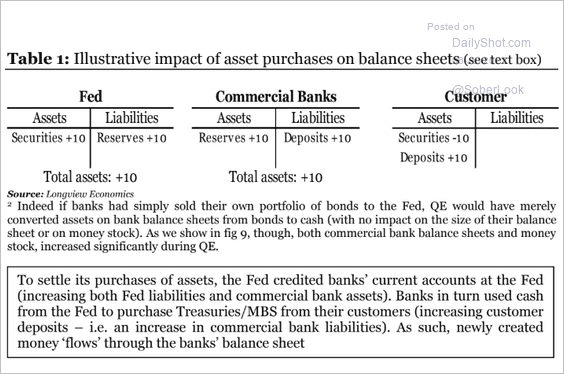

How QE causes customers’ bank balances to swell

The diagram argues that if securities are purchased from banks’ customers, the customers will end up with more cash in their accounts.

Residential Rents

Demand for rental properties seems very strong. Resi REITs in the US are booming. Apartment rents in the USA have seen rents jump 9.2%. I have never known rental growth of this magnitude. Generally, cash rents are very stable, with gross rental yields lagging capital prices by several years. The yield compression since the 90’s has been agonizing in the UK.

US Troops withdraw from Afghanistan

No wonder it’s called the graveyard of empires. Russia resists gloating. I cannot imagine that Russia wasted the real equivalent of well over two trillion dollars in fighting an unwinnable war. At least a lot of defence contractors got rich.

Trump maybe paranoid, but they are out to get him

This thread explains why so many people voted for Trump. It’s that it’s rather too obvious that the establishment were out to get him, even at the cost of cutting a few corners. I am not saying that the assertions in the thread are true, just that they constitute, in aggregate, quite a weight of evidence.

Comments !