2022-10-20

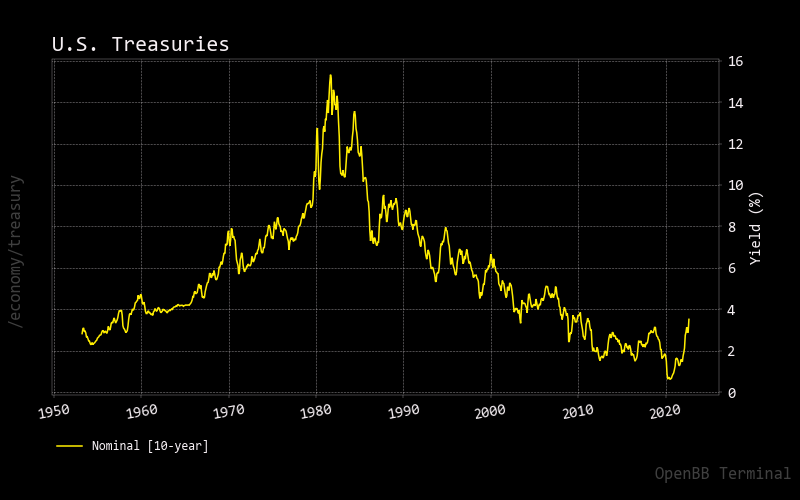

Yields were repressed in the 50s, to pay for WWII. They skyrocketed in the 70s/80s before the very harsh medicine of Paul Volker was used to bring yields down control. Budget deficits are huge now, compared to then, as a proportion of GDP. With many countries having debt to GDP in excess of 100%, it’s hard to see how any politician can tolerate another Volker at the Fed, and doubly so in countries like the UK. My guess is that we get a Havenstein Moment, and yields go to infinity.

Wrap

Pretty dull really. AT&T jumped 7.7%, but otherwise the indexes were down by a fraction of a percent. FOMC voting member (for 2023) Harker made some sort of statement that he expected the Fed Funds to be well over 4% next year. Somehow this was a surprise (huh??).

Comments !