31 August 2021

Housing

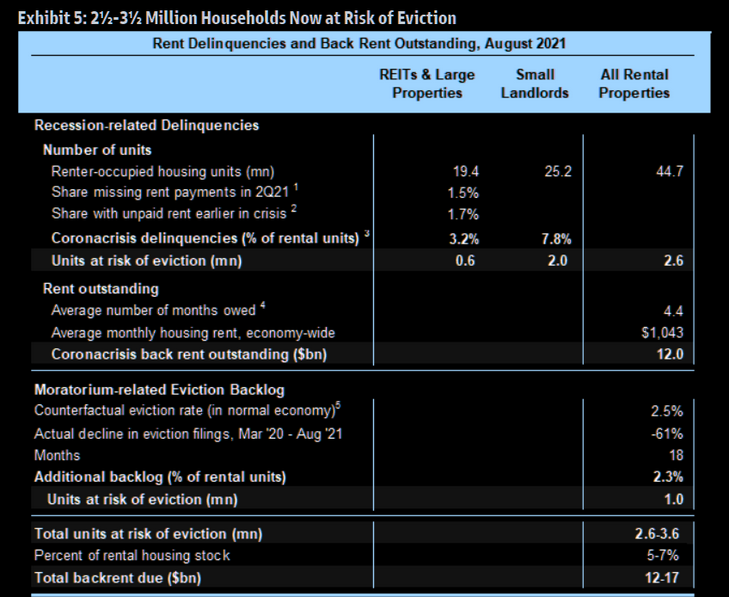

The massive strength of the housing and rental market strongly suggests landlords will try to evict tenants who are delinquent on rent unless they obtain federal assistance. And evictions could be particularly pronounced in cities hardest hit by the coronacrisis, since apartment markets are actually tighter in those cities. Goldman: “We estimate 2½-3½mn households significantly behind on rent and at risk of eviction without policy support. Eviction Lab data indicate that roughly half of eviction filings historically result in eviction (47% over 2006-2016), and in our remaining analyses, we assume that barring a new eviction ban from Congress or a much faster pace of ERA distribution, 750k households will face eviction in the fall and winter months. With 8-9mn Americans currently unemployed and emergency unemployment programs winding down, the sudden loss of tenant protections could plausibly generate an eviction episode of this magnitude”

The above is from the US. Housing has done extremely well, in the US and the UK, since the beginning of 2020. My feeling is that the market will cool off, but that QE and other loose money policies will prevent prices falling. Supply constraints on everything from cement to HGV drivers are likely to provide support for the market. In the UK, planning reform is always glacial, and so I cannot see the new policies promised by the Conservative government having any impact on supply for a decade.

Sentiment

I was browsing on Seeking Alpha when I stumbled across this article. It makes the point that Apple’s best years are behind it, that it will struggle to maintain growth when it already has, arguably, a monopoly position in many of the now-mature markets in which it operates, it faces regulatory scrutiny etc. etc. It then says that a P/E of 26 is unsustainable in such a situation.

My response was “Well, 26 doesn’t seem too big, for a FAANG stock, and anyway, someone would have to have a death wish to short a stock like $APPL.”

I don’t claim to represent anyone, but I strongly suspect that most portfolio managers would be extremely wary of shorting large cap tech. As J M Keynes said, Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally. Or, as people in the IT industry used to say in the 1970’s, “Nobody ever got sacked for buying IBM.

Well, to stack up the quotes, The old order changeth yielding place to new And God fulfills himself in many ways Lest one good custom should corrupt the world. The wheel turns, and Apple will fall. But probably not this year.

Coal, not dead yet!

Coal has had a stonking run this year, doubling. I read somewhere that we haven’t even reached “peak coal,” let alone “peak oil.”

I don’t know where all this coal is being burned. In power stations in South East Asia would be my guess. Oh, and Germany.

Wrap

In equities, there seems to be a rotation into emerging markets and Japan. In bonds, there is a slight weakness, but nothing major. In currencies, EUR has paused after its recent rally. In commodities, precious metals began to shine, but pretty much everything else was dross. Agricultural commodities have gone absolutely nowhere, in aggregate, all year.

Comments !