Notes for 1 July 2021

Fertilizer

I am bullish about food commodities. It’s hard to invest in farmland, but fertilizers are a reasonable proxy. As usual, I am looking for a catalyst to get the stock moving, and an anti-dumping investigation, with the threat of quotas and tariffs provides lots of economic rents for suppliers at home and abroad. Oh, consumers of food have to pay more, but they don’t employ lobbyists, so nobody cares about them, especially when nobody outside the industry joins the dots.

RIP Donald Rumsfeld

He was smart and conscientious, but ultimately worked to start wars in the Middle East that resulted in a horrible legacy of never ending Islamic terrorism. I don’t suppose he could have known what the consequences of his actions would be (Cheney was the instigator, I’ve read), but the fact that he was so embedded in the military industrial complex must have coloured his judgement.

Crumbs

Russia is talking about increasing interest rates to quench inflation, which has recently ticked over 6%.

Energy is having a great few months, but it is still low relative to materials (metals, wood, agricultural products). This is pointed out by Massif Capital, which offers a very nice free newsletter. See the latest for some nice charts illustrating this.

Vols have been ‘crushed’ lately. The Fed is smothering all signs of life in equities and bonds (MOVE), and probably will try to keep doing that at least until J Powell has safely left the building. However, August is often when things blow up, so it might be worth watching the VIX for the next few weeks.

The NY Fed Weekly Economic Index is showing GDP growth of over 10%. Obviously this is affected by base effects, but it’s hard to believe this won’t generate a bit of price inflation.

It seems that Binance and others are offering leverage ratios of 100 to 1 for hedge funds to speculate on crypto. As someone who has read Graham and Dodd and has studies securities for getting on for forty years, this makes zero sense to me. I think the blockchain is a wonderful technology, but it is no more than a rather inefficient database with a decentralized trust model. The world runs Victorian era paper-based systems (e.g. for international trade), but blockchain isn’t really the solution. It is good old 1960s data processing. Paper is a decentralized model, but the trust model of looking at a squiggly ink line drawn on a piece of paper is barely better than the Roman’s use of oaths sworn to minor deities.

Some people assume that the logical outcome of all this interest in crypto is a ‘govcoin’: a crypto currency issued by and tracked by the central bank. I can see the benefit, but I also think I’d like to have the ability to buy and sell things without the government knowing all about the transaction, something the author seems to think is a bad thing.

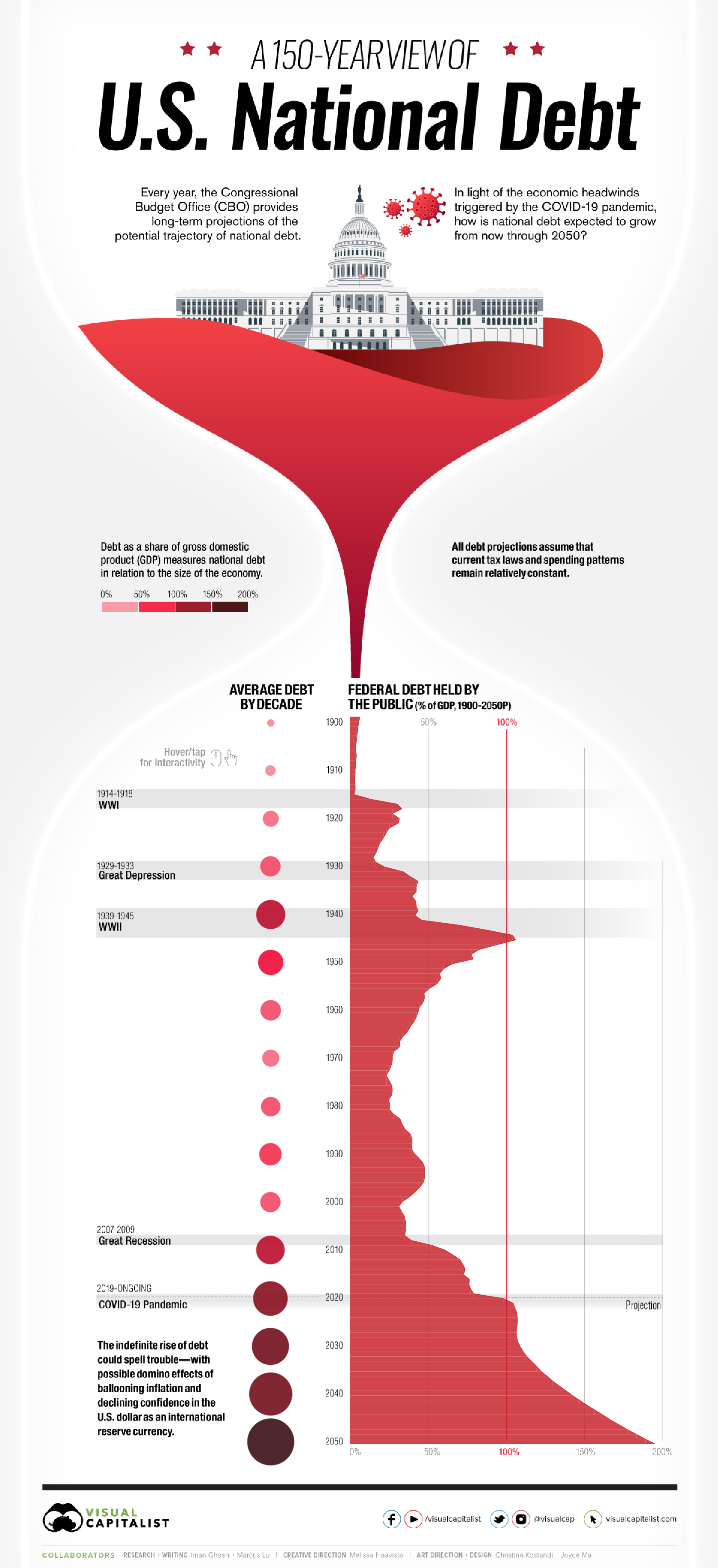

I love long-term charts, and one that goes back 150 years, especially for US govt. data, is wonderful. Admire this great work from the Visual Capitalist:

I am always posting reflation theory links. Here is a link to a deflationist. And Lacy Hunt doesn’t even get a namecheck!

Wrap

Euro stocks are weak. Maybe now that the dollar has found some strength, this will change. European equity markets seem permanently not invited to the party.

Comments !