Crumbs

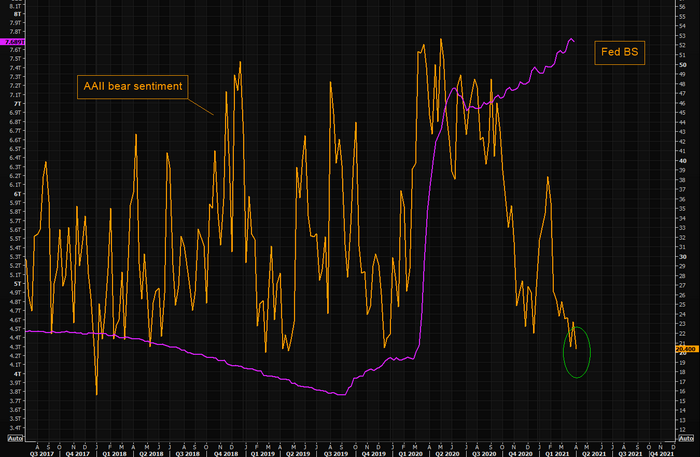

AAII is the American Association of Individual Investors. I originally assumed that this was AALL (but the ‘L’s in lower case, for some camel-case reason): no wonder Google had no idea what this was.

This might have something to do with it

“Sustainability Inc”

I’ve been sceptical about ESG investing. The idea that you can direct investment towards “green” businesses an thereby somehow fix the problem of fossil fuels has never chimed with me. If it works at all, it would do so by increasing the cost of capital of oil companies to the point that producing energy by burning fossil fuels ceased to be competitive. But this requires that the marginal investor has to be prepared to trade investment returns for the ability to signal virtue. As long as someone is willing to fund Exxon, surely, Exxon will continue to produce the world’s cheapest energy. And since we’re not (it seems) actively stopping consumers buying electricity made from fossil fuels, they are going to continue to be used.

As Blackrock disinvests in $BTU, the stock gets cheaper, which (at least in the short term) just makes it a more attractive investment.

Anyway, it seems that the former chief investment officer for Sustainable Investing [sic] at Blackrock agrees. You can read his piece here.

The FT has an article about this here. It’s behind a paywall. It was about the IMF press conference; this is an extract:

At a press conference on Thursday, IMF managing director Kristalina Georgieva said “it makes sense” to tackle as one problem the dual crises of debt pressures on developing countries and their vulnerability to climate change. “Green debt swaps have the potential to contribute to climate finance,” Georgieva said. “We are going to work with the World Bank, and by COP26 we will advance that option, which, of course, is then for creditors and debtors to decide whether to embrace.”

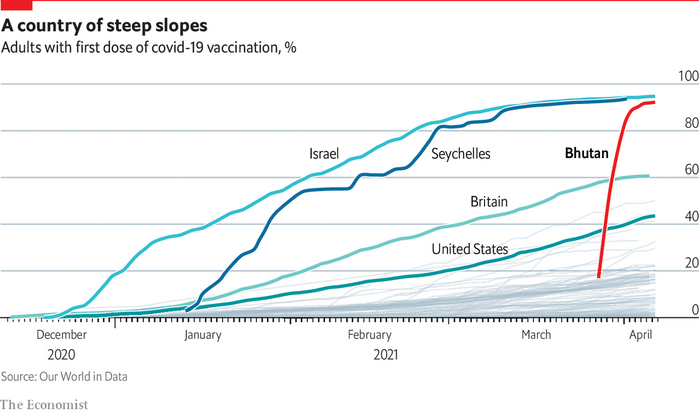

Didn’t Bhutan do well?

Well, this chart probably doesn’t include Bhutan, but it seems to have innoculated most of its citizens against Covid in a week. What is wonderful about these sorts of charts is that governments are shown up for how incompetent they are, so often. Bigger governments should benefits from scale economies and what Ronal Coase called “marketing costs” (we’d now probably say “transaction costs”), but in practice they are often fantastically inefficient, as demonstrated by the performance of other countries.

Here’s a graph including Bhutan, stolen from The Economist.

KEDM is hiring

Kuppy is probably a hard taskmaster, but the weather should be good.

Workers convinced that robots are coming for their jobs

The WEF says this. For what it’s worth, I am not so sure. I very much doubt it’s worth learning to code.

Next Fed Chair

As Nordea Bank points out central bankers are jockeying for position to take over Powell’s job. Probably Powell will get a second term, but that is not, presumably, guaranteed:

The current crop of woke central bankers are going on parade in the coming week, with Riksbank’s Ohlsson on Monday participating in a webinar to discuss “distributionary effects of current monetary policy”. He will likely conclude that the current policy is not causing problems, or if it is, then it’s either not the Riksbank’s fault, or it’s all worth it (even the NBER has found that central bank researchers who report successful policy experience more favourable career outcomes. Why? Because incentives matter).

Fed’s Daly, Mester, Bostic and Rosengren are then set to go on to discuss racism (Tue) – whatever that has got to do with the Fed’s mandate … Then social justice concerns take a breather for a little while, as Harker (Tue), Powell and Clarida (Wed) will discuss two parts which are actually part of the Fed’s mandate, i.e. the economy and the policy framework. Then we return to social justice, with Bostic to discuss racism (Wed) and inequality (Wed), while Mester has chosen to discuss inclusion (Thu). For some reason, Daly is set to speak on financial stability (Thu), maybe she wanted to take a pause from discussing the future of education?

To be honest, few of these central bank speeches are likely to be of much relevance for the market, but the list of topics reveals that these so-called “independent” central banks have become extremely political (if you think it’s not, go ask the MAGA crowd what they think) and have become so in an extremely short span of time. Perhaps this is partly about “beating the other girls to the bride’s bouquet” (i.e. the bouquet being the next chair of the Fed?). After all: “if there’s one fool for you then I am it (Janet)”.

Currently, central banks think they have saved the world’s economies, and can afford to move onto other problems the world faces. I am not so sure, and I’m not so sure that the whole world agrees with bankers that the only problems facing the world a few degrees rise in the temperature and some individuals from minority groups feeling overlooked.

The General Semantics of Wall Street

This book by John Magee, seems to be about investing. But it’s really about how to see the world, and how to communicate ideas about it. It’s about the difference between words and their meaning, between maps and the territory they represent (a metaphor which is heavily used in the book). It’s about humility in approaching the world in general, but also stock prices. It’s about recognizing that a small scale map, which lacks fine detail, may be useful and, in some situations, more useful than a large scale map.

It’s hard to summarize the book, as it is very discursive and almost rambling. The last part is about how to achieve happiness in life by accepting one’s lot. This is a valuable lesson, but it will not tell the reader which options to buy.

It can be purchased quite cheaply from Amazon, although it seems to have been OCR’d as part of some library project and may be available non-commercially.

Wrap

Another risk-on day:

- stocks generally up, although the Russell flat,

- the 10Y Treasury Note is trading at 1.664%, so barely changed,

- EUR.USD down 0.1% (so flat),

- Emerging markets looking weak,

- Developed markets up, modestly, except UK.

- Commodities down, oil at 59.32, gold at 1744.

Explain to me how this is different from Theranos pic.twitter.com/QDTn1Op63h

— tim nutt (@twnutt) April 9, 2021

This is how Europe looked like just a century ago, in 1914. via @onlmaps pic.twitter.com/B7r4KohhBM

— Velina Tchakarova (@vtchakarova) April 9, 2021

Comments !