14 Sept 2021

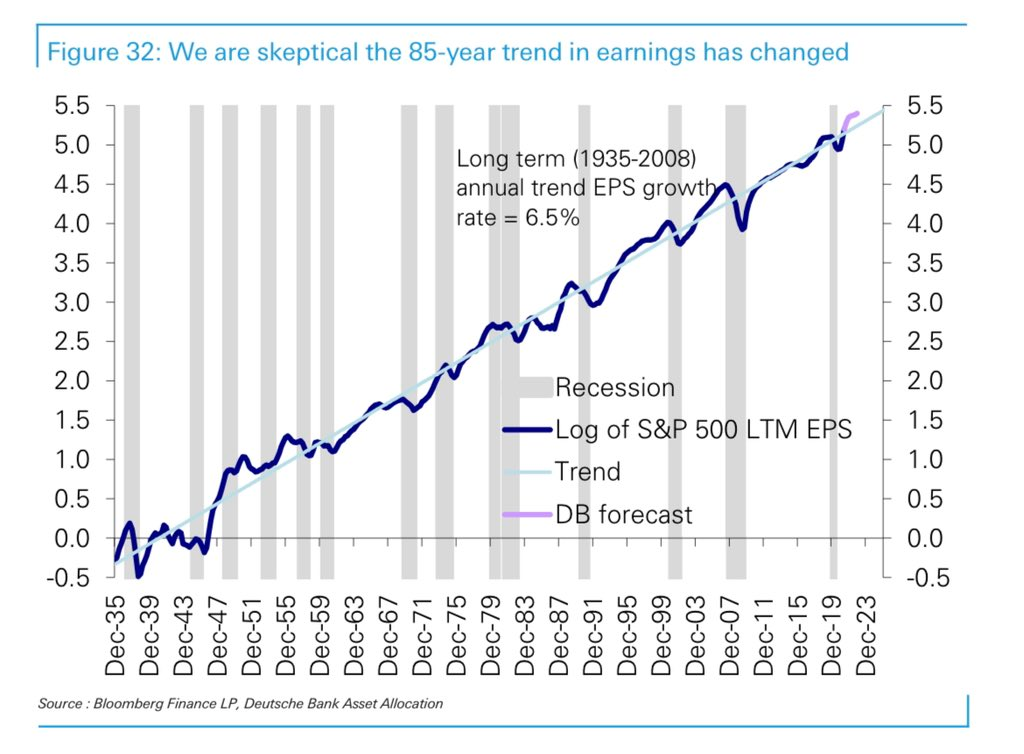

EPS for US shares has been on a monotonic trend for eighty five years.

This is a pretty amazing chart, which I’ve stolen from This week’s Callum Thomas’ Chartstorm

Basically, earnings per share have kept going up by around 6% annually, relentlessly, since 1935.

Will the BoE ever need to call upon the UK Treasury’s indemnity to protect it from losses on its QE portfolio?

Chris Marsh thinks that the BoE could possibly come unstuck waiting for its gilts holdings to self-liquidate. He explains that as soon as bank rate exceeds 100bp, the BoE will face capital losses on its portfolio. I am in awe of people like Chris who write such detailed stuff for free. Stuff that covers the topic so much more authoritatively than the FT or similar. I don’t even know who Exante are. Presumably, a bunch of nerdy economists with a talent for in-jokes.

US inflation slows … to 5.3%

The fans of Lacy Hunt are slugging it out with the fans of Bill Fleckenstein. Basically, for every statistic that supports the thesis that inflation is breaking out, there is an equally convincing one that we’re headed, in the longer term, to turn into Japan. “We” meaning the USA, but once inflation takes off there, it’s likely to spread to the rest of the world. Not that S. Africa or Turkey are exactly in a deflationary spiral right now.

One of the arguments that inflation truly is temporary (or ‘transitory’ as J Powell refers to it) is that if inflation was actually going to become embedded, we’d see evidence for this in the markets. Certainly, the Eurodollar futures markets show almost no sign of an expectation of short term rates going up. One might argue that this just an expectation that the Fed isn’t going to raise short term rates, probably ever. The problem is that even 30 year treasuries are steady, whereas if markets really believed there was a real risk of persistent inflation, they’d be collapsing.

Wrap

Yes another risk-off day. This must be the longest run of bad news (for bulls) for a year. The CPI numbers were more or less in line with expectations. The Democrats have proposed a bill to reverse some of Trump’s cuts in corporation tax, which may explain some of the movement, though global equities were weak and they will benefit, relatively, one would have thought. Consumable commodities (i.e. everything but precious metals) were generally down. Gold and miners were up. Uranium, which has had a stonking run of late, faded, with the Sprott Trust, $U.UN:TSE losing 14%. DX was flat, but USD.JPY was down 32bp.

There was a proposal for some sort of surcharge on those making $5M or more pa: the sort of tax bracket where it would be possible to route earnings through some sort of tax-advantaged entity to avoid this sort of tax. I don’t even know why I wrote that: I don’t even understand the UK tax system, so how can I guess what would work in the USA? Except to say that in a tax code of the monumental complexity of that country’s there has to be a few.

Of course, equity valuations are stretched beyond breaking points, by almost any metric, so maybe it’s just that the market has woken up to this. Or, maybe it’s because central banks are now nearly all easing off on QE. I find it hard to believe that the Fed will not at least commit to tapering within a month or two.

Image of the day

Comments !