Wednesday 19, January 2022

What does Larry want companies to do?

I am a huge fan of Matt Levine. His analysis is top class. He is great at questioning everyone and everything. Today he looks at what the point of Larry Fink’s letter to CEOs is. In some sense, it’s a defence of the Friedmanite position that a CEO should focus on maximizing returns to shareholders, and let those shareholders decide on what non-financial objectives they wish to pursue. It’s impossible to summarize: I recommend that you just read it. His newsletter is free, except for the opportunity cost of having to read it every day.

Dash for (losing) cash

I have never used a food delivery app. (Boomer here!) I have ordered plenty of takeaways in my time, of which I’ve collected on 99.5% of occasions. The odd time I’ve had food delivered, it has taken ages, and it has been cold and unappetizing by the time it reached me. Nowadays I’m good enough at basic cooking that I can rustle up something edible in less time than it would take me to order and collect a takeaway.

So, all the apps make no sense to me. But they are highly priced by the market, since they have shown frenzied growth over the lockdown, and sales and sales growth are the only metrics that matter to today’s investors. But the tide is turning, and investors are becoming sceptical. This hatchet job on Door Dash is worth a look. The author points out the quite severe headwinds facing $DASH, and the venal behaviour of its CEO. It’s on my long-list, but it looks as though the shareprice plunge that is taking place now might spell the end. Of course, Apple might come up with a bid for it at a premium of four times the market price, so be careful out there! Seriously, the sector looks ripe for consolidation, which will create dangerous obstacles for any short sellers.

UK Inflation

It’s looking bad.

source: tradingeconomics.com

source: tradingeconomics.com

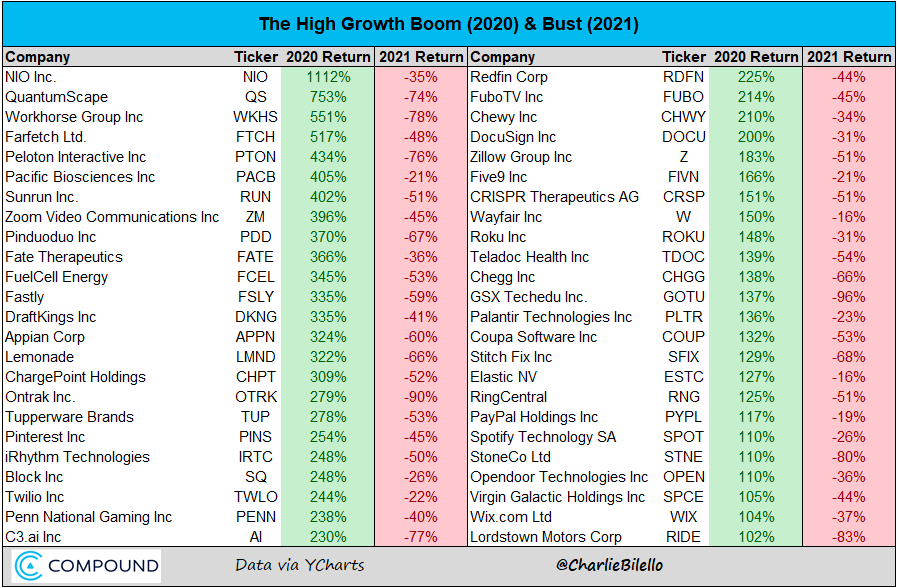

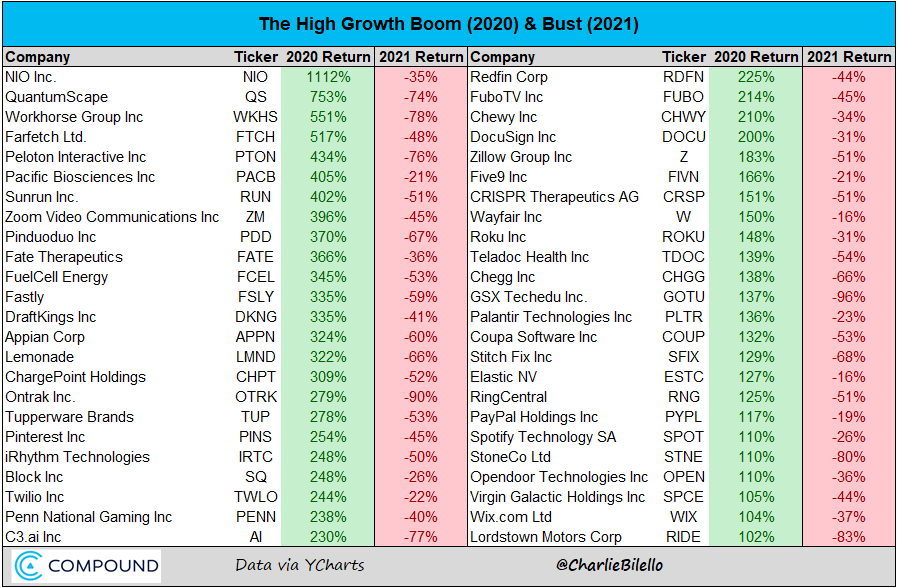

Wheee — stocks about to come down to earth?

I’m thinking $NIO especially.

Can I change this and get a dynamic update?

What you should have bought

Understanding Bidens attack on the meat-packing industry

Doomberg is dope. This is a wonderful article about how the sausage factory works. You should read it, because you might learn how to make a fortune trading cattle futures. But the main thrust of the article is how laws get passed as a quid pro quo for political donations. I was going to say “as a result of lobbying,” but it’s nothing to do with lobbying: it’s naked corruption. As Doomberg points out, both the big parties in the US are equally implicated, so there is no where for the voter who doesn’t want laws dictated by corporate donors to turn.

$TSMC is an amazing company

Nicole Hemsoth explains why Taiwan Semi is such a dominant force in the industry. OK, it’s expensive: 150 trailing P/E, 130 forward. This doesn’t leave much room for error but, damn, it must have a deeper moat than $AAPL or $AMZN. I don’t know about this. At least the operation makes a profit, unlike so many high-tech stocks. Maybe the problem is that it’s so big, growth will weaken going forward.

Autonomous Trucks

Embark looks a clear short.. Not advice, just my take on The Bear Cave’s article on the subject. It’s a software house developing autonomous driving code, with no patents, no sales, no credibility, which went public via a SPAC. What’s not to like?

Lyn Alden Jan Newsletter

Read it here. Always worth a look, it seems that Lyn has moved from the stance that “US equities are too expensive, but you gotta keep buying them anyway” to the stance that “Maybe inflation, tightening, commodity supply shocks and all the rest will finally make a difference.” Several good charts to show US exceptionalism, in terms of how much global savings ends up there. Basically 61% of global asset markets, but only 23% of global economy: a big disconnect.

Demographic challenges

We are getting old, as a society. The direction of travel of productivity is terrible. Growth is negative, and this weighs on the ability of societies to distribute consumption to the working classes. The response of governments is to create money. Since 1971, there is no external anchor for currencies. The experiment has allowed governments to run incredible deficits and through them maintain social programs without offending the 0.01% that hold so much of society’s wealth. This worked remarkably well over the pandemic, but now many central banks are raising rates. Real rates are still going down, but this will lead to inflation, which on its own will do the hard work of redistributing wealth downwards, which is politically intolerable.

I don’t know what will happen, but I cannot see this ending well, and I also cannot see realized and implied volatilities on all assets, but particularly forex rates staying as low as they are right now.

Oscar Health

Oscar Health: health insurance disruptor.

Wrap

The Nasdaq looks ugly.

Twitter is getting twitchy: $AAPL has closed beneath its 50-day MA for the first time in living memory.

Forex and bonds were quiet, although the 10Y is now up at 1.88%.

Commodities all seem to be higher.

The market has decided that ‘transitory’ is definitely ‘taboo’.

Bitcoin looks sick:

Comments !