Crumbs

- every bull market has it’s shooting star, and for this one, it is undoubtedly Tesla,

- TSMC is going up

Kuppy’s Event Driven Monitor

Kuppy is a fixture on The Market Huddle podcast, and is always good to listen to. He’s started up a new venture, which is a newsletter devoted to “event driven” opportunities, principally in the small cap space. Kuppy is no fool, and is admirably cynical about the world. His focus is on events that cause mis-priced securities to be re-evaluated by the market and (hopefully) come closer to their economic value. He is good on short squeezes: he called Gamestop ($GME) correctly a while ago before it exploded, and Dillards. There are a few stocks mentioned, and helpfully he’s provided a summary of his own newsletter at the beginning. I don’t know enough about all this, but $POWW and $BBBY look interesting. The latter has a very large proportion of the float as short interest, and it’s doing buybacks, which is could be difficult for the short sellers. On the other hand, if the market tanks now the reality of Biden as president becomes apparent, maybe we should stand well back.

Another event he looks at is spinoffs. Because so much investing is passive now, and the spinoff stock, gifted to the parent stockholders, will have to be sold into the market (assuming it is not in the same index). This creates an initial opportunity.

He also looks at privatizations, and de-mutualizations, which are what they sound like, but obviously usually create a pop.

Via this tweet.

Via this tweet.

$TAN is getting tanned

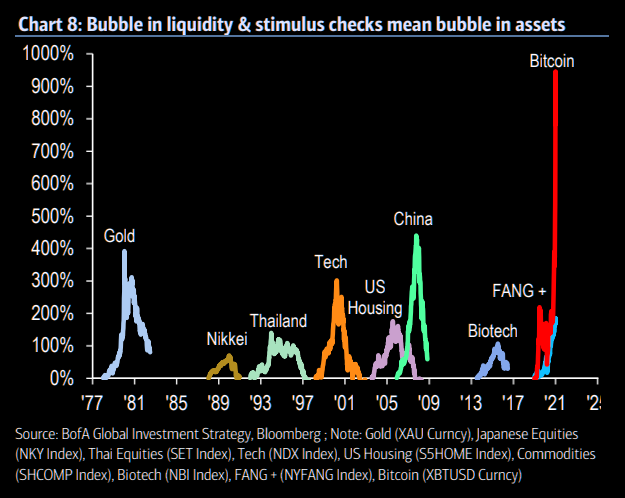

Parabolic moves have one thing in common, the psychology of masses (and eventually the incompetence of risk management). Bitcoin, TAN and Tesla share some of those massive psychological aspects of “investing”, where greed and fear (first of missing out up and then down) are primary drivers of prices.

We saw TAN put in some rather bearish px action last week. Bitcoin has lost the mojo and is “frustrating” many longs that were supposed to enjoy the long weekend. Tesla has shown signs of rolling over small, but is still the most extreme of them all. Could Tesla roll over properly going forward, if nothing, just to restart the fear part of the greed and fear “narrative”?

EM looking toppy

EM is a huge consensus long, and people have continued putting money where their mouth is. As BofA notes on EM flow, “6th largest inflow ($7.0bn) to EM equity ever”.

Lot of the EM logic is built around the weaker for longer dollar, but the dollar has reversed rather violently. Will EEM catch up?

EEM is as we all know full of Asian tech, so it is not really what it used to be. More “clean” plays on the EM bull is stuff like Brazil, EWZ. Note EWZ tanked yesterday, -4.5%, and vol exploded to the upside, VXEWZ +12%, closing at highest levels since early Dec.

Tech note

I’ve been looking at ledger-cli. This has a lot of development behind it, and will be around for the foreseeable future. It’s a useful alternative to gnucash. It has an ecosystem of supporting software, such as ledger autosync. It’s not for everyone, but for geeks, it’s an accounting program which Ken Thompson and Dennis Richie would have approved of.

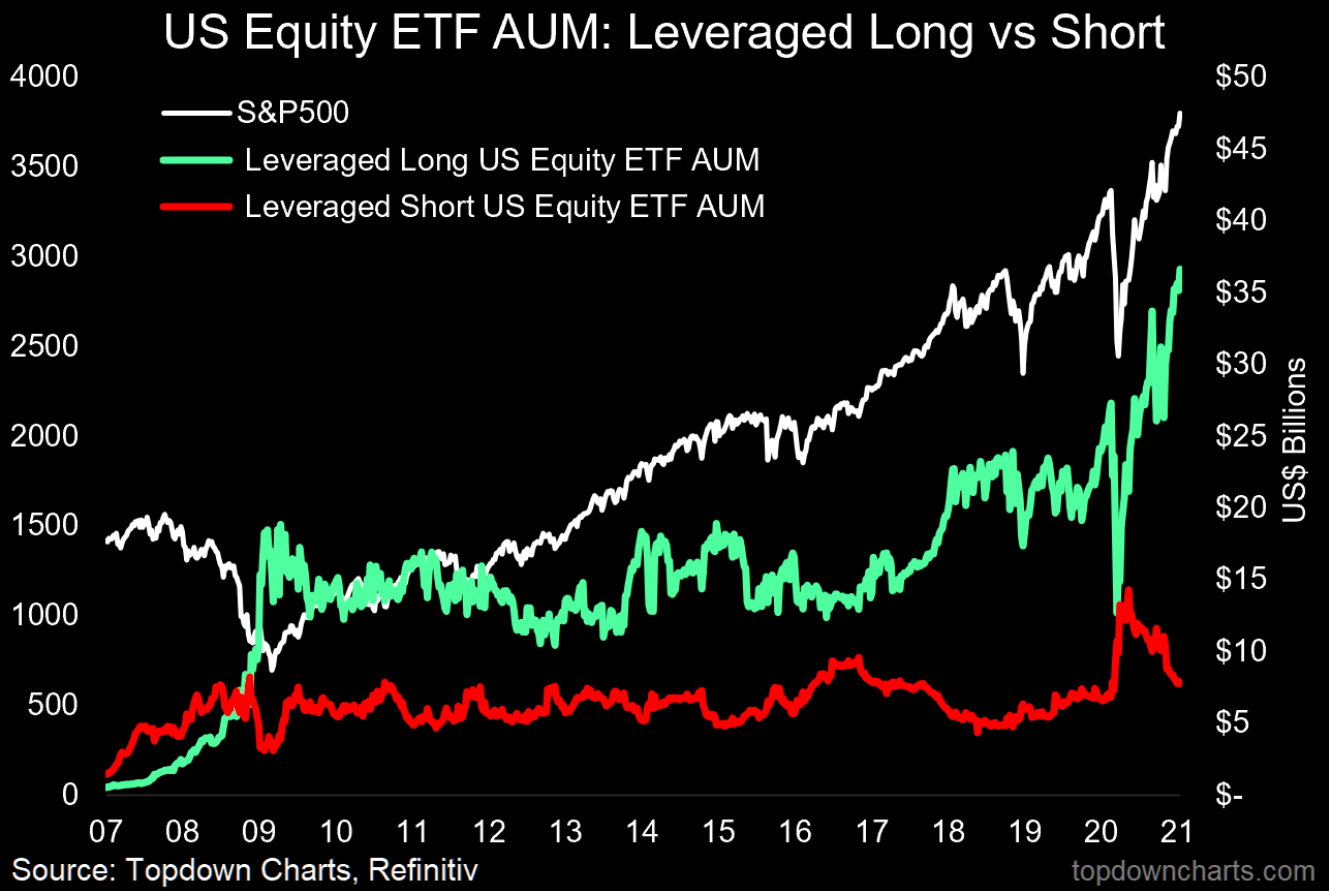

Nobody loves leveraged short ETFs. Yet.

.

.

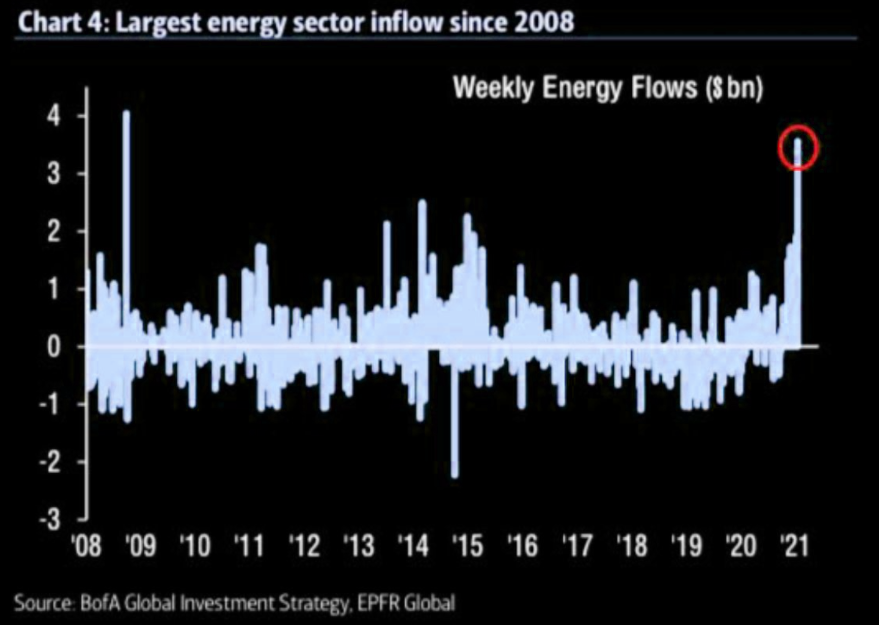

Energy catching a bid

Not a bubble. Really?

Comments !