Helicopter Ben still to blame

The Credit Bubble Bulletin is a

Where has all the money gone?

See this thread.

The big question is … why? Supplementary questions are:

- the Japs did a lot of QE. Why hasn’t their stock market gone through the roof?

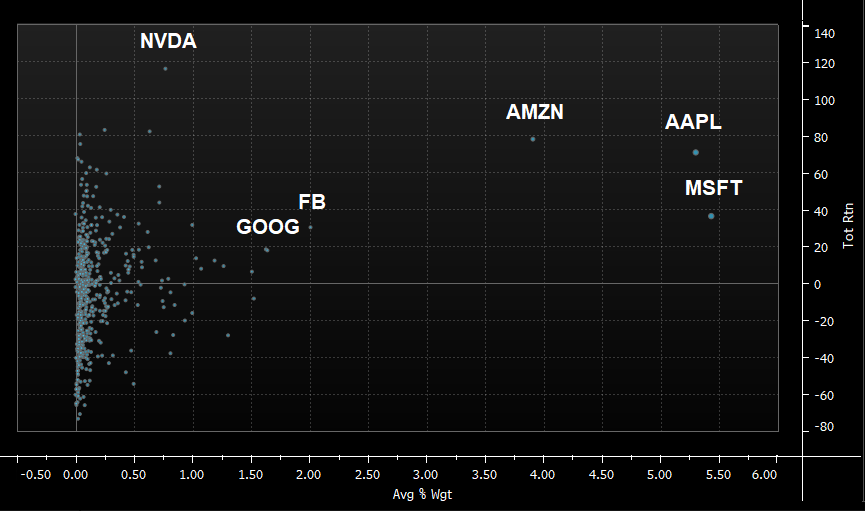

- the stocks that have gone up had fortress balance sheets already, and would have done well whether or not the Fed had stepped in. In fact, their competitors might have been driven out of business.

- can it really be Robinhood? The vast bulk of investment is via passive flows. Admittedly, there is no re-balancing with (market cap weighted) passive, but this goes for everything in the SP 500.

It’s Saturday!

The markets were closed today. It’s been a rough week. My evening read today is “The Mind of Wall Street”. Unusually (for me), it’s hardcopy (but not hardback). If you’re local (well, say UK) and you’d like to read it drop me a line & I’ll lend it to you for free. I will take a few days to read it. Initial chapters are very encouraging.

Good night!

It’s now Sunday

And I’m too lazy to create a new file.

This caught my eye. Trends can persist for a long time. Clearly, the top people at Shell felt that NG prices would be strong for a couple of decades after 2011. In fact, there has been a glut. The thesis that NG was a byproduct of oil, and so when oil demand collapsed because of Covid the price of NG would spike (thanks, Kuppy) has proved to be false. (Although, maybe it’s too early to say…) Anyway, I keep an eye on NG, as I think it has potential as a fuel beyond the next decade, but I’ve probably been too skeptical on green energy for a while, and the price may never recover. I have no position in NG, nor am I ever likely to take one at this rate.

Chasing Macro: Fiscal Edition

Episode 93 of The Macro Huddle was all about macro. I listened to it in fragments, but my takeaways were:

- we’ve run out of road on monetary policy, and fiscal is coming down the road,

- politics matters, and until the elections are over, there may be a pause in fiscal,

- yield curve control is coming, and with it inflation,

- the dollar is going down (or up, or flat: one of the above),

- Natural Gas is probably going up: it’s hard to see anything taking its place: Biden promises a lot but probably won’t deliver, just like everyone thought that the new administration four years ago was going to do something about big pharma’s outrageous profits.

There is a lot of other stuff. Chase seems a cool guy. His newsletters seem a good read and can’t be beaten on value for money (they are free!).

Comments !