Crumbs

Kuppy dumps BTC

Kuppy is no Jamie Dimon. You don’t think “Jamie is telling me that the stockmarket is going up for the foreseeable future, I’d better liquidate my holdings ASAP.” OK, Kuppy is not as wealthy as Jamie either, but the main thing is that you feel that Kuppy just speaks his mind as he doesn’t have a board and shareholders, and the SEC to be worried about. His position on bitcoin is nuanced: he has always thought it was a Ponzi scheme, but he’s gone very long anyhow. Now, his view has changed, and he’s getting out. You should read the piece, but he basically says that his gut instinct tells him that the game is up. I missed out on the rally, but I’m far too risk averse to try shorting this crazy thing. At some point it’s going to crater, just like $TSLA, but until it’s established a clear longish term trend down, it’s best to stand well back. A lot of people are going to spend a lot of money to support BTC before they throw in the towel.

What is interesting is that BTC is, to me, the purest measure of sentiment. If people see BTC grinding lower, they may start to get nervous about the rest of the Ponzi sector. It’s just an idea …

Has China Won?

Kishore Mahbubani thinks that China is doing a much better job of giving its citizens what they want. Science works by coming up with a hypothesis, and trying to find counterexamples to what it predicts. A fairly persuasive theory of political science is that only democracies make their citizens better off, because only democracies need the consent of the governed to keep governments in power. Dictatorships find that it’s much most cost effective for leaders to suppress dissent, and distribute resources controlled by the govt. to insiders. It’s relatively hard to do this when those resources are taxes payed by ordinary people: if you want to have a good life as an autocrat, make sure you pick a country with bags of mineral wealth – you’ll last much longer. The problem is that in some ways, China does act like a democracy: although it’s tax rates, especially for the modest middle class is very high, people put up with them as they see their standard of living improving year on year, courtesy of rapid economic growth. China is a big counterexample to the theory that only democracies enable nations to prosper. Mahubabani says that China is terrified of getting into the same state as the old Soviet Union, where riots eventually overwelmed the authorities. Towards the end, the authorities admitted that the country was on the skids, which might have been true, but wasn’t a good thing to say out loud.

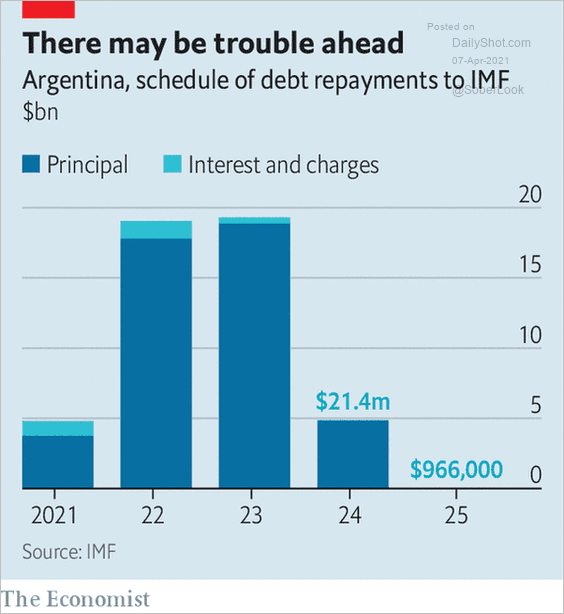

Argy-bargy over debt coming up

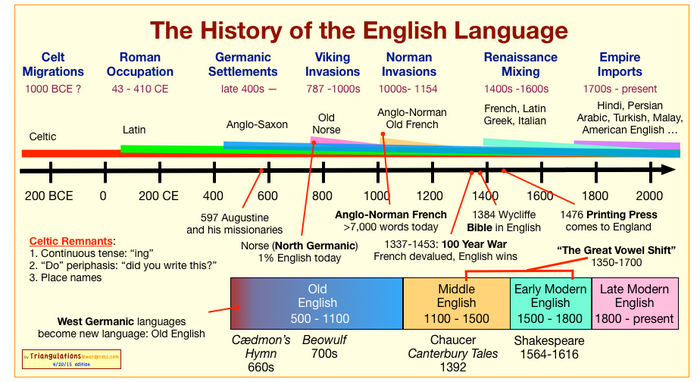

History of English Language

Iceland

We can’t do experiments in economics. But we can examine different countries, especially ones with radically different politics, central bank operation and interest rates to ours. This podcast discusses a number of ways in which Iceland differs radically from the rest of Europe. It is worth listening to, even if you think that MMT is voodoo economics.

Wrap

Unemployment claims at 744K in the US. Above market expectations, but didn’t impact equity markets. Argentina’s inflation rate is running at 41%. It will have a huge problem repaying dollar loans.

Today was relatively flat:

- DXY down a bit, to 92.056,

- UST 10Y yield down a tiny fraction at 1.62%,

- gold seems to be catching a bit: up 1.2%; silver up 1.44%,

- NDX still roaring ahead, other US and foreign indexes up healthily.

Comments !