Thoughts for today

The old order changeth … when exactly?

Packy McCormick writes a cracking blog. His latest post is about trying to imagine what will push Facebook, Google, Amazon et al. off their place at the top of the pyramid. He points out that the economics of their services are different. Not only are they natural monopolies in the sense that their marginal costs do not start to go up before they satisfy all demand, but that their marginal cost is simply zero at all scales. This makes the traditional strategy for a disruptor, where they pick off a small segment and establish a bridgehead, unviable. He goes on to make the point that they control the ultimate scarce resource: access to the teeming mass of original content providers. Think of Spotify: to buy all the albums you have access to with a subscription would cost $100MM. It’s yours for $10 a month. Spotify controls that toll bridge, and can charge a modest fee for something valuable but unobtaintable otherwise.

He asks us to think what the disruptors will look like, to imagine ourselves as a local newspaper owner in 1995 wondering about Craig’s List. Well, his prediction is that Web3, blockchain, and disintermediation will do the trick. For what it’s worth, I think that I’ve read too many predictions of the end of intermediation over the years to be wholly convinced. I think there is golden opportunity for someone to set up a micropayments system to allow consumers of content to transact directly with producers. But as Ronald Coase explained, the sort of combinatorial explosion of contracts would be extremely costly. Hence the existence of FB as a sort of clearing house for advertising.

The likes of FB grow in value very rapidly with numbers of members, typically as the square as the membership size, which relates to the number of pairs. Payments systems are tricky to run. Blockchain has failed in bring down transaction costs (relative to Western Union, let alone Visa). It seems to me that the price of decentralizing the recording of transactions is too high. I don’t know what the answer is: maybe central bank digital currencies will come to the rescue.

I think there is clearly a need to escape the transaction toll bridges erected by eBay, Spotify, Facebook, Google etc. I think that these monopolies are very unhealthy for society, both economically and politically, but I can’t believe that blockchain will be the key to the breakup.

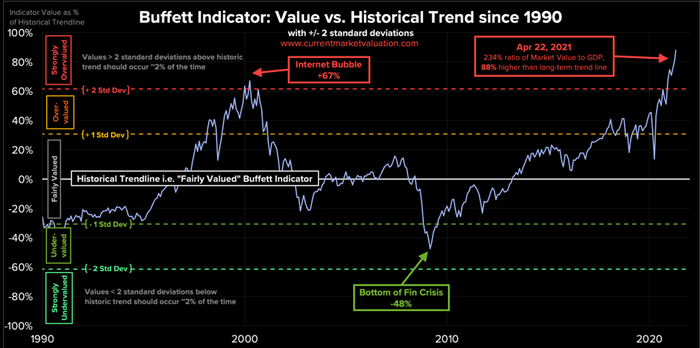

Buffett indicator hits ATH

Yes, that is the Buffet indicator. Currently it is trading 88% higher than the long term trend line according to currenmarketvaluation.com. This is definitely nothing for the short term trader to watch, and this time is “different” as rates remain at historically low levels, but it is still worth having the chart in the back of your head as Fed continues “forcing” everyone into long equities.

European Energy

We have seen commodity index, BCOM, continue the latest surge.

Oil has lagged this move and the gap vs commodities is wide here. Momentum chasers continue chasing momentum, but we would not be surprised if people started chasing some laggards soon, think oil.

One of the biggest energy laggards is the EU energy sector. So, we have oil under performing BCOM and EU energy under performing oil big time.

According to GS the EU energy sector trades at a historical discount to the market.

At the same time upside in SXEP is very well bid. The 1 month 25 delta call skew trades at elevated levels.

What does this mean?

People are basically paying up big time for upside call options in SXEP.

The case for EU energy offers interesting risk/reward from a “catch up”/value play, and given the steep upside skew pricing of options, you could play the upside with;

-

simple upside call spreads where you end up selling the relatively more expensive upside in terms of vol

-

covered calls, where you sell the elevated vol in the upside call logic, but obviously this one has you “naked” (long stock) to the downside as you have practically sold a put.

(The above logic is valid for the XLE as well, although the XLE has performed better relative to the SXEP).

(From The Market Ear)

GSX Fraud

Everyone knew that $GSX was a fraud, but it made sense to hold it.

https://wallstreetonparade.com/2021/04/mega-banks-on-wall-street-held-3-billion-in-archegos-related-gsx-techedu-months-after-numerous-short-sellers-wrote-that-it-was-a-fraud/

Financial Conditions

By all measures, financial conditions are as easy as they have ever been. Most asset prices are hitting all time highs. Real assets, and highly speculative digital and virtual ones. Ponzi stocks are on a tear. Where will it end? Nobody knows, but there has to be a small chance that it will end spectacularly badly.

source tradingeconomics.com

Wrap

The Fed, via J Powell, the chairman, stated that it will leave the target for Fed funds unchanged, and it will continue to buy $120B of US Treasuries per month. So, no change in policy. In response equity and bond markets remained calm:

- equities flat: SPX up 16bp,

- commodities, especially energy, up again, WTI up 1.13% to $63.65,

- UST 10Y, yield stuck at 1.61%,

- $HLF, Herbal Life, down 2.4%. This pyramid marketing scheme may be reaching its expiry date.

Comments !