2022-12-06

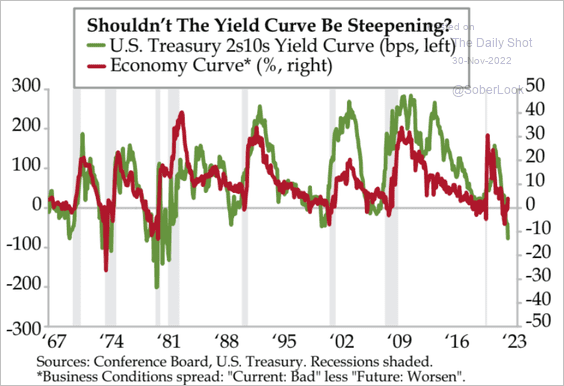

This article argues that the Fed is going to have to cut, and cut a lot, creating a huge steepening. Maybe the crash in oil prices (and the downturn in stocks, which amounts to a tightening) will be the nail in the coffin of further above-expectation rate hikes.

Wrap

Most energy commodities were hammered today. The following is Trading Economics gloss on the move:

WTI crude futures dropped more than 4% to below $74 per barrel, the lowest since December 2021, as sentiment remained clouded by concerns about weak global demand. Advanced economies, especially the US and Europe, are witnessing a drop in manufacturing activity due to tightening financial conditions. On top of that, better-than-expected US services and jobs data stoked worries that the Fed will need to remain aggressive for longer. Still looking for the demand side but putting a floor under prices, China has been dialing back virus curbs following widespread protests, with several cities scrapping testing requirements that have hindered movement in the world’s top crude importer. On the supply front, OPEC+ decided to stick to their existing policy of reducing oil output by 2 million barrels a day from November through 2023. Investors were also assessing the impact of the latest sanctions on Russia, including a price cap and a European Union embargo on seaborne imports of Russian oil.

I read in the FT that a price cap of $60/barrel will make essentially no difference to Russia, as that’s what it’s oil is selling at now.

Gas and energy usage in Europe has dropped a lot, as industry has put off consumption, and the weather has been very mild for October and November. It’s cold now (believe it, I am freezing!).

The oil crash dragged down all risk assets and has increased the bear flattening, with 10Y yields down nearly 9bp. Practically every last global stock-market was down a point or two.

Universities, subjects, selectivity and their effects on graduate income

This is rather interesting. Going to a highly selective institution, to study a competitive subject like economics, makes a big difference to your earnings potential. I believe that this is mostly down to signalling effects, but that doesn’t make it any less real.

It’s interesting how economics is such an outlier subject. Studying it makes a bigger impact on future earnings than studying law or medicine, or even computer science.

It’s a bit depressing that studying maths, physics or chemistry have such a meh effect on earnings potential.

Comments !