The day in question

Post-Brexit trade with the EU

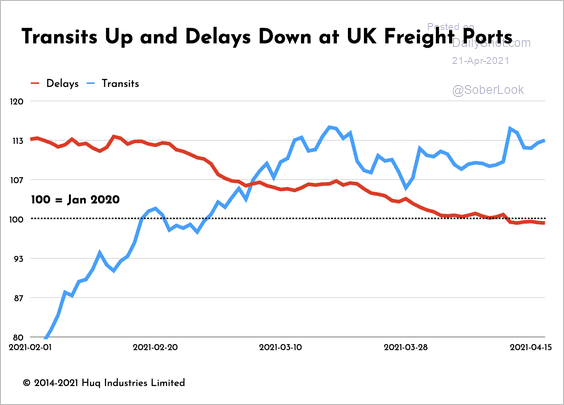

It looks as though trade is flowing more freely. Full details.

Vaccines and globalism

Politicians have been making things worse by interfering with the normal mechanisms of global trade. The end result will almost certainly be more votes for them, but more deaths for the global population.

Stimulus

Mario Draghi announced that Italy would spend €221 bn to stimulate the Italian economy. This is a big number. The UK will probably follow suit, the IMF is recommending that countries run deficits of 5% of GDP, the USA is hitting the ball out of the park, with combined spending of the order of $5T, about 25% of GDP. The current bill is over 2T, which is intended to fix a few bridges.

Italy will find itself mired in problems, because it is verging on being a failed state. Twenty five percent of taxes are not collected, according to this article, which of course will just make anyone who is not well enough connected to escape paying his fair share cynical about the whole exercise. Sicily is littered with half-built overpasses, underpasses and road schemes that are simply not connected to the rest of the road network. It is not a coincidence that cement making is a monopoly, run by the mafia (whichever one controls the island). If the money spend just ends up in Swiss bank accounts controlled by criminals, I can’t see it improving productivity in Italy, which refuses to budge.

Euro enthusiasts, like Martin Wolf, used to argue that once Italy got rid of the lira, it would be forced to confront its chronic productivity shortfall vis-a-vis Germany because there would no longer be the option of just letting the lira drift down against the DM. How naive! Instead, politicians have simply forced the taxpayers of Germany to endlessly bail out the feckless and corrupt Italians.

What is interesting, is that nobody (well, no economists) have spoken out against stimulus. Well, Larry Summers, perhaps, but he soon shut up.

Krugman thinks that the Republican party is no so far beyond the pale that even the small minority of Republican-supporting proper economists who would be sceptical about this are keeping their mouths shut, because the party now follows the advice of people who are simply not proper economists, like Kudlow and Peter Navarro.

Somehow, inflation is never coming back.

Well, we’re certainly going to test the thesis.

Markets

US stocks hit by a Biden comment about doubling Corp Tax. EU stocks and Asian ones, pretty flat. Bonds flattish. DXY up a bit, 91.29, continuing its rally. BTC continues to fade, $53K, Metals (copper, gold and silver) down, other commods fairly positive.

Generally, the reflation trade is not getting traction. Results are generally strong, but they are all baked in.

I share the following without comment:

— Compound248 (@compound248) April 22, 2021

“President Biden will propose almost doubling the cap gains tax rate for wealthy to…be as high as 43.4%

“For New Yorkers, the combined state and federal capital gains rate could be as high as 52.22%. For Californians, it could be 56.7%.” pic.twitter.com/rLh67nhR8U

Comments !