Wrap

S&P down 0.6% this week (up 2.1% y-t-d). Ten year Treasury yields fell four bp on the week (down 12bps ytd). Most international equities were down, apart from inflation-prone places like Mexico and Turkey. I feel that the weakness of currency is the biggest weakness of my general bearishness on developed markets equities. The dollar rallied 1.8% to a two-month high. The argument for a drop is the terrible twin deficits (and weak savings, but that’s implied). The argument for a continued rally is the Fed’s action being taken as a template for every other CB on the planet.

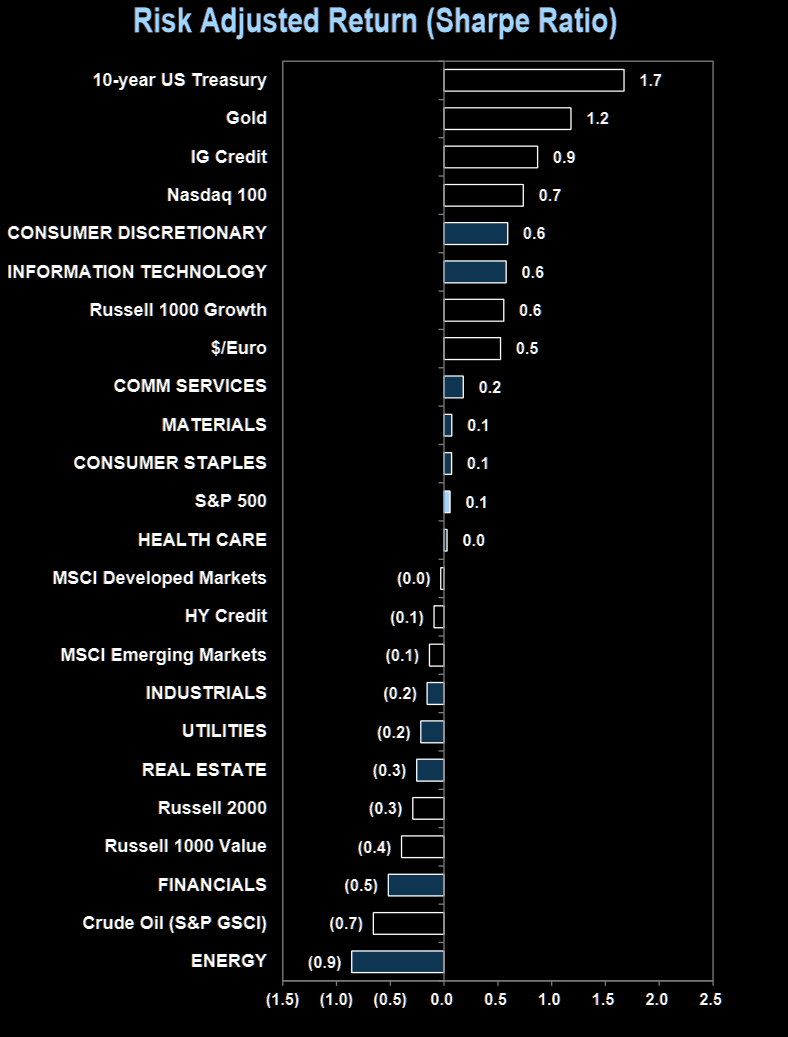

10-year Treasurys still the best risk-adjusted returns:

(Not clear what the time frame of this is.)

Short interest rising

Politics

It’s only a month away, and the US presidential race is hotting up. Like everyone else on the planet, I don’t know who will win, but I feel sure that Biden will be pretty bad for the stockmarket, relatively. I guess Trump & Biden would endorse any sensible pandemic assistance polices, but I would guess that Trump will be more hands-off.

Comments !