Friday 14, January 2022

Mid-month review

This month is half way through already. Some trends are becoming clear. The most dramatic one is that inflation is going up rapidly in the USA and in Europe. Mostly, this seems to be supply chain disruption as a result of a switch from consuming services, like overseas holidays, to goods, like motor cars. Energy prices have also gone up a lot, in part because economic activity has picked up, in spite of Omicron variant lockdowns, and because producers are holding their nerve on increasing output. OPEC+ seems to have learned its lesson, that all members are better off if none of them cheat. It’s a prisoners’ dilemma situation, but one which is keeps being repeated. Gas in Europe is expensive to encourage the EU to approve the finalization of Nord Stream 2.

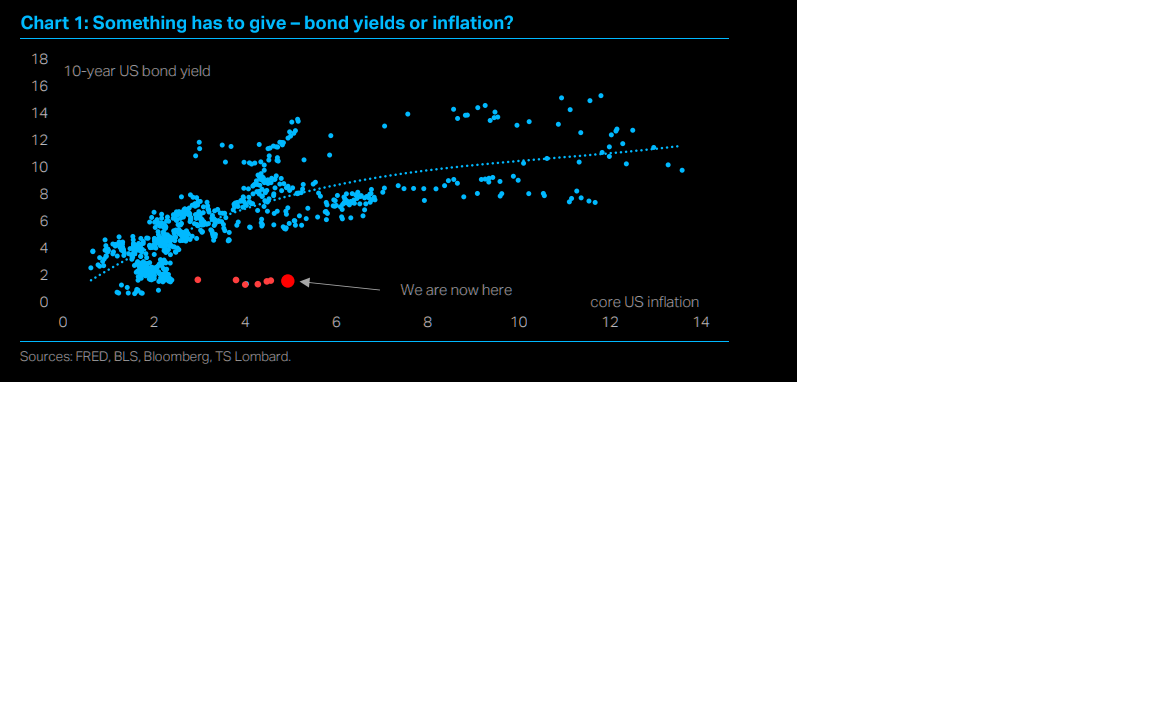

Governments have spent a lot of money, and have paid for it by issuing a lot of debt, and creating a lot of money. Combined with cost pressures, this is feeding into inflation, and weaking bond prices, particularly in the five to ten year range. The UST 10Y yield is now nearly 1.8%. This is 40 odd bps above where it was six months ago. In today’s debt-ridden world, ten basis points translates to a lot of cashflow. The most important weapon in the armory of central banks is the widespread belief that they control the world economy, and have a crystal ball which tells them what will happen next. Of course, these are utterly false beliefs, but it suits the financial establishment to go along with them, because they are fairly transparent, and if people believe that the Fed controls the market, it’s easy to make money by front running it. Recently, though, many serious commentators: Mohammed El-Erian, Larry Summers, Frederick Mishkin, have all publicly stated that they believe that the Fed has lost the plot. Once the public see behind the Wizard of Oz’s curtain, his power evaporates.

Something odd has happened to the job market. Labour force participation has been going down, but at the same time as unemployment. Quit rates are going up. There are signs that labour, as a factor of production, is finally becoming more expensive. Inflationary pressures happen with a lag. Gas bills have not yet been delivered, new mortgage rates haven’t yet bitten. Deflationary pressures, too, will not produce changes very fast. Whatever governments do now will not change much before the middle of the decade. A lot of elections will have happened between now and then. The price of milk is very visible and salient to the ordinary voter. Incumbents will be disbelieved when they say they are doing something about this. Central banks are likely to delay acting until the problem is severe.

Lots of loss-making high-tech companies have nosebleed valuations predicated on growth continuing into the distant future, with eventual dividends and buybacks rewarding long-term holders. The US yield curve is still inverted over the 20-30 year interval, but it not for the rest of the curve. Eurodollar rates have been going up steadily over the last week or two. Once that market gets some momentum, it will be difficult to stop it: nobody knows quite how big it is, but it’s probably at least $20 trillion: not far off the size of the US annual GDP.

Of course, the big unknown is China: the Middle Kingdom, but also the black hole at the centre of the global economy. For me, the mystery is why so much long-dated debt trades at negative or near-zero yields. This implies an expectation of a collapse in demand for debt. Governments have an insatiable demand for debt, as do consumers outside of Asia. It seems to me that the one thing that could export deflation to the world is an implosion in China. Domestic demand there seems to have weakened, driving the current account deep into surplus. At some point, to keep the factories humming, China will do something drastic, like lower its currency. I guess this is the big threat to bond markets (if you are short!). Of course, China has looked unsustainable for decades, but it’s kept growing at 6.5% annually. Maybe it will continue for the next three decades. But it’s hard to see this being sustained by infrastructure and real estate investment, which is currently 40% of the Chinese economy.

Pandemics also might drain demand, but somehow I can’t quite believe we’re heading for another one. But you never know: they might be like buses.

Caveat emptor, caveat vendor!

Wrap

Tech shares bounced a bit after a fairly brutal week. The NDX was up modestly (83bp), although more than the 500 (28bp). Most global markets were down. The big news seems to be the U of Michigan consumer sentiment index, which went down to 68.2, which is the second lowest in a decade. My guess is this is a lagged reaction to Omicron, but what do I know? Most commodities were down, consistent with weak consumer sentiment, but oil was very strong: 2.67% for WTI crude futures. In spite of weak consumer sentiment, bonds were down. The US 10Y is now standing at 1.79%. There really does seem to be a change in mood about the economy. Investors have decided that prices are not going to crash, especially core commodities like energy, and that the world is not going to experience deflation again any time soon.

The only assets which were still weak were the ones in the “Tiger Global Index.” This is the list:

| Symbol | Change % |

|---|---|

| $TAL | 5.2% |

| $ONE | -6.09% |

| $MNTV | -2.48% |

| $SEMR | -2.13% |

| $KC | -2.66% |

| $YQ | -1.71% |

| $FPI | 0.99% |

| $RDFN | -1.23% |

| $DADA | 3.45% |

| $OSH | -7.09% |

| $NABL | -1.38% |

| $DOYU | 0.0% |

| $OKTA | 1.18% |

| $SWI | -0.5% |

| $HCAT | -2.62% |

| $OM | -5.6% |

| $HUYA | 2.24% |

| $AMWL | -0.65% |

| $ALKT | -0.68% |

| $DBX | -0.08% |

| $PD | 1.16% |

| $VERX | 1.93% |

| $SPLK | 1.81% |

| $KNBE | 2.05% |

| $SVFB | 0.2% |

| $PAQCU | 0.0% |

| $XP | -1.98% |

| $ZI | -2.47% |

| $LI | 1.16% |

| $LDHAU | -0.4% |

| $LEGAU | -1.21% |

| $SVFC | 0.2% |

| $EDR | -0.19% |

| $DESP | 2.11% |

| $DCT | -0.95% |

| $CZOO | -5.57% |

| $CD | -3.2% |

| $DIDI | 0.0% |

| $MEKA | -0.39% |

| $SRAD | -0.19% |

| $AVLR | 0.16% |

| $LMACU | 0.38% |

| $RERE | 1.16% |

| $EDU | 1.1% |

| $ROOT | 2.23% |

| $NCNO | -4.18% |

| $NET | 1.31% |

| $AGCB | -0.31% |

| $SVFAU | -0.1% |

| $JOBY | -1.93% |

| $OLO | -1.45% |

| $REVHU | 0.3% |

| $XPEV | 4.37% |

| $AFRM | -4.25% |

| $TWLO | -0.93% |

| $CFLT | 3.15% |

| $TCVA | -0.1% |

| $SMAR | 2.09% |

| $DDL | -17.38% |

| $DUOL | 0.86% |

| $STNE | -0.42% |

| $DH | -6.58% |

| $TUYA | 1.28% |

| $KPLT | -2.66% |

| $LITTU | 0.0% |

| $DNA | -6.04% |

| $SQSP | -1.22% |

| $FRSH | 2.38% |

| $FROG | -0.57% |

| $DT | -3.2% |

| $MSP | 0.12% |

| $V | -0.15% |

| $BZ | -3.69% |

| $MDB | 1.53% |

| $ALCC | 0.0% |

| $AVPT | 0.48% |

| $APP | -0.68% |

| $INTU | -0.39% |

| $ONTF | 0.0% |

| $AI | -0.93% |

| $GRUB | -0.28% |

| $BMBL | 1.98% |

| $API | -2.24% |

| $BKSY | 0.61% |

| $DOCS | -3.19% |

| $TOST | -6.94% |

| $SPIR | 9.39% |

| $MNDY | -1.32% |

| $BIGC | -1.09% |

| $BEKE | -0.43% |

| $PLAN | 2.72% |

| $S | 1.1% |

| $ZEN | 1.25% |

| $YSG | 0.0% |

| $SUMO | 1.01% |

| $GDRX | -1.34% |

| $BHG | 0.33% |

| $CPNG | -5.7% |

| $CRM | 1.12% |

| $JAMF | 0.29% |

| $ABNB | -1.23% |

| $PRM | -0.45% |

| $OSCR | -1.1% |

| $DOCN | -9.97% |

| $OZON | -5.93% |

| $MTTR | -5.85% |

| $DLO | -6.29% |

| $GDS | 2.34% |

| $PLTK | 3.22% |

| $TASK | -3.19% |

| $WEAV | -2.5% |

| $FLT | -0.91% |

| $EGHT | -1.33% |

| $ONEM | -8.96% |

| $SQ | -2.75% |

| $IS | -1.53% |

| $EMBK | -3.76% |

| $VTEX | -2.24% |

| $PYPL | -1.45% |

| $BLND | 0.0% |

| $MA | 0.7% |

| $XM | -2.64% |

| $ASAN | -2.36% |

| $RUN | -2.99% |

| $COUP | -2.17% |

| $FUTU | 3.21% |

| $ADBE | 0.71% |

| $DV | -3.26% |

| $WRBY | -3.53% |

| $PATH | -2.4% |

| $HOOD | -0.86% |

| $SPOT | -3.61% |

| $ESTC | -3.52% |

| $COIN | 0.78% |

| $BABA | 0.15% |

| $PTON | -2.62% |

| $NFLX | 1.23% |

| $DDOG | 2.28% |

| $PCOR | -3.27% |

| $UBER | -3.28% |

| $TEAM | -0.42% |

| $WDAY | 1.93% |

| $RNG | -2.23% |

| $TDG | -0.81% |

| $SHOP | 3.5% |

| $ZM | -1.49% |

| $PDD | 4.62% |

| $RBLX | -1.43% |

| $NOW | 1.84% |

| $APO | -1.05% |

| $SNOW | -0.75% |

| $FB | 1.63% |

| $CRWD | 1.02% |

| $CVNA | -4.23% |

| $AMZN | 0.57% |

| $DOCU | -0.11% |

| $DASH | -0.19% |

| $SE | -3.15% |

| $JD | 3.09% |

| $MSFT | 1.74% |

generated from csv exported from Yahoo finance using

q -H -d ',' "select '$'||symbol, round(100*Change/[Current Price],2)||'%' from tiger_global.csv" | csv2md | clip

Comments !