Stock of the day: Whitecap Resources, a Canadian carbon-capture play

This article makes the bull case for $WCP:TOR It’s an oil company that’s carbon negative, because it can store CO~2~ in so-called carbon-capture underground storage (CCUS). I’m not sold on CCUS, but I think all these schemes to reduce CO~2~ emissions are wildly expensive. For $WCP, it doesn’t matter, presumably, because the income will come from taxpayers (or, the public, via wheezes like the “fossil fuel obligation”). I have solar panels: they are a crazy way of generating electricity, but as long as I get my feed-in tariff, I’m happy.

Expectations and inflation

Jeremy Rudd doesn’t think that expectations matter, at least for determining the path of inflation. His paper for Jackson Hole causes quite a stir when it came out, more for the footnotes than the content, possibly. But expectations matter a whole lot for equity prices. In particular analysts’ expectations of income numbers, heavily adjusted and massaged although they nearly always are. The problem is that they’ve been been way out of line recently. I always thought that these estimates were not really estimates but numbers whispered to the (favoured) analysts by CEOs and CFOs a short time before the print, just to make sure that vested shares could be sold into a rally. Maybe I overestimated the CEOs (or underestimated the analysts), because this big overshoot has been dramatic this time.

I got this from The Market Ear. I can’t give a link to the post, because you have to sign up for the free newsletter.

Data Trek asks the highly relevant question; how good Q3 US corporate earnings season have to be to get a large cap stock rally into the end of 2021? Data Trek answer: “In a typical quarter, companies beat Wall Street’s earnings estimates by 3-4 percent. In Q1 and Q2 2021, however, the beats were much higher: 23 and 17 percentage points above analysts’ estimates, respectively. It is that extraordinary level of operational outperformance that has given us a 17 percent YTD return on the S&P 500. Our answer: the companies of the S&P 500 need to beat by an aggregate 10 percentage points this quarter, or we’ve almost certainly seen the highs on US equity markets for the year”. |

Boomer house blockers

There is a popular narrative that post-war baby boomers like me are blocking the path to home ownership for gen X (and gen Y etc.). I totally agree that it is harder for many gen Xers to buy houses, but I feel it’s very unfair to pin the blame on the likes of me. Building housing has some big externalities. People want some control over developers surrounding their village or town with suburbs that grow endlessly. The existing residents suffer a loss, without being either the buyer or the seller of the new houses. To mitigate this loss, which is felt very keenly, politicians in many places have given the power to local people, via their political representatives, the power to prevent development. From a political point of view, this is a pure gain for incumbents: the future occupiers of newly built houses have no current vote, at least in the location where the existing houses are based. The net result of this has resulted in a severe constriction on the supply of new houses, windfalls for land owners, and new yachts for the CEOs of large-scale housebuilders, who are able to exploit the system to generate the economic rents that flow from the barriers to entry created by the planning system.

As the boomers die off and bequeath their housing assets to their kids, the cycle will continue, unless some reform is put in place. The natural solution would be to tax wealth, and particularly land value wealth, which would have the effect of bring down house prices and generate revenue for the government. Probably the most elegant way of levying this tax would be the Common Ownership Self-assessed Tax of Weyl and Posner, which gets around the problem of how to value assets in which there are few or no transactions. The problem with this is selling it to voters: probably an impossible job.

The only consolation to those who are locked out of the market is that a correction in house prices is surely overdue. The UK suffered a correction after 1988, and another milder one after 2006. With retail price inflation cropping up seemingly everywhere, at some point the Bank of England must start to reverse its zero interest rate and unconventional monetary policies, which should have the side effect of stalling house price growth. While the economy is still weak after the pandemic, the very loose policy is likely to continue, but we must be near the end of this cycle. The real challenge for the Bank is piloting the economy on a flight path that results in a soft landing. It will require a great deal of skill, and a Treasury which avoids stalling the plane by tightening fiscal policy at the same time. Some hope.

The inexorable rise of passive investing

This is a good summary of the rise of a new way of managing funds. Passive investing is huge, and it is having a huge impact on how markets behave. In the limit, price discovery is devolved to end investors, but more importantly, it results in an endless extra allocation from cash to equities. Index funds are fully invested, active ones keep some assets in cash to allocate to equities opportunistically. (Most are not allowed to use leverage to have an allocation of more than 100% equities.)

The meat market is not a pretty sight

The amazing Matt Stoller has written a brilliant piece about why beef prices in the USA are on the rise. It’s nothing to do with supply chain issues, and everything to do with four firms tying up the market. The amazing thing is that economists have dismissed the danger of allowing the market to be cartelized in this way. Certainly, as Ronald Coase has pointed out, organizing economic activity purely via an atomized market can give rise to intolerable transaction costs. (Coase used the term ‘marketing costs,’ which was descriptive in the context in which he used it but it confusing to most readers not familiar with his work.)

Read the article here.

Wrap

Continued risk on. Equities all positive, commodities generally up, except gold, bonds all down (curve steepening too), forex pretty flat.

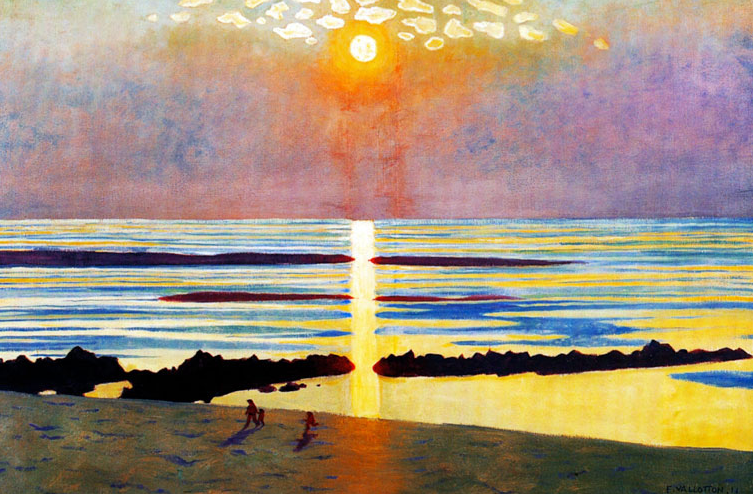

Image of the day

Felix Vallotton

Comments !